Key Takeaways

- Operational discipline, capital redeployment, and sustainability leadership position Bekaert to outperform peers in both margin expansion and revenue growth amid sector transformation.

- Aggressive working capital management and targeted M&A support market share gains, recurring revenue, and exposure to surging infrastructure and energy transition themes.

- Structural industry shifts, cyclical demand volatility, and persistent cost pressures threaten long-term profitability and pricing power despite interim gains from cost reduction efforts.

Catalysts

About NV Bekaert- Provides steel wire transformation and coating technologies worldwide.

- Analyst consensus expects incremental margin improvement from cost optimization and mix shift, but Bekaert's deep operational discipline-evidenced by a €21 million overhead reduction in just six months, ongoing global footprint rationalization, and strong plant utilization in China-signals the potential for a much sharper step-up in net margin once volumes recover, potentially exceeding the 10% target ahead of schedule.

- While analysts broadly cite strategic divestments and focus on growth markets as drivers of earnings, Bekaert's ability to redeploy capital freed from LatAm and other non-core exits into high-growth segments (such as energy transition and ultra-high tensile applications) could accelerate top-line growth and rapidly improve the revenue mix, especially as emerging market end-markets re-accelerate.

- Bekaert's leadership in sustainable, recycled, and advanced material solutions is highly aligned with a global pivot to urbanization and infrastructure overhaul, positioning the company to disproportionately benefit from a multi-year wave of green construction investments and regulatory tailwinds, with recurring revenue streams and margin upside as adoption accelerates.

- The company's aggressive working capital optimization, including a two percentage point reduction year-on-year and efficient inventory management, releases additional cash for innovation and M&A at a time when competitors may be unable to invest, paving the way for outsized earnings growth and market share gains during the sector's structural transformation.

- Bekaert's robust balance sheet and explicit intention to consolidate the industry through M&A puts it in a unique position to capture share in value-added niches-as electrification, renewable energy, and grid modernization accelerate globally, the company can leverage its technology and integration playbook to grow revenue well above sector averages while structurally raising profitability.

NV Bekaert Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on NV Bekaert compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming NV Bekaert's revenue will grow by 2.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.5% today to 7.8% in 3 years time.

- The bullish analysts expect earnings to reach €326.9 million (and earnings per share of €6.43) by about September 2028, up from €173.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.6x on those 2028 earnings, down from 11.0x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 9.9x.

- Analysts expect the number of shares outstanding to decline by 2.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.6%, as per the Simply Wall St company report.

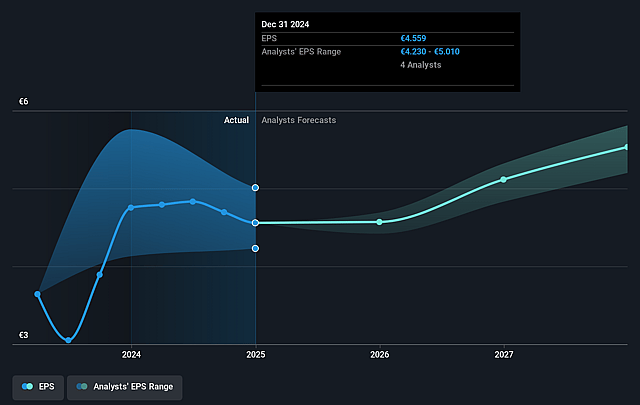

NV Bekaert Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Bekaert's strong exposure to traditional steel and wire solutions leaves it vulnerable to declining long-term demand driven by global decarbonization and substitution trends, which could erode its core revenues as end markets pursue more sustainable materials.

- The company's reliance on cyclical sectors such as automotive, construction, and energy-including recent commentary on weak demand in Europe and the U.S. and only partial offsets from China-creates persistent revenue volatility and undermines earnings visibility, especially during global economic slowdowns.

- Intensifying trade protectionism, tariff escalations, and ongoing FX headwinds have already proven difficult to fully pass through to customers, and management's stated concern that further cost increases may dampen overall demand points to sustained pressure on both net sales and profit margins.

- The business continues to experience margin erosion due to a combination of negative product and country mix (less exposure to higher-margin U.S. and Oceania), fixed cost under-absorption from reduced volumes, and slower-than-expected growth in higher-value specialties like hydrogen, all of which threaten long-term profitability.

- Focus on cost and overhead reduction has temporarily supported EBIT margins and free cash flow, but structural risks remain from ongoing advanced material substitution and increased bargaining power among consolidated end-customers, each of which could compress net margins and limit the ability to regain pricing power in future cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for NV Bekaert is €55.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NV Bekaert's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €55.0, and the most bearish reporting a price target of just €32.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €4.2 billion, earnings will come to €326.9 million, and it would be trading on a PE ratio of 9.6x, assuming you use a discount rate of 7.6%.

- Given the current share price of €38.0, the bullish analyst price target of €55.0 is 30.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.