Key Takeaways

- Divestment of noncore assets and capital recycling enable reinvestment into high-growth sectors, strengthening revenue and earnings growth opportunities.

- Operational streamlining and strategic sector expansion boost margin resilience, while favorable investor dynamics support asset valuations and long-term profitability.

- Heavy reliance on struggling office assets, rising financial risk, and potential asset sales threaten Abacus Group's earnings stability and make it vulnerable to shifting market dynamics.

Catalysts

About Abacus Group- A strong asset backed, annuity style business model where capital is directed towards assets that provide potential for enhanced income growth and ultimately create value.

- Significant capital recycling and divestment of noncore assets, alongside a potential windfall from a strategic stake in ASK (via either ongoing management fees or proceeds from a partial/full sale), could generate substantial balance sheet capacity for reinvestment into higher-growth sectors like office and retail, positively impacting future revenue and earnings growth.

- Improving urban infrastructure (such as new metro stations in Sydney) and ongoing urban migration are driving increased leasing demand and occupancy rates-especially for prime and A-grade office assets close to transport nodes in Abacus' portfolio-supporting sustained rental growth and stronger revenue trajectory.

- Expansion and growth in the self-storage sector through the Abacus Storage King platform is delivering high-margin, defensive earnings streams with RevPAM (Revenue per Available Meter) and occupancy both trending positively, supporting group net margins and providing a buffer to overall earnings volatility.

- Platform streamlining initiatives, including consolidation of operating systems and finance processes, have already delivered cost savings and are positioning Abacus for further operational efficiency, supporting net margin improvement and enhancing the scalability of future earnings.

- Institutional real estate investors are increasingly allocating capital towards high-quality, income-generating assets, providing favorable asset valuation support and improved refinancing options for Abacus, which is bolstered by its recent A+ credit rating and competitive access to capital-positively impacting net interest costs and long-term profit margins.

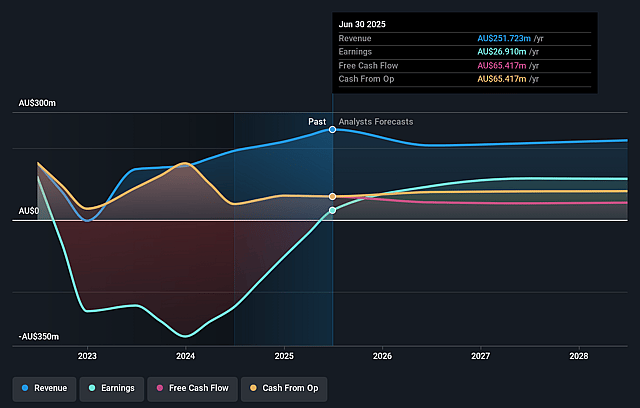

Abacus Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Abacus Group's revenue will decrease by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.7% today to 51.7% in 3 years time.

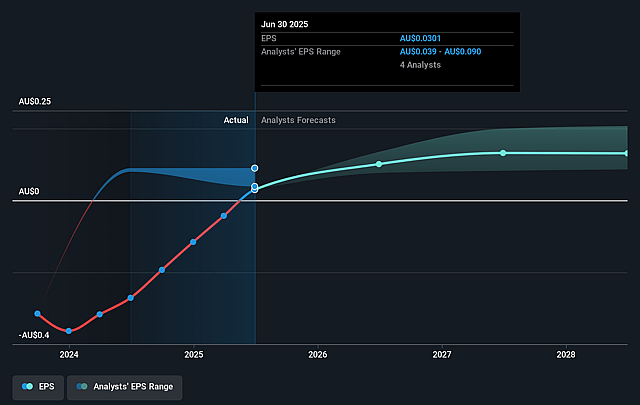

- Analysts expect earnings to reach A$114.5 million (and earnings per share of A$0.13) by about September 2028, up from A$26.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$185 million in earnings, and the most bearish expecting A$78.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, down from 40.0x today. This future PE is lower than the current PE for the AU Office REITs industry at 57.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.58%, as per the Simply Wall St company report.

Abacus Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant exposure to traditional office assets in CBD and secondary markets leaves Abacus vulnerable to the long-term secular trend of hybrid/remote work, which may suppress long-term occupancy rates and slow rental growth, negatively impacting future revenues and earnings.

- Declining value of office assets-30% drop since pre-COVID and ongoing cap rate expansion-reflects wider industry challenges; continued weakness in office asset valuations would compress Abacus Group's balance sheet strength, jeopardize refinancing options, and potentially pressure net margins.

- Abacus' gearing remains elevated at 34.5%, and with carryforward tax losses nearly exhausted, any rise in interest rates or tightening in credit markets could increase interest expenses and tax outflows, compressing net margins and eroding earnings resilience.

- High incentives offered (notably up to 42% at flagship assets) and concentration of earnings in a few properties or sectors (office, retail, ASK) add risk if market conditions deteriorate or leasing momentum falters, potentially leading to lower recurring revenue and increased earnings volatility.

- Prospective sale of the self-storage platform (ASK), which currently generates stable income and high-margin management fees, could reduce overall portfolio defensiveness and earnings diversity, making future revenues more susceptible to downturns in the less-resilient office and retail sectors.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$1.304 for Abacus Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$1.41, and the most bearish reporting a price target of just A$1.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$221.5 million, earnings will come to A$114.5 million, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$1.2, the analyst price target of A$1.3 is 7.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.