Key Takeaways

- Rising costs, regulatory pressures, and declining reserve quality threaten Evolution Mining's margins, revenue growth, and long-term production stability.

- Expansion projects and higher capital spending raise financial risk, potentially straining cash flow and balance sheet strength if market conditions deteriorate.

- Strong exploration success, operational discipline, and financial flexibility position Evolution Mining for sustained growth, margin resilience, and reduced financial risk amid industry headwinds.

Catalysts

About Evolution Mining- Engages in the exploration, mine development and operation, and sale of gold and gold-copper concentrates in Australia and Canada.

- Rapid acceleration of global decarbonisation and the ongoing shift to renewable energy are expected to intensify investor and regulatory scrutiny of traditional gold miners, which is likely to restrict Evolution Mining's access to affordable capital, increase compliance costs, and limit investor interest-ultimately weighing on both net margins and future revenue growth.

- Increasingly stringent ESG regulations and heightened community and environmental opposition globally are poised to drive up operating and development costs for Evolution's growth projects, cause project delays, and compress margins, with a higher risk of cost overruns and reduced return on capital employed.

- Sustained depletion of reserves at key assets such as Cowal and Mungari, without proportionate high-quality replacements, puts future production volumes at risk, threatening long-term revenue stability and exposing earnings to sharper declines as high-grade stockpiles are exhausted.

- Industry-wide declines in average ore grades and escalating complexity of new discoveries are set to drive structural increases in all-in sustaining costs across Evolution's operations, and the company's own guidance reflects a material step-change in cost inflation that will likely erode margins even if spot gold prices remain elevated.

- Existing and planned capital investment programs, including ongoing expansion at Cowal and potential extensions at Ernest Henry, present increased financial risk; should gold prices weaken or capital costs rise, this could drag on cash flows, lower free cash available for dividends or debt reduction, and raise the risk of future balance sheet pressure.

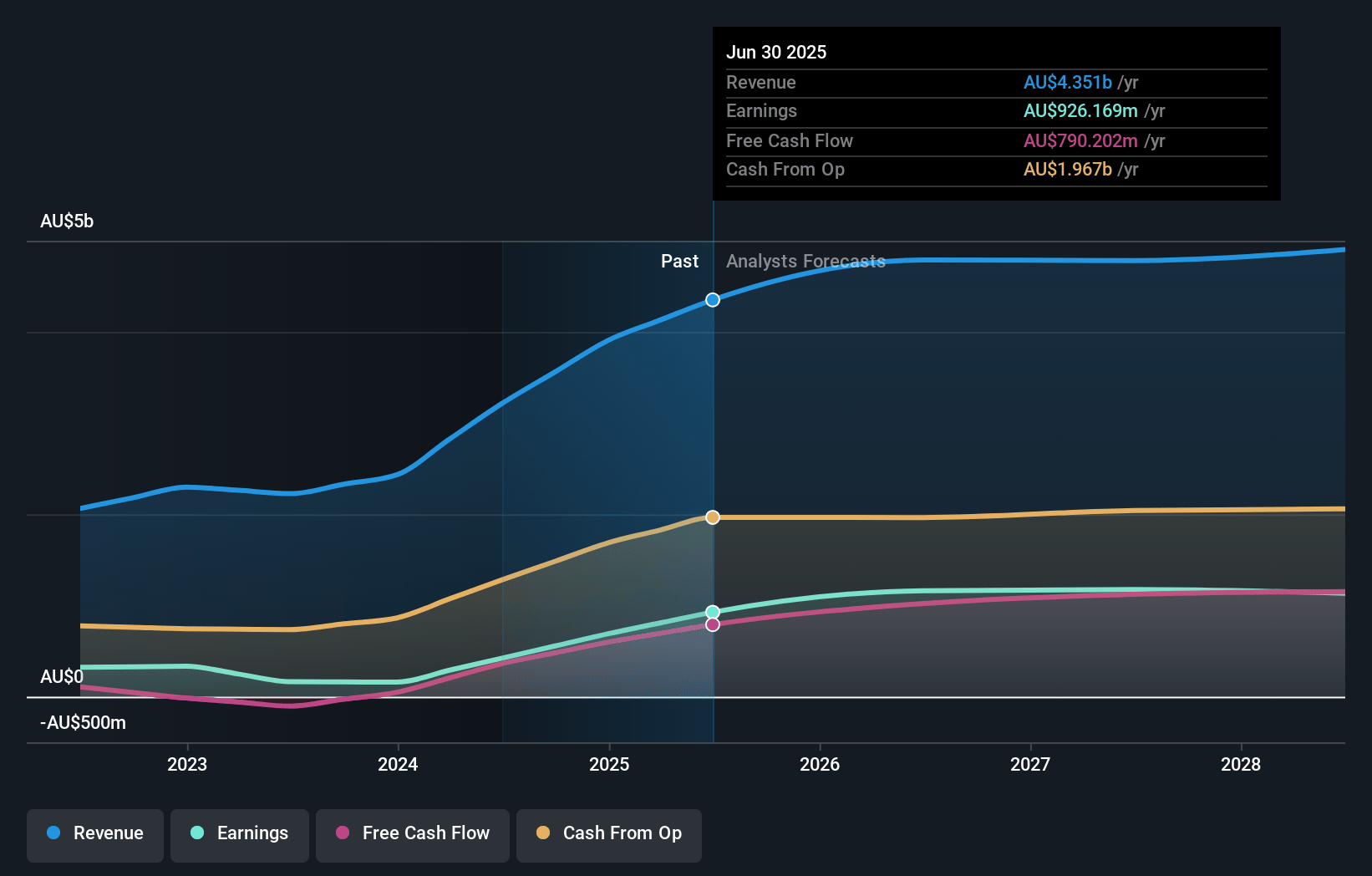

Evolution Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Evolution Mining compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Evolution Mining's revenue will grow by 1.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 17.7% today to 23.6% in 3 years time.

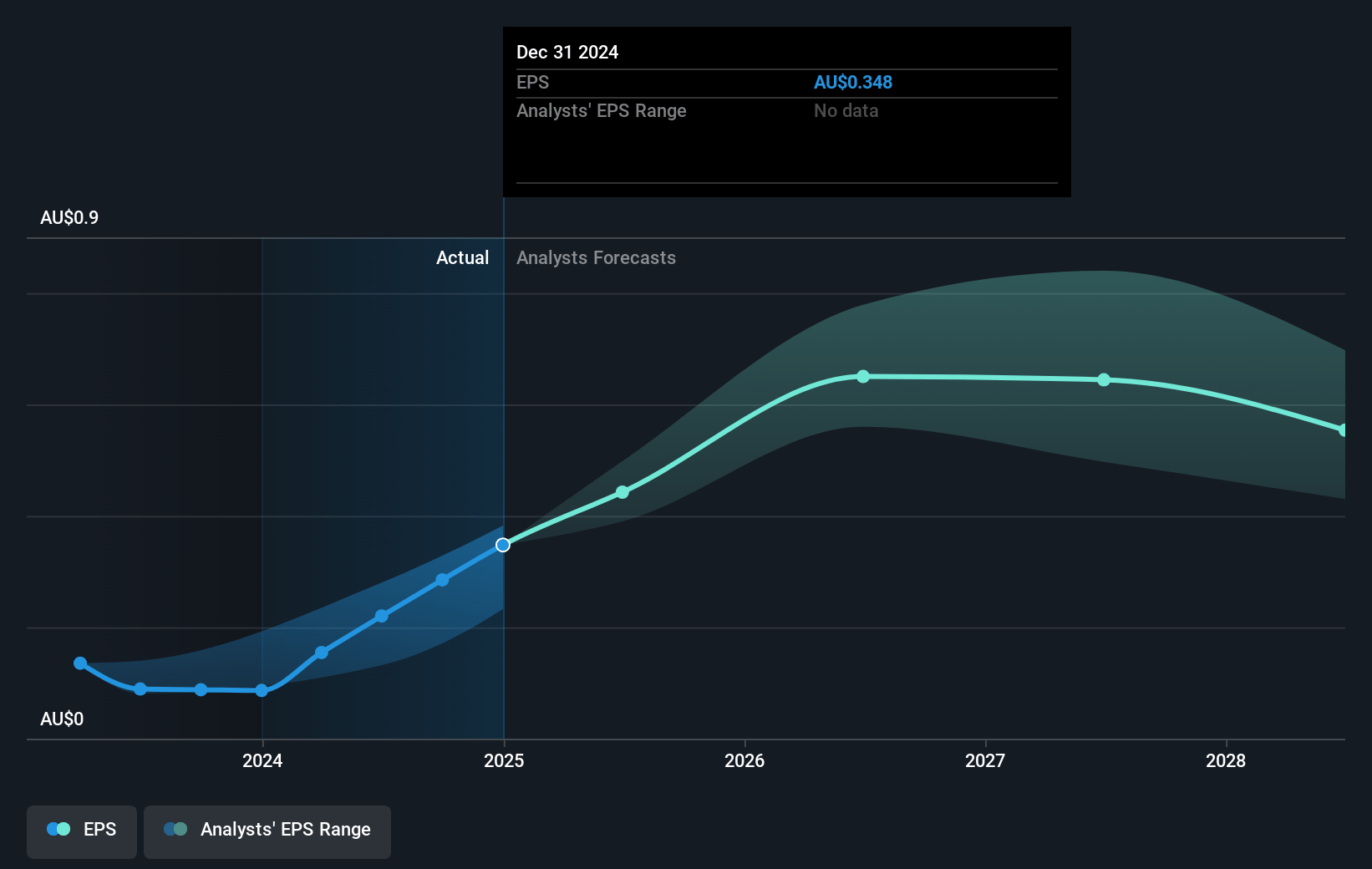

- The bearish analysts expect earnings to reach A$966.2 million (and earnings per share of A$0.48) by about July 2028, up from A$690.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, down from 21.8x today. This future PE is lower than the current PE for the AU Metals and Mining industry at 13.5x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.26%, as per the Simply Wall St company report.

Evolution Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Evolution Mining's aggressive exploration success at sites like Mungari and Northparkes is increasing confidence in further resource growth, which could extend mine lives and sustain or grow gold and copper production, supporting long-term revenue and earnings stability.

- The company demonstrated operational consistency and discipline, meeting original group guidance, producing record cash flow, and breaking multiple financial, safety, and operational records, indicating strong execution that can support margins and net earnings resilience.

- Significant high-grade resource discoveries (such as Genesis and Solomon veins at Mungari) and pipeline project developments (like the Cowal OPC project with a 35% to 70% rate of return) point to robust organic growth opportunities, which could underpin future revenue growth and counter concerns over depletion.

- Capital flexibility is strong, with over $760 million in the bank, full early repayment of debt commitments, improved gearing down to 15%, and an undrawn $525 million revolver available to fund projects or navigate potential downturns, all of which reduce financial risk and help maintain dividends.

- Advancements in operational efficiency, plant expansions (such as Mungari's commissioning), and continued exploration investment (especially at Red Lake and Ernest Henry) position Evolution Mining to capitalize on long-term industry trends of constrained supply and strong gold demand, supporting higher margins and cash flow against sector headwinds.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Evolution Mining is A$4.8, which represents two standard deviations below the consensus price target of A$7.24. This valuation is based on what can be assumed as the expectations of Evolution Mining's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$9.05, and the most bearish reporting a price target of just A$3.8.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$4.1 billion, earnings will come to A$966.2 million, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 7.3%.

- Given the current share price of A$7.52, the bearish analyst price target of A$4.8 is 56.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.