Key Takeaways

- Exceptional project delivery and capital efficiency position Evolution Mining for robust cash flow and superior margin growth versus industry peers.

- Low-cost production and strategic commodity mix offer significant earnings resilience and upside from high gold prices and global electrification trends.

- Rising operating costs, heavy capital spending, and uncertain reserve replacement threaten profitability, while ESG pressures and competition from alternative assets may weaken future gold demand and revenues.

Catalysts

About Evolution Mining- Engages in the exploration, mine development and operation, and sale of gold and gold-copper concentrates in Australia and Canada.

- While analyst consensus recognises the Cowal Open Pit Continuation project's strong rates of return, the market may still underappreciate the exceptional capital efficiency and rapid payback of the project, which is forecast to generate between 34 and 71 percent returns and recover its investment in as little as 1.5 years, delivering significant increases to operating cash flow and future net margins far sooner than expected.

- Analysts broadly agree that the Mungari plant expansion and other growth projects carry execution risks, but their on-time and under-budget delivery, as well as early commissioning, highlight Evolution Mining's superior project management and operational discipline, which is likely to support revenue and margin growth well above sector averages as these assets become major cash contributors.

- The company is poised to benefit strongly from sustained higher gold prices, given minimal hedging and sector-leading low production costs, translating near-real-time gold price increases directly into revenue growth and expanding gross profit margins.

- Evolution's growing copper production, alongside its established gold operations, strategically positions the company to capture long-term demand growth driven by the global shift toward electrification and clean energy, creating multi-year revenue diversification and enhanced earnings resilience.

- The company's ongoing success in resource definition and exploration, especially at Cowal and Mungari, indicates strong potential for extending mine lives and increasing production profiles, which should support sustained top-line growth, higher reserve valuations, and long-term investor confidence.

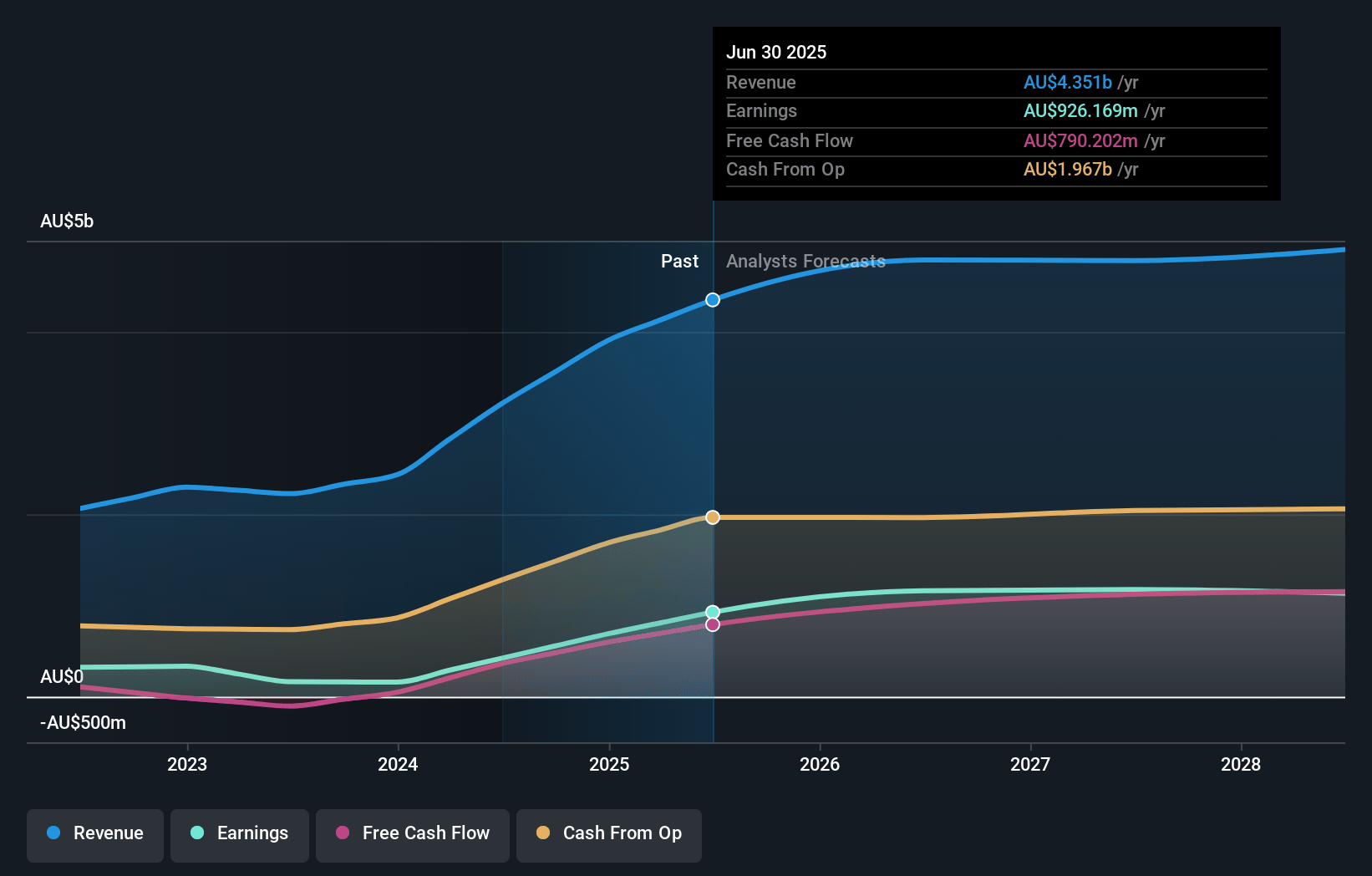

Evolution Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Evolution Mining compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Evolution Mining's revenue will grow by 14.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 17.7% today to 23.7% in 3 years time.

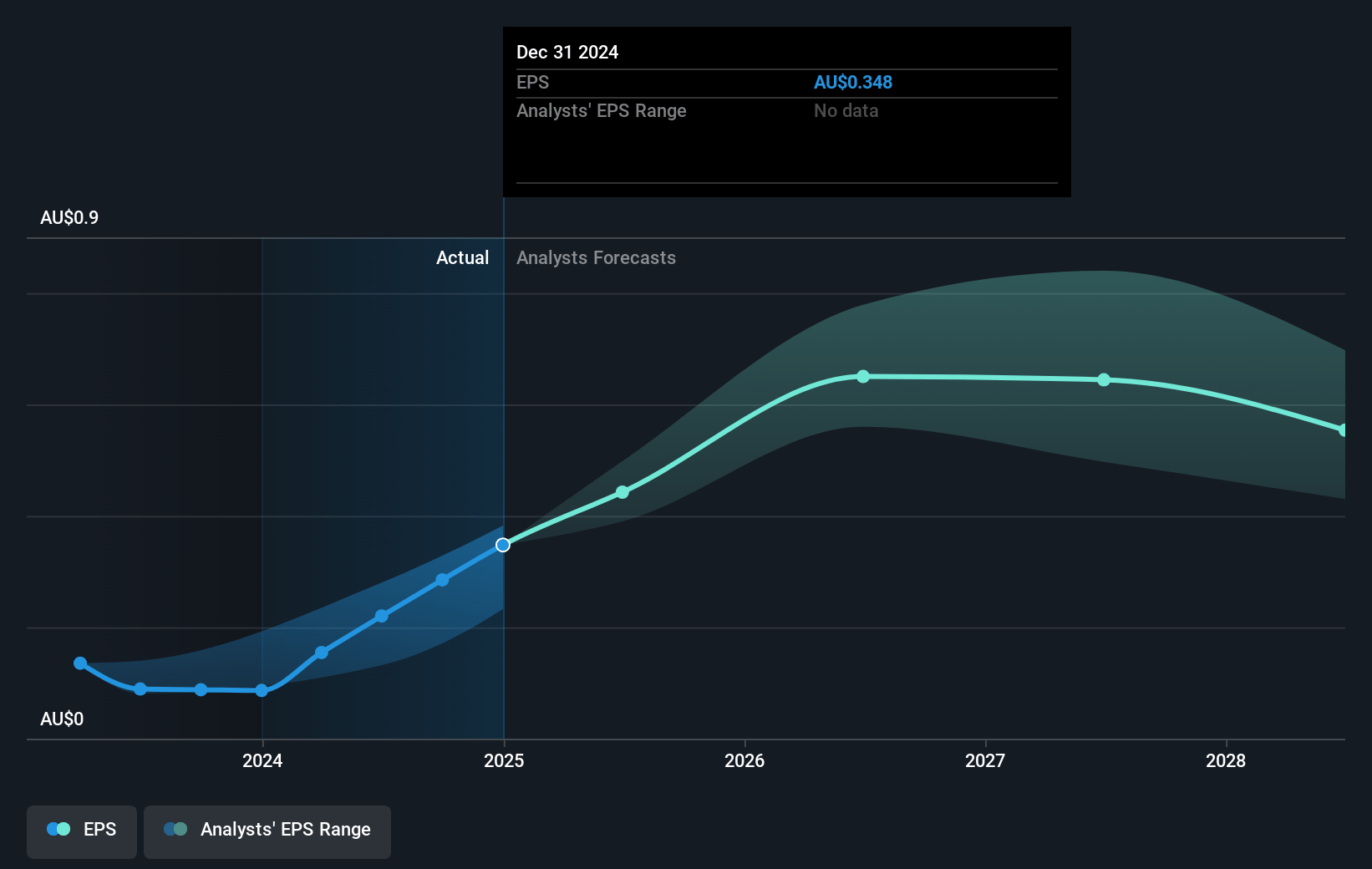

- The bullish analysts expect earnings to reach A$1.4 billion (and earnings per share of A$0.7) by about July 2028, up from A$690.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.2x on those 2028 earnings, down from 21.6x today. This future PE is greater than the current PE for the AU Metals and Mining industry at 13.3x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.27%, as per the Simply Wall St company report.

Evolution Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces rising input costs due to inflationary pressures in energy, labor, and equipment, with management acknowledging labor costs make up about half of the cost base and are expected to rise by three to four percent per year, which could compress net margins and erode profitability over time.

- There are substantial capital expenditure requirements, with the company planning to invest an average of $750 million to $950 million annually over the next five years, particularly front-loaded at projects like Cowal, which could strain free cash flow and increase the risk of equity dilution or higher leverage, ultimately affecting net income.

- Reserve replacement and exploration success remain uncertain and reliant on ongoing drilling results, as leadership emphasized the need for continued discovery, particularly at Cowal and across the portfolio, meaning failure to replace or expand reserves could result in shrinking production volumes and declining future revenues.

- Tougher global ESG standards and changing regulatory environments pose long-term risks, with mention of environmental risks and lake protection requirements for Cowal and regulatory approvals being gating factors, possibly resulting in increased compliance costs and threatening operating margins and project timelines.

- Secular risks from decarbonization trends and the rise of alternative investment vehicles such as cryptocurrencies could reduce the role of physical gold as a safe haven, potentially lowering long-term gold prices and diminishing Evolution Mining's revenues and cash flows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Evolution Mining is A$9.05, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Evolution Mining's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$9.05, and the most bearish reporting a price target of just A$3.8.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$5.8 billion, earnings will come to A$1.4 billion, and it would be trading on a PE ratio of 16.2x, assuming you use a discount rate of 7.3%.

- Given the current share price of A$7.44, the bullish analyst price target of A$9.05 is 17.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.