Key Takeaways

- Expansion of exploration success and strong project pipeline positions Evolution Mining for long-term production and earnings growth, leveraging favorable gold market conditions.

- Outstanding ESG credentials and disciplined capital management enable premium gold pricing and enhanced shareholder returns through dividends and buybacks.

- Rising costs, declining ore grades, operational concentration, and greater regulatory pressures threaten profitability, cash flow stability, and long-term growth prospects.

Catalysts

About Evolution Mining- Engages in the exploration, mine development and operation, and sale of gold and gold-copper concentrates in Australia and Canada.

- Analysts broadly agree Evolution Mining's exploration success at Mungari and Northparkes supports future resource growth, but with aggressive drilling and a pipeline of untested, high-grade targets now opening entirely on 100%-owned tenure, there is potential for multiyear production upside far above current expectations, translating into sustainably higher revenues and earnings growth.

- While analyst consensus highlights successful delivery of production expansions (like Mungari mill and Cowal OPC), it significantly understates how these assets-combined with a growing pipeline of organic and brownfield projects and rapid exploration conversion-could drive substantial, multi-decade volume growth just as tightening global supply and underinvestment keep gold prices elevated, enabling compounded top-line and margin gains.

- Accelerating global demand for ethically sourced and transparent gold is likely to disproportionately benefit Evolution's best-in-class safety, ESG and disclosure track record, creating the opportunity for premium pricing on gold sales and structurally enhancing net margins ahead of peers.

- Continued operational discipline, balance sheet strength, and early debt retirement give Evolution flexibility to pursue opportunistic growth through high-return acquisitions or faster project approvals, which could catalyze unexpected step-changes in group earnings power and cash flow over the next several years.

- Near-record free cash flow generation, robust dividend policy, and capital management discipline position Evolution to materially increase shareholder returns through higher dividends and share buybacks, especially if persistent global inflation and increased urbanization keep gold prices at historic highs, directly boosting earnings per share.

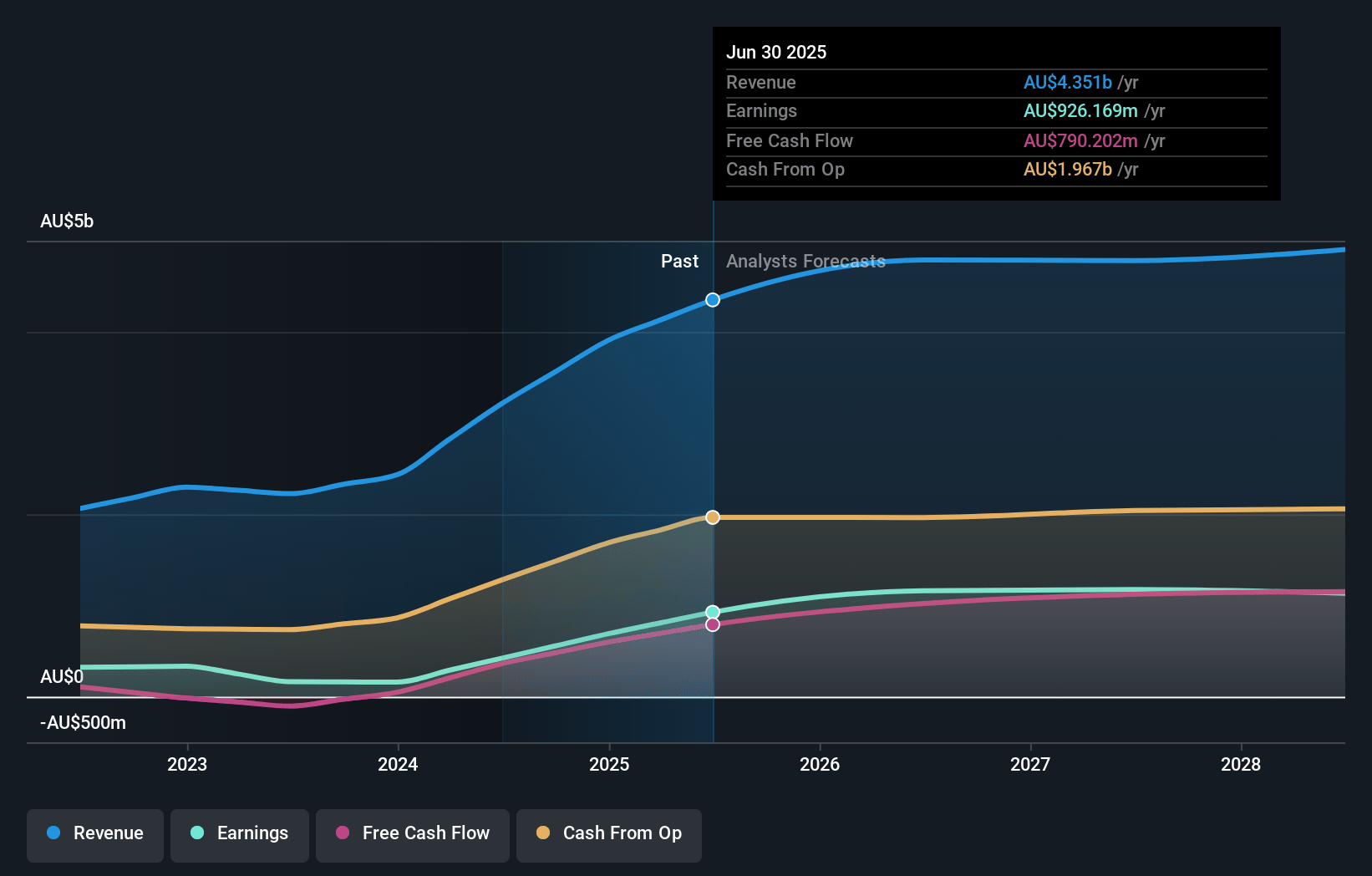

Evolution Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Evolution Mining compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Evolution Mining's revenue will grow by 14.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 17.7% today to 23.8% in 3 years time.

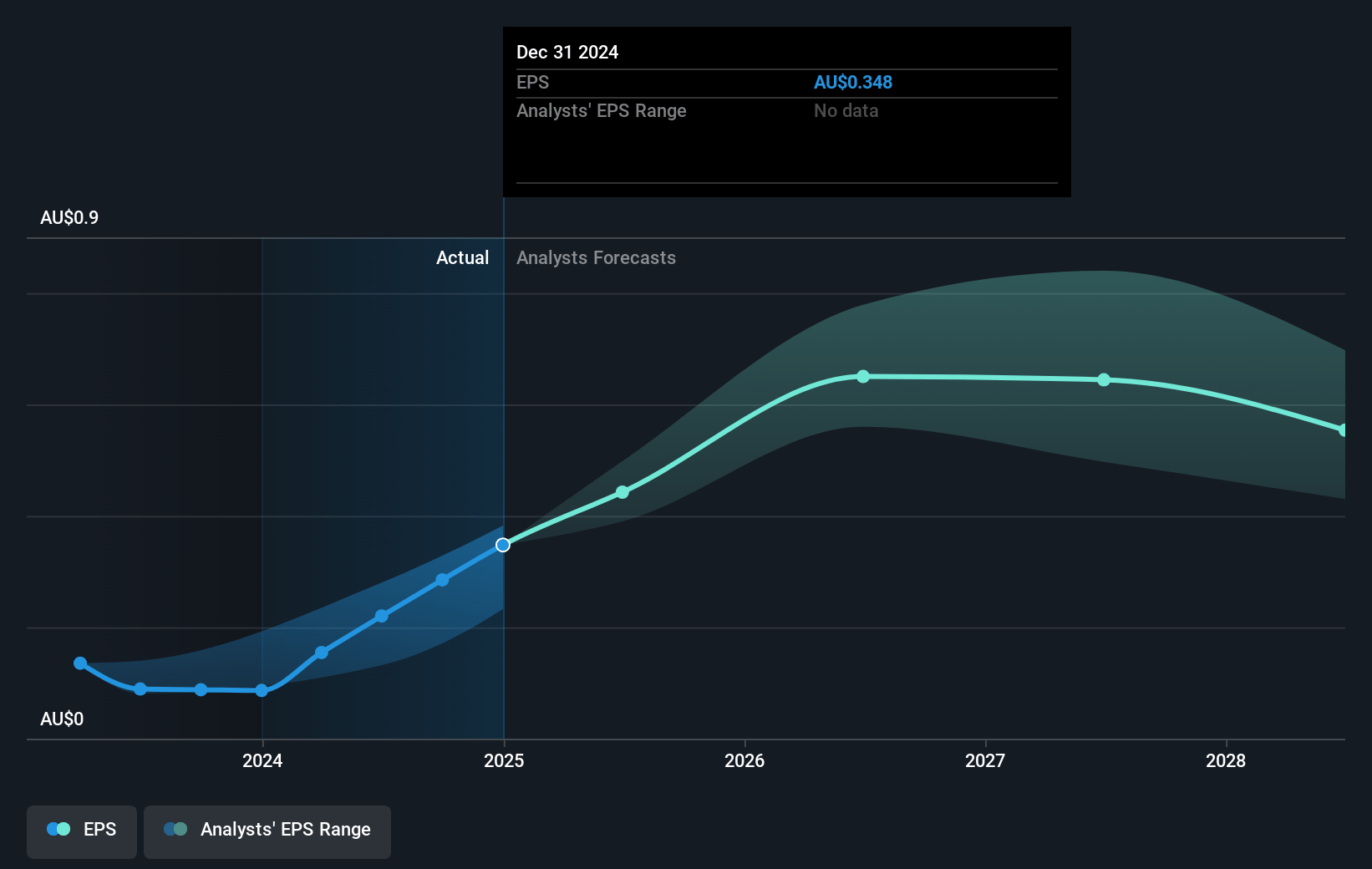

- The bullish analysts expect earnings to reach A$1.4 billion (and earnings per share of A$0.7) by about July 2028, up from A$690.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, down from 22.5x today. This future PE is greater than the current PE for the AU Metals and Mining industry at 13.1x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.26%, as per the Simply Wall St company report.

Evolution Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising operating and all-in sustaining costs, driven by inflation, royalties, increased use of stockpiled lower-grade ore, and projected AISC guidance between $1,720 and $1,880 per ounce for FY '26, threaten to compress net margins and weaken free cash flow, especially if gold prices fall from current highs.

- Declining average ore grades at assets like Ernest Henry and Red Lake, as well as dependence on stockpile ore at Cowal and Northparkes, raise the risk of higher production costs per ounce and volatile revenues, putting consistent earnings at risk.

- Long-term project pipeline growth is vulnerable to resource depletion and concentration risk, with reliance on a few key operations such as Cowal and Red Lake; any operational disruptions, permitting delays, or grade variability could cause significant volatility in group revenues.

- Increasing regulatory, environmental, and ESG-related costs due to pressure from global decarbonisation, expanded reporting obligations, and community opposition may materially raise compliance expenditures and capital requirements, eroding profitability.

- Heightened resource nationalism, potential changes to royalty and tax regimes, and risk of lagging behind in technological adoption could combine to increase operating costs, restrict access to new resources, and lead to lower long-term returns on capital for Evolution Mining.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Evolution Mining is A$8.7, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Evolution Mining's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$8.7, and the most bearish reporting a price target of just A$3.8.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$5.8 billion, earnings will come to A$1.4 billion, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 7.3%.

- Given the current share price of A$7.75, the bullish analyst price target of A$8.7 is 10.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.