Key Takeaways

- Accelerated adoption, regulatory shifts, and digital innovations could drive recurring revenue and margin growth far ahead of current analyst expectations.

- Strategic manufacturing integration and potential acquisitions may rapidly expand market reach, cost advantages, and diversification within infection prevention.

- Heavy reliance on a single product and exposure to regulatory, operational, and competitive risks threaten profitability, sustainable growth, and business diversification.

Catalysts

About Nanosonics- Operates as an infection prevention company globally.

- Analyst consensus suggests strong growth in North America driven by trophon placements and upgrades, but this likely understates both the upgrade cycle rate and total addressable market as increased regulatory scrutiny and rapid turnover of legacy equipment could accelerate unit adoption and push recurring revenue well above current forecasts, delivering a sustained uplift to revenue and net margins.

- While analysts expect margin expansion from the Indianapolis consumables plant, this site's vertical integration and dual manufacturing for both trophon and CORIS positions Nanosonics to rapidly scale volumes, minimize tariff and logistics exposure, and unlock cost advantages that could drive margin expansion at a pace far exceeding consensus expectations, especially as demand surges in North America.

- The digitization of infection prevention, supported by enhanced DICOM integration and cloud-based traceability from new device launches, is set to unlock high-margin SaaS and data analytics revenue streams that are not fully appreciated in current forecasts, supporting faster-than-expected growth in recurring revenue from digital services.

- Nanosonics' capacity to leverage its robust balance sheet and cash generation for opportunistic M&A following CORIS commercialization could accelerate entry into adjacent infection prevention segments, meaningfully broadening its product portfolio and total addressable market, with material upside to group revenue and earnings.

- Global demographic shifts-including the surging elderly population and rising chronic disease rates-are likely to drive step-change increases in ultrasound and endoscopic procedure volumes, underpinning a structural, long-term acceleration in demand for automated disinfection, which supports higher-than-expected underlying installed base growth and recurring annuity revenue.

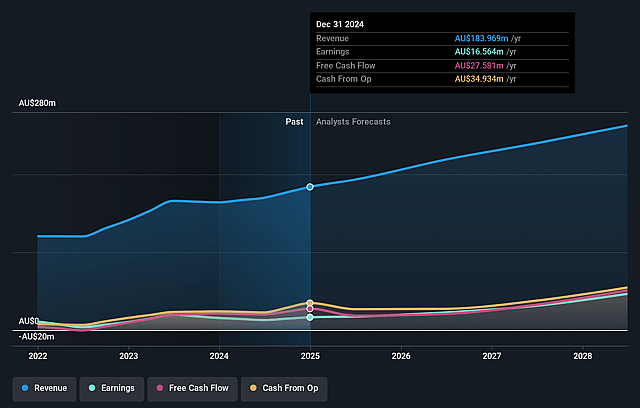

Nanosonics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Nanosonics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Nanosonics's revenue will grow by 13.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.4% today to 19.6% in 3 years time.

- The bullish analysts expect earnings to reach A$57.4 million (and earnings per share of A$0.19) by about September 2028, up from A$20.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 39.3x on those 2028 earnings, down from 56.7x today. This future PE is greater than the current PE for the AU Medical Equipment industry at 34.5x.

- Analysts expect the number of shares outstanding to decline by 0.71% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.05%, as per the Simply Wall St company report.

Nanosonics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained healthcare budget pressures and potential reductions in hospital capital expenditure, especially in North America and Europe, could dampen demand for Nanosonics' equipment and slow revenue growth if hospitals defer or transition away from capital purchases.

- The company's heavy reliance on its trophon franchise exposes it to substantial risk if new infection prevention technologies-such as advanced antimicrobial coatings or alternative disinfection solutions-gain market traction, which could undermine core recurring revenues and compress future net margins.

- Nanosonics faces margin pressure from a combination of higher tariffs, intensified competition, and the risk of commoditization in disinfection technology; these factors could drive gross margins lower and limit EBIT and earnings growth over time despite mitigation strategies like price increases.

- Ongoing global supply chain vulnerabilities, particularly given new manufacturing expansions in the U.S. and Australia, present risks of operational disruptions, increased costs, or delays in product delivery, which could negatively affect both revenue consistency and profitability in the long term.

- The upcoming commercialization of CORIS carries significant execution and regulatory risks. If CORIS fails to achieve broad regulatory approval, sufficient market penetration, or meets resistance on perceived cost or efficacy, Nanosonics may struggle to diversify revenues, leading to prolonged reliance on a maturing trophon business and constraining future earnings expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Nanosonics is A$6.18, which represents two standard deviations above the consensus price target of A$4.7. This valuation is based on what can be assumed as the expectations of Nanosonics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$6.39, and the most bearish reporting a price target of just A$3.9.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$292.8 million, earnings will come to A$57.4 million, and it would be trading on a PE ratio of 39.3x, assuming you use a discount rate of 7.1%.

- Given the current share price of A$3.86, the bullish analyst price target of A$6.18 is 37.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.