Key Takeaways

- Dependence on a single premium product and increased competition from emerging disinfection technologies threaten revenue growth and pricing power.

- Rising compliance costs, stronger customer bargaining power, and unfavorable currency movements risk compressing margins and hindering global expansion.

- Strong recurring revenues, new product launches, and digitalization initiatives position Nanosonics for sustained earnings growth and enhanced profitability across expanding global markets.

Catalysts

About Nanosonics- Operates as an infection prevention company globally.

- Growing global healthcare cost containment and tightening hospital capital expenditure budgets threaten to slow adoption of premium disinfection products like trophon and CORIS, exposing Nanosonics to flattish capital equipment sales and stagnating top-line revenue growth, particularly in North America.

- The company's ongoing dependence on a single flagship product exposes its earnings and future net margins to technological obsolescence and substitute innovations, especially as advances in alternative disinfection technologies such as UV-C, vaporized hydrogen peroxide, and next-gen antimicrobial devices may reduce the addressable market and erode pricing power.

- Heightened regulatory scrutiny and the increasing burden of compliance, including evolving standards for data privacy and cybersecurity in cloud-connected medical devices, are likely to drive up operational costs and impede timely market entry for pipeline products, further compressing profitability and constraining global expansion.

- Consolidation among hospital groups and healthcare providers is increasing the bargaining power of Nanosonics' largest customers, leading to lower selling prices, reduced gross margins, and increased risk of price-based competition adversely affecting net margins over the long term.

- Persistent currency volatility and strength of the US dollar could erode international earnings as the company expands in EMEA and Asia-Pacific regions, making reported revenue and profit before tax increasingly susceptible to external macroeconomic headwinds that limit earnings growth despite operational execution.

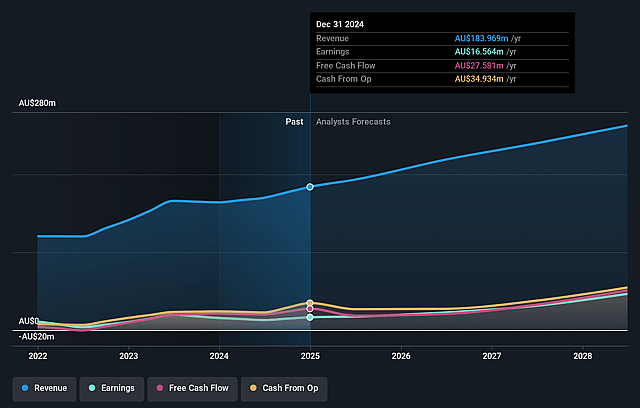

Nanosonics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Nanosonics compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Nanosonics's revenue will grow by 6.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 10.4% today to 7.6% in 3 years time.

- The bearish analysts expect earnings to reach A$18.3 million (and earnings per share of A$0.06) by about September 2028, down from A$20.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 77.6x on those 2028 earnings, up from 60.9x today. This future PE is greater than the current PE for the AU Medical Equipment industry at 33.4x.

- Analysts expect the number of shares outstanding to decline by 0.71% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.11%, as per the Simply Wall St company report.

Nanosonics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust long-term demand for infection prevention technologies, driven by secular trends such as heightened global attention on antimicrobial resistance and stricter hospital accreditation standards, is likely to result in sustained revenue growth for Nanosonics over the coming years.

- A large and expanding installed base of over 37,000 trophon units, combined with recurring consumables and service revenues growing at double-digit rates, builds a solid foundation for stable cash generation and stronger net margins.

- The launch of next-generation products like trophon3 and trophon2 plus, together with successful FDA clearance and pipeline expansion (including CORIS), provides Nanosonics with multiple potential revenue streams and ongoing product upgrades that can support long-term earnings growth.

- Strategic investments in digitalization, such as cloud infrastructure and DICOM integration, position the company to participate in the healthcare trend toward digitization and traceability, potentially unlocking higher-margin SaaS-based recurring revenues and enhancing profit margins.

- Geographic expansion, particularly in North America and Europe, alongside a growing service and consumable component in revenue, offers the company improved operational leverage and earnings scalability, strengthening its ability to maintain or grow profitability even under macroeconomic uncertainty.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Nanosonics is A$3.9, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Nanosonics's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$6.39, and the most bearish reporting a price target of just A$3.9.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$241.4 million, earnings will come to A$18.3 million, and it would be trading on a PE ratio of 77.6x, assuming you use a discount rate of 7.1%.

- Given the current share price of A$4.15, the bearish analyst price target of A$3.9 is 6.4% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.