Key Takeaways

- Expansion of automated disinfection solutions and next-generation product launches are driving adoption, recurring revenue, and higher margins globally.

- Scalable operations and investment in innovation position the company for sustained earnings and margin growth as its product and geographic footprint expands.

- Geopolitical risks, competition, slow product adoption, capital spending constraints, and rising regulatory costs all threaten margins, revenue growth, and long-term profitability.

Catalysts

About Nanosonics- Operates as an infection prevention company globally.

- Increasing global demand for infection prevention, driven by a larger ageing population and heightened post-pandemic focus on patient safety, is fueling recurring revenue growth via higher procedural volumes and expanding installed base-expected to support long-term revenue and earnings expansion.

- Regulatory tailwinds and a stronger market pull for automated, validated disinfection solutions are increasing adoption rates of Nanosonics' platforms, supporting deeper penetration in hospitals worldwide and underpinning recurring consumable/service revenue and margin stability.

- Launch of next-generation products (trophon3 and trophon2 plus) with cloud-based traceability and digital integration (e.g., DICOM compatibility) opens new avenues for SaaS and subscription revenues, which are higher margin and enhance net earnings and margin profile over time.

- Controlled market launch and commercialization plans for the CORIS platform are well underway, with significant regulatory milestones achieved; as CORIS penetrates the large global endoscope reprocessing market, its higher consumable revenue per device is likely to materially boost long-term revenue growth and gross margins.

- Continued disciplined investment in R&D and global manufacturing/supply chain infrastructure, coupled with a scalable operating model and operating leverage, suggests that as Nanosonics expands geographically and broadens its product base, both top line growth and net margins will improve, supporting a sustained upward re-rating of earnings.

Nanosonics Future Earnings and Revenue Growth

Assumptions

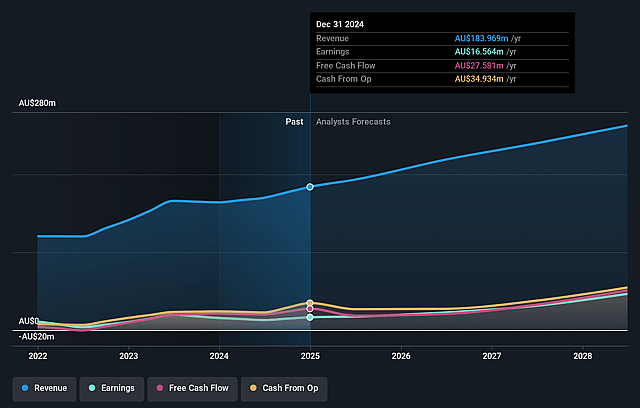

How have these above catalysts been quantified?- Analysts are assuming Nanosonics's revenue will grow by 9.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.4% today to 13.8% in 3 years time.

- Analysts expect earnings to reach A$36.2 million (and earnings per share of A$0.12) by about September 2028, up from A$20.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$55.8 million in earnings, and the most bearish expecting A$17.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 47.9x on those 2028 earnings, down from 60.9x today. This future PE is greater than the current PE for the AU Medical Equipment industry at 34.5x.

- Analysts expect the number of shares outstanding to decline by 0.71% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.11%, as per the Simply Wall St company report.

Nanosonics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geopolitical risks and rising tariffs-such as the current $4 million annual tariff impact-are already pressuring Nanosonics' gross margins and could further disrupt supply chains or erode profitability if trade tensions intensify or mitigation via price increases proves insufficient, directly impacting earnings and margins.

- Heightened competition (particularly from larger medtech companies) and technological obsolescence risk due to Nanosonics' heavy reliance on a limited product portfolio (mainly trophon) could threaten long-term revenue growth and market share, especially if new disinfection technologies or alternative reprocessing solutions gain traction.

- Slower-than-anticipated adoption or commercial rollout delays for new products, notably CORIS, may result in subscale performance, delayed revenue diversification, and leave the company's cost base elevated, compressing net margins and challenging future earnings growth.

- Increasing pressure on healthcare capital expenditure budgets, especially in key markets such as North America (as referenced in management's guidance sensitivities), could limit the pace of new installed base growth and shift purchasing models (e.g., from outright sales to rentals), thereby reducing revenue visibility and upfront cash flow.

- Rising regulatory and compliance costs (including ongoing R&D requirements to secure new market approvals and maintain cybersecurity accreditations), coupled with complex controlled market releases, could elevate ongoing expenses and slow profit growth, negatively affecting overall net income and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$4.748 for Nanosonics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$6.39, and the most bearish reporting a price target of just A$3.9.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$263.3 million, earnings will come to A$36.2 million, and it would be trading on a PE ratio of 47.9x, assuming you use a discount rate of 7.1%.

- Given the current share price of A$4.15, the analyst price target of A$4.75 is 12.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.