Catalysts

About Santos

Santos is an Asia Pacific focused energy company producing LNG, domestic gas and oil, with growing carbon capture and storage operations.

What are the underlying business or industry changes driving this perspective?

- Although Barossa LNG and Pikka Phase 1 are expected to lift production by around 30% by 2027, delays in ramp-up, commissioning issues or cost overrun risks could temper the uplift in revenue and keep unit costs higher for longer, limiting near term earnings accretion.

- Despite strong Asian LNG demand and long term oil linked contracts that currently support cash generation, increased global LNG supply from competing projects and contract repricing risk could pressure realized prices and compress cash margins over time.

- While the low cost, self execution operating model has driven unit production costs toward the company’s target below USD 7 per barrel of oil equivalent, sustaining these efficiencies across aging assets and new geographies may prove challenging and could erode net margins if productivity gains slow.

- Although carbon capture and storage and lower emissions initiatives like Moomba CCS and electrification can enhance the longevity of gas infrastructure, evolving climate policy, carbon pricing and approval risk for projects such as Bayu Undan CCS may restrain capital deployment and weigh on long term earnings growth.

- While a sizable pipeline of backfill and tie back opportunities in PNG, Western Australia, the Cooper Basin and the Beetaloo underpins future volumes, execution risk, environmental constraints and community or regulatory delays could defer production additions and limit revenue growth from these options.

Assumptions

This narrative explores a more pessimistic perspective on Santos compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

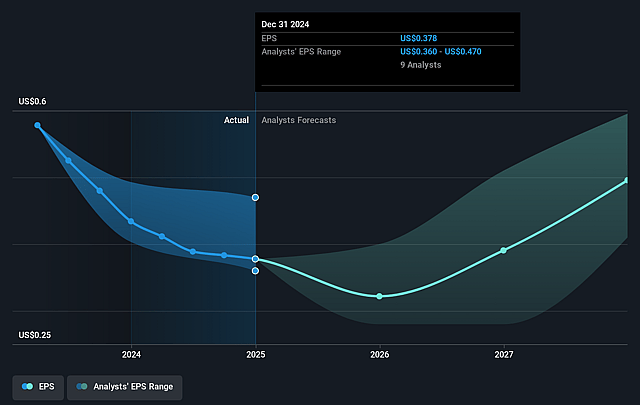

- The bearish analysts are assuming Santos's revenue will grow by 6.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 19.6% today to 19.1% in 3 years time.

- The bearish analysts expect earnings to reach $1.2 billion (and earnings per share of $0.37) by about December 2028, up from $1.0 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $1.7 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.0x on those 2028 earnings, down from 13.1x today. This future PE is lower than the current PE for the AU Oil and Gas industry at 13.1x.

- The bearish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.72%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The proposed all cash acquisition by the XRG Consortium could ultimately proceed on attractive terms for current shareholders, crystallizing a takeover premium above the present market price and driving a one off re rating of the share price, directly impacting total shareholder returns and capital gains.

- Commissioning of Barossa LNG and Pikka Phase 1 ahead of or in line with schedule, with early production data already pointing to strong well performance and lower drilling costs, may lead to higher than expected production growth of around 30% by 2027 and structurally lower unit production costs, lifting long term revenue and earnings above current expectations.

- The company’s track record of delivering three major projects Moomba CCS Phase 1, Barossa and Pikka within roughly 10% of original budgets, combined with a disciplined low cost self execution model that has reduced unit production costs to around USD 7.28 per barrel of oil equivalent, suggests further operating efficiencies and margin expansion could emerge over time, boosting net margins and free cash flow.

- Long dated, largely oil linked LNG contracts into a structurally growing Asian LNG market, with around 92 percent of portfolio volumes contracted and approximately 80 percent oil linked between 2025 and 2029, may provide more resilient pricing and cash flows than implied by a flat share price view, underpinning stronger and more stable revenue and earnings over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Santos is A$5.95, which represents up to two standard deviations below the consensus price target of A$7.53. This valuation is based on what can be assumed as the expectations of Santos's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$10.27, and the most bearish reporting a price target of just A$5.95.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $6.3 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 13.0x, assuming you use a discount rate of 6.7%.

- Given the current share price of A$6.26, the analyst price target of A$5.95 is 5.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Santos?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.