Key Takeaways

- Heightened regulatory, funding, and credit risks could hinder growth, raise costs, and compress margins, especially amid expansion into new products and less mature markets.

- Intensifying competition and shifting consumer payment preferences threaten Zip's relevance, market share, and scalability despite ongoing investments in innovation.

- Strong U.S. and ANZ expansion, innovation, and partnerships position Zip Co for increased market share, improved margins, and long-term revenue and earnings growth.

Catalysts

About Zip Co- Engages in the provision of digital retail finance and payments solutions to consumers, and small and medium sized merchants (SMEs) in Australia, New Zealand, Canada, and the United States.

- Regulatory pressures on BNPL and digital lending, particularly in the major U.S., U.K., and Australian markets where Zip operates, are likely to intensify and could increase compliance costs, restrict the company's agility in launching new products, and force stricter requirements that may limit user acquisition, which would negatively affect both revenue growth and the company's long-term margins.

- Persistently high or rising interest rates would continue to directly dampen consumer demand for discretionary spending and credit products, especially among Zip's core demographic of consumers underserved by traditional finance. This scenario would limit transaction volumes, slow customer acquisition, and drive higher funding costs, materially impacting both top-line revenue expansion and net margins.

- Credit losses and default rates could meaningfully increase as Zip rapidly expands into less mature international markets and ramps up new lending products such as personal loans and higher-limit credit offerings, especially if macroeconomic volatility persists. If underwriting standards fail to keep pace with growth, this would require higher provisions and tighter risk controls, eroding net profit margins and overall earnings.

- Dependence on external funding and securitization markets remains a structural weakness. In a scenario of ongoing financial tightening or shifts in capital markets, Zip could face more expensive or limited access to funding, forcing it to slow growth, reduce transaction volumes, or undertake dilutive equity raises, all of which would impair earnings and restrict potential for scalability.

- The emergence and adoption of alternative payment technologies-such as instant bank-to-bank transfers and widely integrated digital wallets-could disintermediate the BNPL business model. As competitive pressures mount from both larger fintechs and incumbent banks with broader ecosystems, Zip risks seeing market share, revenue margins, and long-term relevance erode even as it invests heavily in innovation and expansion.

Zip Co Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Zip Co compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Zip Co's revenue will grow by 18.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -4.6% today to 14.7% in 3 years time.

- The bearish analysts expect earnings to reach A$231.6 million (and earnings per share of A$0.12) by about August 2028, up from A$-44.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.2x on those 2028 earnings, up from -89.0x today. This future PE is greater than the current PE for the AU Consumer Finance industry at 12.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.48%, as per the Simply Wall St company report.

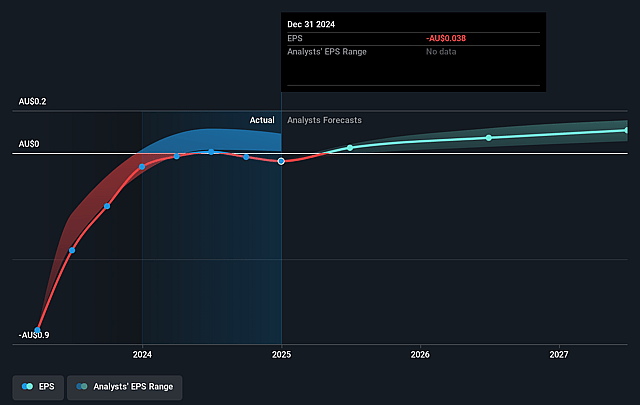

Zip Co Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rapid growth in the U.S. and ongoing expansion in Australia and New Zealand, including significant increases in transaction volumes and new product launches, may drive top-line revenue growth and customer acquisition over the long term.

- Improved credit performance, as evidenced by falling credit loss rates and strong underwriting with disciplined risk settings, could enhance net margins and profitability as the business scales.

- Successful execution of capital-light strategies and diversification into personal loans and new financial products in ANZ could enable Zip Co to target a larger, more diverse customer base, resulting in higher revenues and long-term earnings potential.

- Expansion of strategic merchant partnerships and growing integration with major platforms such as Stripe and Adyen, as well as enterprise merchant onboarding, strongly positions Zip Co for increased transaction volumes and market share, which could support strong revenue growth and scalability.

- Sustained innovation, investment in proprietary data and risk management capabilities, and operating leverage from scale may continue to improve profitability, cash EBTDA, and operating margins, supporting shareholder value growth over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Zip Co is A$2.27, which represents two standard deviations below the consensus price target of A$3.38. This valuation is based on what can be assumed as the expectations of Zip Co's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$4.31, and the most bearish reporting a price target of just A$2.1.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$1.6 billion, earnings will come to A$231.6 million, and it would be trading on a PE ratio of 16.2x, assuming you use a discount rate of 8.5%.

- Given the current share price of A$3.04, the bearish analyst price target of A$2.27 is 33.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.