Key Takeaways

- Strong U.S. growth potential and product innovation position Zip Co to outperform peers in the expanding BNPL and alternative credit market.

- Improved credit risk management and a capital-light partnership strategy support higher profitability, recurring income, and long-term earnings growth above industry norms.

- Increased regulatory scrutiny, competition, credit losses, and market concentration pose significant risks to Zip Co's profitability and future revenue growth.

Catalysts

About Zip Co- Engages in the provision of digital retail finance and payments solutions to consumers, and small and medium sized merchants (SMEs) in Australia, New Zealand, Canada, and the United States.

- While analyst consensus believes Zip Co's U.S. growth opportunity is significant, their view may be conservative; Zip is consistently outpacing both peer growth rates and U.S. BNPL market averages, indicating Zip could become a market leader in a vast, underpenetrated space, with the potential to drive U.S. revenue and EBITDA far above current forecasts.

- Analyst consensus highlights operating leverage and cost discipline, but Zip's multi-year track record of improving credit loss ratios and strong unit economics suggest a structural shift toward sustainably higher net margins and earnings, with the possibility of performance well ahead of guidance as operational scale and risk analytics compound.

- Zip is positioned to aggressively capitalize on the secular shift away from traditional credit cards toward alternative, democratized credit solutions, and its product innovation pipeline (such as rolling out the Pay-in-Z platform and new personal lending products) provides unique optionality, enabling outsized top-line revenue growth as consumer adoption of BNPL accelerates globally.

- The company's early transition to capital-light and partnership-driven models in Australia gives Zip the ability to unlock higher return on equity, create new recurring income streams, and drive rapid earnings expansion while minimizing balance sheet risk-potentially reshaping long-term profitability well above sector norms.

- Zip's substantial merchant and customer network, combined with platform integrations and growing partnerships (notably with Stripe and Adyen), promises compounding network effects that could accelerate TTV growth, increase customer stickiness, and provide robust upside to both revenue and recurring earnings as digital payments and e-commerce penetration deepen worldwide.

Zip Co Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Zip Co compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Zip Co's revenue will grow by 23.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -4.6% today to 13.0% in 3 years time.

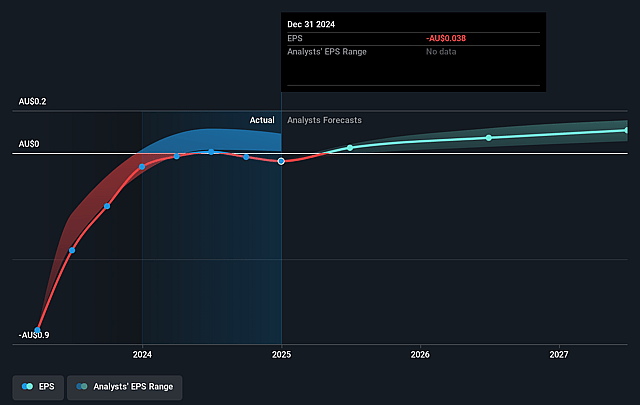

- The bullish analysts expect earnings to reach A$231.6 million (and earnings per share of A$0.32) by about August 2028, up from A$-44.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 30.7x on those 2028 earnings, up from -89.0x today. This future PE is greater than the current PE for the AU Consumer Finance industry at 12.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.48%, as per the Simply Wall St company report.

Zip Co Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened regulatory scrutiny and potential reclassification of Buy Now Pay Later products as credit may increase compliance costs and restrict Zip Co's business model, negatively impacting future revenue and net margin.

- Intensifying competition from traditional banks and major tech/payment platforms entering the BNPL space could result in margin pressure and higher customer acquisition costs, limiting Zip Co's ability to scale profitably and eroding earnings over time.

- Persistent dependence on the ANZ and U.S. markets with limited geographic diversification could expose Zip Co to local economic downturns or regulatory shocks, putting revenue growth at risk if either market slows or faces constraints.

- Sustained credit losses and elevated bad debt expense, particularly as Zip Co targets subprime and underserved customers, could pressure net income and require ongoing increases in loan loss provisions, reducing net margins and profitability.

- Rising consumer skepticism toward debt products and changing macroeconomic conditions such as higher interest rates or inflation may weaken consumer repayment ability, elevate default rates, and threaten Zip Co's revenue and cash flow resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Zip Co is A$4.31, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Zip Co's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$4.31, and the most bearish reporting a price target of just A$2.1.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$1.8 billion, earnings will come to A$231.6 million, and it would be trading on a PE ratio of 30.7x, assuming you use a discount rate of 8.5%.

- Given the current share price of A$3.04, the bullish analyst price target of A$4.31 is 29.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.