Last Update 19 Dec 25

ZIP: Expanded US Payment Reach Will Drive Further Share Upside

Analysts have slightly reduced their price target on Zip Co to around $5.10 per share, reflecting marginally lower discount rate and valuation multiple assumptions while keeping long term growth and profitability expectations effectively unchanged.

What's in the News

- Expanded US reach as Zip becomes available through Stripe’s optimized checkout interfaces, including Elements, Checkout, and Payment Links, via a no code activation from the Stripe Dashboard (Client Announcements)

- New Stripe integration enables merchants to offer Zip’s pay in installments option while still receiving full payment upfront, with Zip managing customer repayments and associated risk (Client Announcements)

- Partnership with Opportunity Knocks launches a national casting call where selected participants, including one Zip customer, can receive up to $20,000 in targeted financial support and coaching (Client Announcements)

- Zip customers and viewers gain access to Opportunity Knocks’ free digital tools, including the Opportunity Coach for personalized financial guidance and the Opportunity Finder, which connects users to over 17,000 local services (Client Announcements)

Valuation Changes

- Fair Value: unchanged at approximately A$5.10 per share, indicating stable long term valuation assumptions.

- Discount Rate: fallen slightly from 8.72 percent to approximately 8.69 percent, modestly lifting the present value of future cash flows.

- Revenue Growth: effectively unchanged at around 20.31 percent per annum, suggesting consistent expectations for top line expansion.

- Net Profit Margin: effectively unchanged at approximately 12.61 percent, indicating no material shift in long term profitability assumptions.

- Future P/E: fallen marginally from about 34.84x to 34.80x, reflecting a slightly lower valuation multiple applied to future earnings.

Key Takeaways

- Strategic partnerships and tech investments are fueling revenue growth, improved margins, and risk management while reducing customer acquisition costs.

- International growth and rising adoption among younger consumers strengthen market positioning and support long-term scalability.

- Rising regulatory pressures, competition, and structural challenges threaten Zip Co's growth prospects, profitability, and margins as it expands product offerings and shifts geographic focus.

Catalysts

About Zip Co- Engages in the provision of digital retail finance, personal finance, and payments solutions in Australia, New Zealand, and the United States.

- Zip Co is poised to benefit from the accelerating shift toward digital payments and increasing e-commerce penetration, as evidenced by strong transaction volumes (up 30%) and targeted partnerships with platforms like Google and Stripe, which are likely to drive higher transaction values and revenue growth.

- Enhanced adoption among Millennials and Gen Z, who favor flexible, interest-free payment options, is driving increased transaction frequency and customer engagement (with transactions per active customer up 62% over two years), supporting durable volume growth and inflating total revenue.

- The company's ongoing international expansion-particularly in the underpenetrated U.S. market where BNPL is less than 6% of e-commerce spend-provides significant runway for organic revenue growth and supports geographic diversification, de-risking the business model and enabling long-term scale.

- Improvements in underwriting and credit risk management, alongside investments in AI and machine learning, have resulted in better credit outcomes and lower bad debts (net bad debts now 1.5% of TTV), which bolster net margins and underpin increasing cash earnings.

- Scaling distribution through partnerships and embedded finance with major merchants and platforms (such as Google Pay, Stripe, and large retailers in key verticals) is decreasing customer acquisition costs and increasing take rates, which should drive further operating leverage and higher earnings.

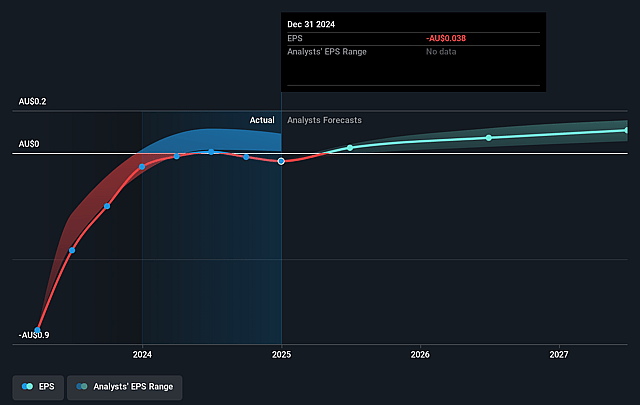

Zip Co Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zip Co's revenue will grow by 17.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.5% today to 12.5% in 3 years time.

- Analysts expect earnings to reach A$216.9 million (and earnings per share of A$0.16) by about September 2028, up from A$79.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$266 million in earnings, and the most bearish expecting A$122 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.5x on those 2028 earnings, down from 66.9x today. This future PE is greater than the current PE for the AU Consumer Finance industry at 11.5x.

- Analysts expect the number of shares outstanding to decline by 1.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.27%, as per the Simply Wall St company report.

Zip Co Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing regulatory scrutiny in key markets (especially the US and Australia) may result in higher compliance costs, tighter underwriting standards, and more complex customer onboarding, potentially restricting product offerings and slowing customer and revenue growth.

- The long-term sustainability of low credit losses is uncertain; as Zip Co scales, expansion into new customer segments or more complex/specialized products (e.g., Pay-in-8, personal loans) could lead to higher bad debts and increased provisions, negatively impacting net margins and earnings.

- The broader BNPL industry faces intensifying competition from incumbent financial institutions, other fintechs, and emerging payment methods (e.g., digital wallets, direct bank links), risking pricing pressure and possible stagnation or decline in Zip Co's transaction volumes and market share, which would affect top-line revenue growth.

- Continued margin compression risk arises from Zip's increasing dependence on the US business, which operates at a lower revenue margin than ANZ; this product and geographic mix shift may limit Zip's ability to sustain improvements to overall operating or net profit margins, affecting future earnings growth.

- Structural pressures from rising (or potentially volatile) interest rates could increase Zip Co's cost of funding and reduce consumer borrowing demand; while management is currently benefiting from refinancing at lower margins and potential rate cuts, future cycles or credit tightening may reverse this trend, directly lowering Zip Co's net margins and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$4.442 for Zip Co based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$5.0, and the most bearish reporting a price target of just A$4.08.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$1.7 billion, earnings will come to A$216.9 million, and it would be trading on a PE ratio of 32.5x, assuming you use a discount rate of 8.3%.

- Given the current share price of A$4.14, the analyst price target of A$4.44 is 6.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Zip Co?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.