Last Update 14 Dec 25

Fair value Increased 11%HUB: Index Inclusion Will Expose Lofty Expectations And Likely Overvaluation

Analysts have raised their price target for HUB24 by about A$6 to reflect stronger projected revenue growth, slightly higher discount rates, improved long term profit margins, and a modestly lower future P/E multiple in their updated valuation models.

What's in the News

- HUB24 Limited has been added to the FTSE All-World Index, increasing its visibility among global institutional investors (Index Constituent Adds).

Valuation Changes

- Fair Value Estimate has risen moderately, increasing from A$56.13 to about A$62.48 per share.

- Discount Rate has edged up slightly, moving from roughly 7.63% to about 7.71%.

- Revenue Growth Assumption has increased meaningfully, from approximately 15.52% to about 17.94% per year.

- Net Profit Margin Assumption has risen modestly, from around 22.36% to roughly 23.83%.

- Future P/E Multiple has declined slightly, easing from about 40.33x to roughly 39.18x forward earnings.

Key Takeaways

- Accelerating digital competition and ongoing fee pressure threaten HUB24's margins and long-term earnings outlook.

- Regulatory reforms and industry consolidation could increase costs and constrain organic revenue and profit growth.

- HUB24's innovation, organic growth, and diversification amid industry tailwinds and sector consolidation position it for expanding margins, recurring revenue, and sustained long-term earnings growth.

Catalysts

About HUB24- A financial services company, provides integrated platform, technology, and data solutions to wealth industry in Australia.

- The rapidly increasing adoption of advanced AI and automation technology in wealth management may accelerate the entry of new low-cost digital competitors, undermining HUB24's ability to maintain its current revenue margins and driving significant downward pressure on platform fees.

- Intensifying regulatory scrutiny and the likelihood of further reforms targeting transparency and fee structures can materially increase compliance costs and restrict some revenue streams, eroding net profit margins and dampening future earnings growth.

- As Australia's population ages, a slowdown in overall superannuation inflows and possible stagnation of wage growth could sharply reduce the rate of growth in addressable assets under management for HUB24, limiting the long-term expansion of funds under administration and constraining top-line revenue growth.

- A high dependency on a finite pool of independent advisers, combined with the risk of adviser industry consolidation, increases vulnerability to a plateau or contraction in net inflows, which would substantially curtail organic revenue and profit growth.

- Ongoing commoditisation of platform services coupled with aggressive competition from both established bank-affiliated and emerging global platforms is likely to erode HUB24's pricing power, resulting in sustained margin compression and lower long-term earnings potential.

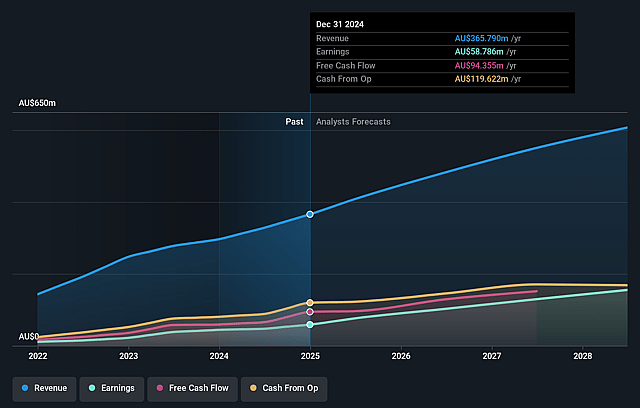

HUB24 Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on HUB24 compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming HUB24's revenue will grow by 15.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 19.7% today to 22.4% in 3 years time.

- The bearish analysts expect earnings to reach A$138.8 million (and earnings per share of A$1.71) by about September 2028, up from A$79.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 40.3x on those 2028 earnings, down from 104.2x today. This future PE is greater than the current PE for the AU Capital Markets industry at 21.9x.

- Analysts expect the number of shares outstanding to decline by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.63%, as per the Simply Wall St company report.

HUB24 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong secular tailwinds in the Australian wealth management sector, such as the upcoming multi-trillion dollar intergenerational wealth transfer and rising demand for financial advice, are likely to support continued increases in HUB24's funds under administration, driving up both platform revenue and total earnings in the long term.

- Adoption of technology and digital transformation among advisers and clients is accelerating, and HUB24's proven ability to innovate and roll out new solutions-like Engage, Private Invest, and integrated technology platforms-positions it to benefit from increased operating leverage and further margin expansion as scale increases.

- Robust organic growth as evidenced by record net inflows, high adviser advocacy, expanding adviser penetration (from 16 percent to 33 percent in four years), and growing market share (from four percent to nine percent), provide a strong base for reliable recurring revenues and support a positive long-term view on earnings growth.

- The ongoing consolidation in the financial advice and platforms sector is positioning leading, independent and specialist providers like HUB24 to capture additional flows from subscale or disrupted competitors, which could allow the company to command premium pricing and further grow its net profit margins over time.

- HUB24's successful diversification into adjacent products (data solutions, myprosperity, managed accounts) and execution of large-scale migrations demonstrate management competency and the ability to unlock cross-sell synergies, increasing stickiness of client relationships and resulting in higher total group revenue and sustainable EPS growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for HUB24 is A$56.13, which represents two standard deviations below the consensus price target of A$99.75. This valuation is based on what can be assumed as the expectations of HUB24's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$125.0, and the most bearish reporting a price target of just A$42.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$620.9 million, earnings will come to A$138.8 million, and it would be trading on a PE ratio of 40.3x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$101.92, the bearish analyst price target of A$56.13 is 81.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on HUB24?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.