Key Takeaways

- Accelerating adviser network penetration, technology-driven operational efficiencies, and a powerful ecosystem position HUB24 for outsized revenue and margin growth beyond current expectations.

- Strong balance sheet enables strategic acquisitions and partnerships, potentially cementing HUB24's dominance and rapidly expanding recurring revenue through network effects.

- Intensifying competition, regulatory pressures, and reliance on the Australian market threaten HUB24's margins, innovation, and long-term revenue stability as industry dynamics shift.

Catalysts

About HUB24- A financial services company, provides integrated platform, technology, and data solutions to wealth industry in Australia.

- Analyst consensus expects ongoing market share gains and adviser network growth to drive robust revenue, but given that HUB24's adviser penetration has more than doubled to 33% over four years-while the industry average FUA per adviser remains over triple HUB24's current figure-there is clear upside for a step-change in revenue if adviser FUA penetration accelerates, especially as intermediaries consolidate onto single platforms.

- While analysts broadly agree that technology enhancements and AI-driven automation will gradually drive operational efficiency and margin expansion, they may be underestimating the margin uplift possible: continued high EBITDA margin expansion, now approaching mid-40s and possibly reaching high-40s or even 50% over the medium term, could occur as ongoing digital adoption and scale effects reduce per-unit costs materially faster than consensus expects.

- HUB24's positioned to disproportionately capture the imminent wave of intergenerational wealth transfer and the ongoing retirement of defined benefit members into defined contribution superannuation, putting the platform at the forefront of new, large net inflows and thus supercharging future FUA and revenue growth.

- The company's ecosystem approach-with successful cross-sell already delivering over $1 billion of FUA from myprosperity synergies and rapidly increasing enterprise agreements-suggests a network effect could emerge, unlocking exponential wallet share growth and boosting recurring revenue streams much more rapidly than linear projections suggest.

- With a strong balance sheet and improving cash flow, HUB24 has significant firepower for further strategic bolt-on acquisitions or industry partnerships, potentially accelerating its shift toward a platform "winner takes most" scenario and creating positive surprises for both EPS and long-term shareholder value.

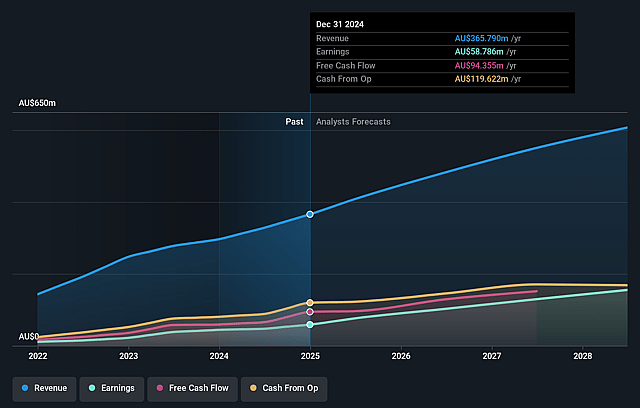

HUB24 Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on HUB24 compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming HUB24's revenue will grow by 19.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 19.7% today to 27.8% in 3 years time.

- The bullish analysts expect earnings to reach A$192.9 million (and earnings per share of A$2.45) by about September 2028, up from A$79.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 64.6x on those 2028 earnings, down from 104.2x today. This future PE is greater than the current PE for the AU Capital Markets industry at 21.9x.

- Analysts expect the number of shares outstanding to decline by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.63%, as per the Simply Wall St company report.

HUB24 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating adoption of direct-to-consumer investment solutions and self-directed platforms poses a long-term risk to HUB24's adviser-centric business model, potentially undermining net inflows and revenue growth if more Australians bypass traditional advisers.

- Increased regulatory scrutiny and compliance costs in financial services could constrain product innovation for HUB24 and squeeze margins over time, leading to higher operating costs and margin compression.

- Persistent industry consolidation and the entry of big tech or fintech firms into the wealth platform market may intensify competition, exerting downward pressure on HUB24's fees and compressing net margins and overall profitability.

- Margin compression is already evident with HUB24's platform custody revenue margin declining by 1-2 basis points year-on-year and institutional revenue margin falling from 13 basis points to 7 basis points over the year, signaling the risk of further fee erosion and reduced net earnings as competitors push for scale.

- HUB24's over-reliance on the Australian market leaves it vulnerable to adverse local economic or regulatory events, meaning a domestic downturn or negative regulatory changes could disproportionately impact its revenue and earnings stability in future years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for HUB24 is A$125.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of HUB24's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$125.0, and the most bearish reporting a price target of just A$42.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$695.0 million, earnings will come to A$192.9 million, and it would be trading on a PE ratio of 64.6x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$101.92, the bullish analyst price target of A$125.0 is 18.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on HUB24?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.