Last Update19 Aug 25Fair value Increased 15%

HUB24’s consensus price target has increased to A$91.50, underpinned by a lower forward P/E ratio and improved net profit margin, indicating stronger anticipated earnings and profitability.

Valuation Changes

Summary of Valuation Changes for HUB24

- The Consensus Analyst Price Target has risen from A$86.53 to A$91.50.

- The Future P/E for HUB24 has significantly fallen from 60.55x to 54.31x.

- The Net Profit Margin for HUB24 has risen from 24.60% to 26.82%.

Key Takeaways

- Structural tailwinds, tech innovation, and adviser migration to digital platforms underpin HUB24's strong growth potential, deepening relationships and expanding wallet share.

- Scale, product ecosystem integration, and regulatory trends favor HUB24's platform, supporting outperformance, margin expansion, and net earnings growth over time.

- Margin compression, client concentration, rising costs, digital disruption, and tighter regulations threaten HUB24's profitability, revenue growth, and long-term relevance in a competitive landscape.

Catalysts

About HUB24- A financial services company, provides integrated platform, technology, and data solutions to wealth industry in Australia.

- Ongoing structural growth in household wealth and the superannuation system, combined with a significant intergenerational wealth transfer and increasing demand for financial advice, are driving robust inflows into investment platforms, positioning HUB24 for continued revenue and AUA growth over the long term.

- Increased technology adoption by advisers and investors-supported by HUB24's ongoing investment in automation, AI, and digital platform enhancements (e.g., Engage, HUBconnect, myprosperity integration)-is expected to accelerate adviser/client migration from legacy systems, deepening client relationships and boosting revenue per user and retention, positively impacting both top-line growth and operating leverage.

- HUB24 is capturing record adviser and market share gains, but penetration per adviser still materially lags the industry average, implying a long runway for higher FUA per adviser through increased wallet share, directly supporting sustained future revenue expansion.

- Scale benefits, product innovation, and ecosystem integration (cross-selling tech solutions, managed portfolios, ESG offerings, etc.) are driving expanding EBITDA margins despite reinvestment and some margin compression, indicating further margin improvement potential as automation and digital adoption increase.

- Industry shifts towards independent, open-architecture platforms and regulatory/compliance requirements favour scalable, cloud-based platforms like HUB24, supporting the company's continued outperformance versus legacy, bank-owned competitors and underlying net earnings growth.

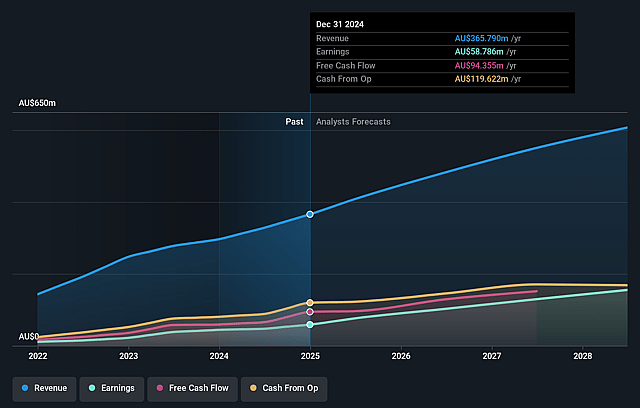

HUB24 Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming HUB24's revenue will grow by 16.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.7% today to 26.6% in 3 years time.

- Analysts expect earnings to reach A$168.7 million (and earnings per share of A$2.05) by about August 2028, up from A$79.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$187.7 million in earnings, and the most bearish expecting A$135.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 58.2x on those 2028 earnings, down from 106.5x today. This future PE is greater than the current PE for the AU Capital Markets industry at 17.7x.

- Analysts expect the number of shares outstanding to decline by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.6%, as per the Simply Wall St company report.

HUB24 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Margin compression risk remains a persistent threat, driven by ongoing fee reductions across the wealth management industry and HUB24's own recent decline in revenue margins (platform margin fell 2bps YOY; institutional margin fell to 7bps in H2). Continued competitive pricing could further impact long-term operating margins and net profit growth.

- Customer and adviser concentration risk persists, as HUB24's flows are highly levered to a relatively small group of large adviser relationships; any major client or dealer group switching platforms would result in earnings volatility and reduced revenues.

- Sustained cost escalation, specifically in employee-related and technology expenses (FTE up 8% YOY, OpEx guided to mid-teens growth), could outpace revenue growth if net inflows or market gains moderate, pressuring EBITDA margins and free cash flow over time.

- Accelerating digital disruption and fintech innovation, including direct-to-consumer platforms and AI-driven wealth tools, present a risk of disintermediation of traditional investment platforms like HUB24, impacting future revenue streams and market relevance.

- Increasing regulatory scrutiny and compliance burden in financial advice and investment platforms may drive up costs and limit product flexibility; ongoing fee transparency requirements and new governance standards (e.g., APRA regulations) could further compress margins and constrain profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$99.752 for HUB24 based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$125.0, and the most bearish reporting a price target of just A$42.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$635.3 million, earnings will come to A$168.7 million, and it would be trading on a PE ratio of 58.2x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$104.84, the analyst price target of A$99.75 is 5.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives