Key Takeaways

- Reliance on traditional active strategies and key personnel leaves GQG highly exposed to technological disruption, fee compression, and leadership risks.

- Limited product diversification and concentration in volatile markets could compound earnings declines during market downturns and shifting investor preferences.

- Strong investment performance, global expansion, strategic diversification, and scalable cost discipline position the business for sustained revenue growth, market share gains, and earnings stability.

Catalysts

About GQG Partners- Operates as a boutique asset management company worldwide.

- Sustained fee pressure from clients shifting towards lower-cost passive funds and the widespread adoption of AI-powered portfolio management threaten the demand for GQG's active strategies, which could drive significant declines in both revenue growth and management fee margins over the long term.

- The company's operational complexity and overhead are likely to rise materially as global regulatory tightening increases the cost of compliance and transparency, compressing net margins and offsetting any operating leverage achieved through scale.

- A continued global move towards robo-advisers and digital platforms may erode the appeal of GQG's traditional investment propositions, forcing the company to make costly technology investments that will dilute earnings and undermine profitability.

- Key-person dependency, especially on Rajiv Jain and the small founding team, creates acute succession and retention risks; any changes in leadership or investment philosophy would likely trigger client redemptions, further depressing assets under management, revenue and net income.

- GQG's lack of meaningful product diversification beyond concentrated equity funds, coupled with exposure to volatile emerging market bets, leaves the business especially vulnerable to sharp asset drawdowns and prolonged earning headwinds during cyclical downturns in global equity markets.

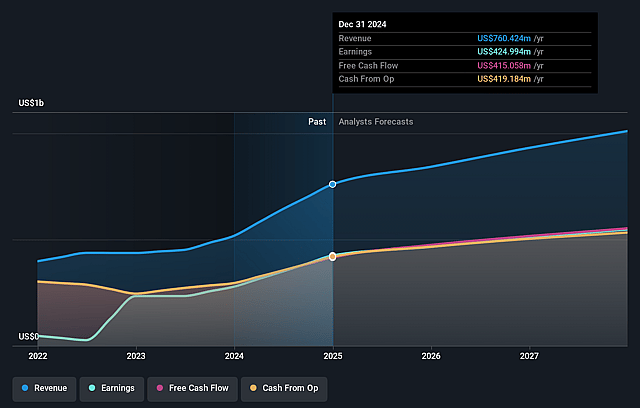

GQG Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on GQG Partners compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming GQG Partners's revenue will grow by 9.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 55.9% today to 46.7% in 3 years time.

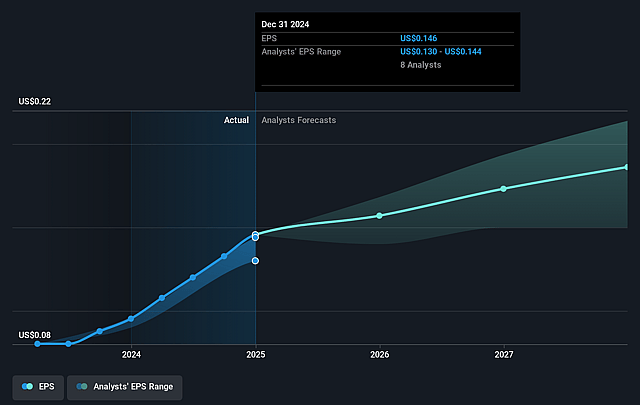

- The bearish analysts expect earnings to reach $463.7 million (and earnings per share of $0.15) by about July 2028, up from $425.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.0x on those 2028 earnings, up from 9.8x today. This future PE is lower than the current PE for the AU Capital Markets industry at 16.0x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.61%, as per the Simply Wall St company report.

GQG Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has demonstrated consistently strong risk-adjusted investment performance across all four core strategies on three-, five-, and ten-year horizons, repeatedly outperforming benchmarks and peers, which directly supports stable or growing net revenues and increases the likelihood of continued asset inflows.

- GQG Partners achieved significant growth in funds under management (FUM), rising $20 billion in net flows to end the year with $153 billion and 27% annual FUM growth, which underpins higher management fee income and operating leverage, enhancing earnings growth.

- The business is experiencing rapid expansion in the wholesale channel globally, not just in the U.S. but also in Australia, Canada, and Europe, suggesting its distribution and new rebranded value strategies can address a much larger market, potentially boosting long-term revenue and market share.

- Strategic investments such as the acquisition of boutique asset managers for the Private Client Services (PCS) business and launching new operations in Abu Dhabi provide diversification, create new growth avenues, and offer access to different client bases, which augments earnings stability and future revenue streams.

- Operating margins are expanding, reaching 76% for the full year, with management fees representing nearly all net revenue and disciplined cost management in compensation and operating expenses, signaling a scalable business model that could drive higher net margins as assets under management continue to increase.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for GQG Partners is A$2.1, which represents two standard deviations below the consensus price target of A$2.84. This valuation is based on what can be assumed as the expectations of GQG Partners's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$3.56, and the most bearish reporting a price target of just A$2.08.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $992.1 million, earnings will come to $463.7 million, and it would be trading on a PE ratio of 11.0x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$2.15, the bearish analyst price target of A$2.1 is 2.4% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.