Key Takeaways

- GQG's global track record and strategic pivots uniquely position it to capture significant inflows and surpass industry growth, leveraging emerging markets and Middle East expansion.

- Strong ESG integration, operational efficiency, and investment in scalable platforms drive margin expansion and resilience amid industry consolidation and fee pressure.

- GQG faces major challenges from industry shifts toward passive and alternative investments, fee pressure, technological disruption, and heavy reliance on key personnel for stability.

Catalysts

About GQG Partners- Operates as a boutique asset management company worldwide.

- Analyst consensus expects the Quality Value rebranding to tap a larger value universe, but with GQG's sustained top-quintile alpha, risk-adjusted returns, and global peer-beating track record, this pivot could drive inflows that dwarf expectations and enable above-industry revenue and asset growth as performance-chasing capital shifts aggressively towards their newly-branded offerings.

- While analyst consensus highlights the long-term potential of Abu Dhabi operations for access to talent and efficiency, the strategic foothold in the Middle East positions GQG to capture accelerating allocations from rapidly expanding sovereign wealth funds and cross-border investors, potentially making the region a transformative driver for future revenue, AuM, and diversification beyond initial projections.

- The global rise in investable wealth, especially across Asia and other emerging markets, directly aligns with GQG's core expertise in emerging market strategies and longstanding outperformance, setting the company up to capture extraordinary net flows and revenue growth as international demand shifts away from index solutions and towards proven active managers.

- GQG's competitive advantage in ESG integration-particularly in the less crowded emerging markets space-positions it to attract more stable, high-margin institutional mandates from asset owners facing regulatory and sustainability pressures, supporting persistent earnings and improving net margins versus peers.

- The firm's operational efficiency, focus on scalable platforms, and willingness to invest actively in next-generation technology, product expansion (such as ETFs and private assets), and global distribution channels create a structural cost advantage and growth engine poised to deliver outsize margin expansion and resilient long-term earnings even in an environment of industry consolidation and fee pressure.

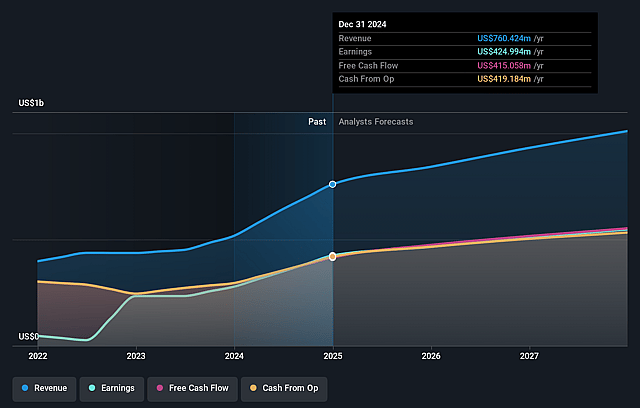

GQG Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on GQG Partners compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming GQG Partners's revenue will grow by 14.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 55.9% today to 56.8% in 3 years time.

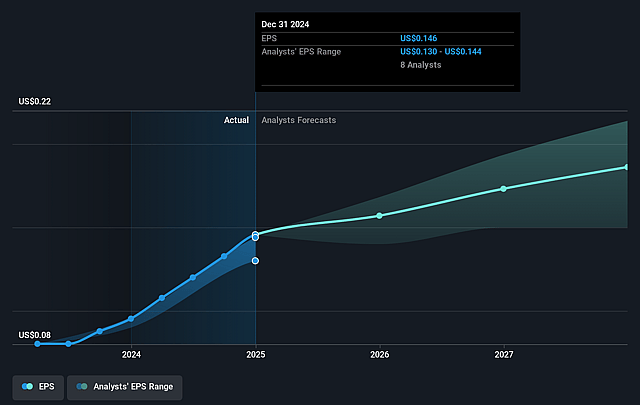

- The bullish analysts expect earnings to reach $646.3 million (and earnings per share of $0.22) by about July 2028, up from $425.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.4x on those 2028 earnings, up from 9.8x today. This future PE is lower than the current PE for the AU Capital Markets industry at 15.8x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.61%, as per the Simply Wall St company report.

GQG Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing industry shift toward passive investment vehicles such as ETFs and index funds could erode long-term demand for GQG's active management services, resulting in persistent pressure on fee levels and limiting the company's ability to sustain current revenue growth rates and net margins.

- GQG's operating margins and earnings are exposed to further compression as competitors and clients increasingly adopt technology and AI-driven investment approaches, potentially requiring significant reinvestment and causing traditional active managers like GQG to spend more just to remain competitive.

- The company's revenue stability is at risk due to a heavy reliance on a concentrated group of star portfolio managers, particularly Rajiv Jain; any unexpected departures or succession missteps may cause large client outflows and undermine overall assets under management, net revenue, and earnings.

- Long-running net outflows in the institutional channel, paired with structurally shrinking institutional pools globally due to maturing pension funds and changing demographics, suggest future organic growth could be increasingly reliant on the more volatile and margin-sensitive wholesale and intermediary channels, which may not be able to fully offset the decline and could increase earnings volatility.

- GQG's relatively high fee structure and dependence on traditional public equity strategies face headwinds from both sustained industry fee compression and the rising popularity of alternative investments such as private credit and private equity, which may challenge its competitive positioning, lead to further margin pressure, and shrink the long-term addressable market for its core offerings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for GQG Partners is A$3.56, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of GQG Partners's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$3.56, and the most bearish reporting a price target of just A$2.08.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $646.3 million, and it would be trading on a PE ratio of 13.4x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$2.15, the bullish analyst price target of A$3.56 is 39.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.