Key Takeaways

- Growth in digital lottery participation and adoption of B2B solutions are expanding Jumbo's market reach, margins, and revenue potential.

- International expansion and regulatory developments are reducing reliance on Australia and providing new long-term earnings opportunities.

- Overdependence on jackpot cycles, rising customer acquisition costs, regulatory risks, and slow overseas expansion threaten revenue stability, margin quality, and long-term growth prospects.

Catalysts

About Jumbo Interactive- Engages in the retail of lottery tickets through the internet and mobile devices in Australia, the United Kingdom, Canada, Fiji, and internationally.

- Accelerating shift towards online lottery participation-evidenced by digital penetration now above 41% and moving closer to 50%-is expanding Jumbo's total addressable market, supporting consistent revenue and TTV growth even as jackpot cycles fluctuate.

- Jumbo's proprietary white-label and SaaS lottery solutions, with growing adoption among charity and international partners, are driving high-margin B2B revenues and increasing group EBITDA margins over time.

- Ongoing international expansion-particularly with Managed Services performing above guidance in the UK and progress in Canada-diversifies revenue and earnings away from the mature Australian market, lowering geographic concentration risk and enabling multi-year top-line growth.

- Continued investment in customer acquisition, data analytics, and personalisation strategies is improving player quality, spend, and retention, which is expected to drive sustainable increases in revenue per user and operating leverage.

- Regulatory digitization and liberalization-such as the Lotterywest government tender and new games/price increases (e.g., Powerball, Saturday Lotto)-create opportunities for Jumbo to win new contracts and improve ticket margins, positively impacting both earnings and cash flow.

Jumbo Interactive Future Earnings and Revenue Growth

Assumptions

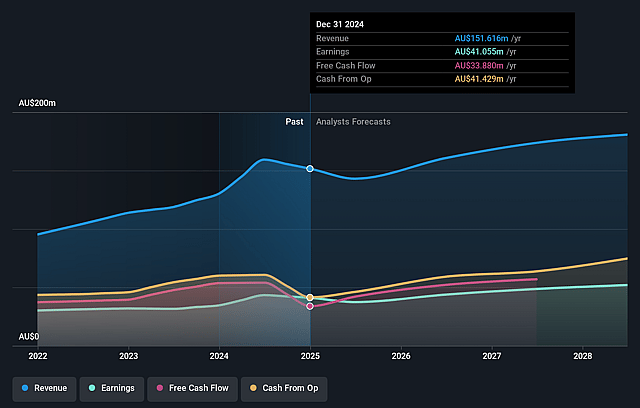

How have these above catalysts been quantified?- Analysts are assuming Jumbo Interactive's revenue will grow by 9.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 27.3% today to 26.6% in 3 years time.

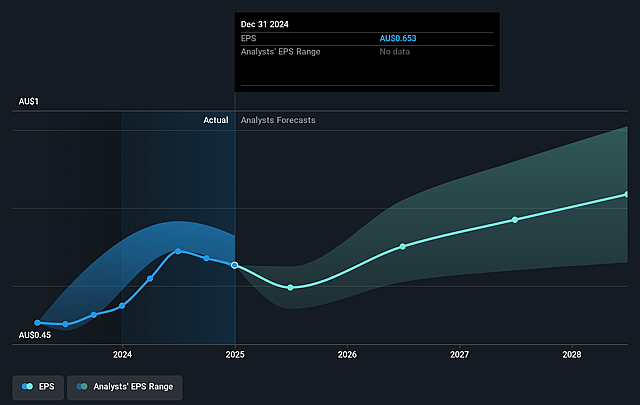

- Analysts expect earnings to reach A$51.4 million (and earnings per share of A$0.8) by about September 2028, up from A$40.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$59.6 million in earnings, and the most bearish expecting A$42 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, up from 17.7x today. This future PE is lower than the current PE for the AU Hospitality industry at 35.2x.

- Analysts expect the number of shares outstanding to decline by 0.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.97%, as per the Simply Wall St company report.

Jumbo Interactive Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Jumbo Interactive's heavy reliance on jackpot cycles means that subdued jackpot environments-like the recent year leading to declines in TTV, revenue, EBITDA, and NPATA-can significantly impact financial performance, increasing the risk of persistent revenue volatility and margin pressure if jackpot normalization is delayed or future cycles are less favorable.

- The company's increasing marketing spend to maintain digital market share suggests customer acquisition and retention are becoming more expensive; if these costs continue to rise while market share stabilizes rather than grows (as management expects), EBITDA margins could be structurally lower over the long term, negatively affecting earnings quality.

- Jumbo's expansion strategy is partially dependent on successful international M&A and new B2C market entries, but management acknowledges slower-than-expected progress, competition for targets, and regulatory uncertainty (particularly in the UK and Canada), all of which could constrain overseas revenue diversification and limit long-term top-line growth.

- Jumbo's major revenue stream remains highly dependent on licensing and partnership agreements with state lottery operators (e.g., TLC, Lotterywest); renewal risk, changes in fee structures, or states shifting to direct-to-consumer models could reduce Jumbo's addressable market, compress margins, or lead to abrupt drops in revenue.

- Pressure from tightening regulation, higher gambling taxes in key markets, or societal shifts toward more scrutiny of problem gambling-combined with greater competitive threats from alternative entertainment and betting platforms-could lead to shrinking customer cohorts, increased compliance costs, and diminished growth opportunities, ultimately weighing on both revenues and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$12.535 for Jumbo Interactive based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$15.2, and the most bearish reporting a price target of just A$9.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$192.9 million, earnings will come to A$51.4 million, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$11.4, the analyst price target of A$12.53 is 9.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.