Key Takeaways

- Rapid player growth, digital innovation, and AI-driven marketing are driving higher player value, improved margins, and positioning Jumbo for sustained online lottery leadership.

- Successful international expansion, managed services, and targeted acquisitions offer diversification, transformative earnings growth, and increased earnings quality.

- Reliance on the Australian lottery market, rising competition, regulatory risks, and disruptive new entrants threaten Jumbo's growth, margins, and future market position.

Catalysts

About Jumbo Interactive- Engages in the retail of lottery tickets through the internet and mobile devices in Australia, the United Kingdom, Canada, Fiji, and internationally.

- Analyst consensus views the Daily Winners Premium Tier loyalty program as an incremental revenue driver, but the rapid adoption rate and evidence of higher-than-expected average spend per engaged player indicate it could unlock a significant uplift in player LTV and accelerate both gross sales and net margins beyond current forecasts, particularly as further product innovations and tiers are layered in.

- While the consensus sees international expansion and Managed Services as gradual revenue streams, the Managed Services segment is already delivering well ahead of margin expectations in the U.K. and Canada, and accelerated wins of major government lotteries (like Lotterywest) and larger SaaS deals could quickly transform overseas earnings, diversify cash flows, and deliver step-changes in group EBITDA.

- The long-term migration of lottery and gaming spend online is likely to be compounded by Jumbo's best-in-class proprietary digital infrastructure, which positions the company to capture wallet share not just from existing lottery players, but from younger digital-native cohorts whose spending power and participation will rise sharply over the next decade, underpinning sustained double-digit revenue growth.

- Jumbo's robust balance sheet and more aggressive pursuit of high-growth, profitable B2C M&A targets-facilitated by management's discipline and sector expertise-mean that even a single successful acquisition could prove highly accretive to group earnings and deliver a multiple re-rating as earnings quality, scale, and growth visibility improve.

- Leveraging AI-powered analytics and personalised marketing, Jumbo has already shown early progress in boosting engagement and higher-value transactions per player; as these capabilities mature, expect structurally higher customer retention and ARPU, directly supporting margin expansion and long-term operating leverage.

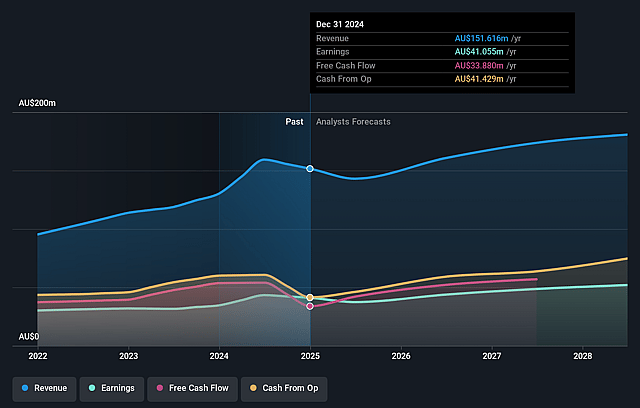

Jumbo Interactive Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Jumbo Interactive compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Jumbo Interactive's revenue will grow by 12.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 27.3% today to 30.1% in 3 years time.

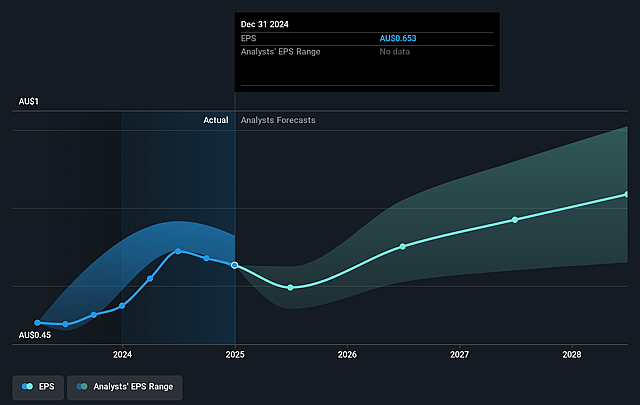

- The bullish analysts expect earnings to reach A$62.6 million (and earnings per share of A$0.92) by about September 2028, up from A$40.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, up from 17.2x today. This future PE is lower than the current PE for the AU Hospitality industry at 35.2x.

- Analysts expect the number of shares outstanding to decline by 0.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

Jumbo Interactive Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Jumbo Interactive's heavy dependence on the Australian lottery market and large jackpot cycles exposes the company to both regulatory risk and market saturation; any unfavorable changes in local regulation or a continued period of subdued jackpots could significantly impair future revenue growth.

- Intensifying marketing competition and rising customer acquisition costs, especially as digital penetration approaches saturation levels, may limit further market share gains and compress net margins over the long term.

- The growing threat of direct-to-consumer channels operated by national lotteries, as well as innovative blockchain-based lottery platforms and alternative gaming options, could erode Jumbo's intermediary role and reduce revenue and earnings predictability.

- Potential adverse renegotiation of key reseller contracts, such as those with Tabcorp and other major operators, poses a risk of less favorable commercial terms, leading to reduced revenue margins and increased earnings volatility.

- Increasing regulatory scrutiny and societal backlash against gambling, including higher taxes and tighter advertising or online participation restrictions, could drive up compliance and operating costs, weigh on long-term sector profitability, and limit Jumbo's ability to expand internationally, thereby impacting both revenue and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Jumbo Interactive is A$15.2, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Jumbo Interactive's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$15.2, and the most bearish reporting a price target of just A$9.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$207.9 million, earnings will come to A$62.6 million, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$11.09, the bullish analyst price target of A$15.2 is 27.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.