Key Takeaways

- Automation, digital platforms, and a unified global system are rapidly boosting productivity and operating leverage, resulting in dramatic margin expansion and profitable growth.

- Surging demand in luxury, cruise, and Asia-Pacific markets, combined with unique experiential travel offerings, positions the company for outsized, high-margin earnings acceleration.

- Slow digital adaptation, over-reliance on physical retail, and rising external pressures could undermine long-term growth, profitability, and resilience against online-first competitors.

Catalysts

About Flight Centre Travel Group- Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

- Analyst consensus believes productivity and cost efficiency improvements from automation and a single global operating system will steadily drive margin gains, but this likely understates the scale and speed of benefits; management expects meaningful productivity uplifts exceeding 15 to 20 percent by FY26, leading to substantial fixed cost leverage and significant net margin expansion.

- Analysts broadly agree that higher-margin businesses, such as luxury, cruise, and corporate, will drive TTV and margins; however, early signs show luxury and cruise are surpassing expectations with both experiencing record profit growth, and significant deferred revenue recognition slated for FY26–27, positioning the company for an outsized leap in high-margin earnings as those investments mature.

- The rapid expansion of the middle class, particularly in the Asia-Pacific region-even as current Asia profits are suppressed by transitory system issues-suggests an imminent and powerful demand surge as the region normalizes, supporting multi-year double-digit TTV growth and sustained revenue expansion as Flight Centre regains profitability in these high-growth markets.

- Flight Centre's proprietary digital platforms, including advanced AI-driven trip planners and scalable independent agent models, are accelerating customer acquisition and conversion rates, enabling dramatic increases in transaction volumes without proportional headcount growth, which should drive long-term operating leverage and boost both revenue and earnings per share.

- The surging global demand for "bucket-list" experiential travel and group events, paired with unique, high-margin integrated products like the new world cruise and expanding MICE (meetings, incentives, conferences, exhibitions) portfolio, position Flight Centre to unlock new, resilient revenue streams, rapidly lifting group TTV, yield per transaction, and ultimately driving record profit growth.

Flight Centre Travel Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Flight Centre Travel Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Flight Centre Travel Group's revenue will grow by 15.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.1% today to 8.8% in 3 years time.

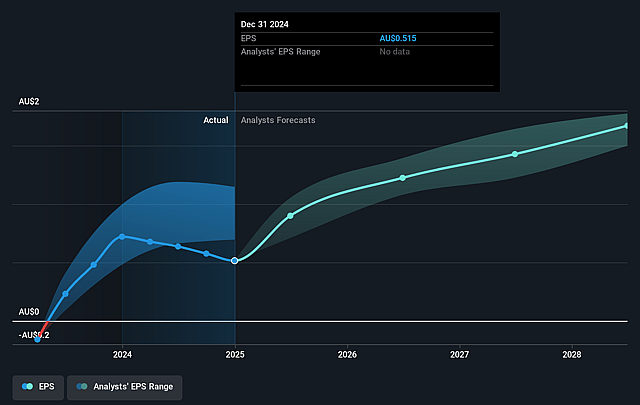

- The bullish analysts expect earnings to reach A$370.6 million (and earnings per share of A$1.78) by about July 2028, up from A$113.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.0x on those 2028 earnings, down from 25.5x today. This future PE is lower than the current PE for the AU Hospitality industry at 32.9x.

- Analysts expect the number of shares outstanding to grow by 0.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.65%, as per the Simply Wall St company report.

Flight Centre Travel Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing shift of consumers to digital self-service travel platforms threatens Flight Centre's traditional retail and consultant-driven business model, risking long-term erosion of both transaction volumes and net margins as in-person foot traffic declines and commission revenue falls.

- Persistent difficulty achieving meaningful digital scale and lagging investment in proprietary technologies could result in sustained market share losses to more agile online competitors, directly limiting future top-line growth and revenue.

- A heavy reliance on physical retail locations exposes Flight Centre to fixed and inflexible cost bases, increasing margin pressure as consumer preferences and booking behaviors migrate online, potentially constraining earnings.

- Rising frequency and severity of external disruptions-such as geopolitical instability, pandemics, or climate events-can compress international travel demand and introduce heightened revenue volatility, making long-term financial predictability and profitability more challenging.

- Heightening regulatory and consumer emphasis on sustainable travel and lower-carbon options may discourage high-volume traditional travel, forcing operational changes that could suppress core booking volumes and depress long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Flight Centre Travel Group is A$21.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Flight Centre Travel Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$21.0, and the most bearish reporting a price target of just A$12.8.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$4.2 billion, earnings will come to A$370.6 million, and it would be trading on a PE ratio of 16.0x, assuming you use a discount rate of 8.6%.

- Given the current share price of A$13.34, the bullish analyst price target of A$21.0 is 36.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.