Key Takeaways

- Shifting consumer preferences, regulatory headwinds, and competitive pressures threaten core alcohol retail and hospitality segments, challenging sustainable revenue and margin growth.

- Rising labour costs, operational complexity, and overreliance on domestic markets elevate execution risks and long-term risk to earnings and cash flow stability.

- Ongoing investment in retail, loyalty, cost control, and innovation positions Endeavour Group for sustained revenue growth, margin expansion, and resilience against economic challenges.

Catalysts

About Endeavour Group- Engages in the retail drinks and hospitality businesses in Australia.

- As public health consciousness accelerates and consumers shift increasingly toward healthier lifestyle choices, including no

- and low-alcohol alternatives, Endeavour Group's core alcohol retail and hospitality segments face structural headwinds with long-term volume declines, directly threatening revenue growth and eroding operating leverage.

- Regulatory risks are mounting, with increasing scrutiny and anti-alcohol sentiment likely to drive tighter restrictions, higher excise taxes, and curbs on advertising and gaming; these could lead to sustained compression in net margins and substantial earnings volatility across Endeavour's business lines.

- The continued rise of direct-to-consumer brands and fragmentation of the digital retail landscape is set to intensify competitive pressure, challenging Endeavour's brick-and-mortar advantage, diluting customer loyalty, and forcing deeper discounting that undermines both top-line and profit margins.

- Labour market pressures, including workforce shortages, rising wage costs, and increased regulatory complexity, are anticipated to further inflate the company's cost base, constraining Endeavour's ability to mitigate flat or declining sales with cost optimisation and directly impacting future net profit.

- Overreliance on domestic markets and growing operational complexity from ongoing hotel renewals, technology investments, and potential integration missteps may elevate execution risks, leading to increased costs, diminished efficiency gains, and long-term risk of margin erosion-undercutting the sustainability of current earnings and cash flow levels.

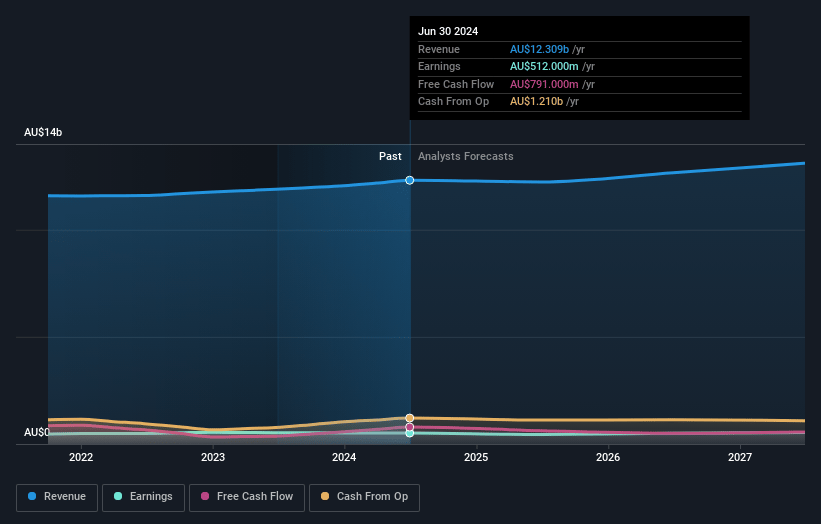

Endeavour Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Endeavour Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Endeavour Group's revenue will grow by 1.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.7% today to 3.8% in 3 years time.

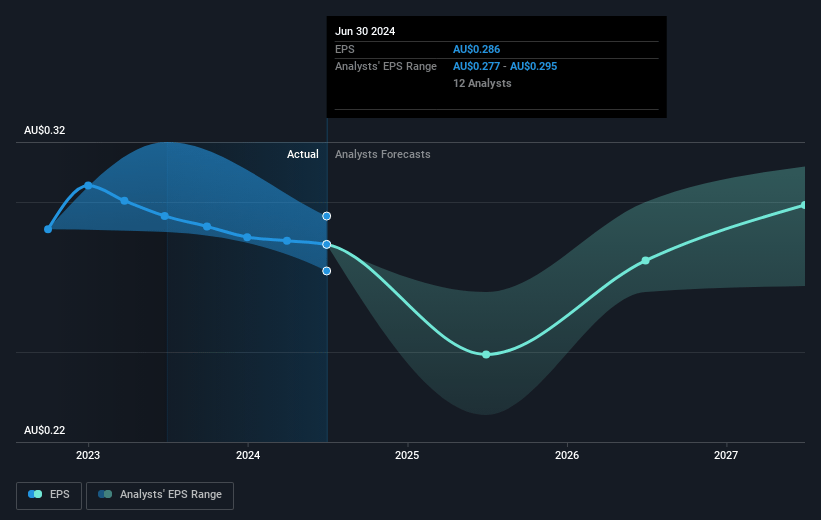

- The bearish analysts expect earnings to reach A$491.4 million (and earnings per share of A$0.27) by about July 2028, up from A$459.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.0x on those 2028 earnings, up from 15.7x today. This future PE is lower than the current PE for the AU Consumer Retailing industry at 23.0x.

- Analysts expect the number of shares outstanding to decline by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.45%, as per the Simply Wall St company report.

Endeavour Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continued expansion and modernization of Endeavour Group's retail and hospitality network, including investments in omnichannel capabilities and hotel renewals, positions the company to capture long-term revenue growth and higher returns on invested capital, which could support sustained improvement in net margins and overall earnings.

- Endeavour's robust loyalty programs, such as My Dan's and pub+, with increasing customer engagement and higher basket sizes, may drive gains in customer retention and lifetime value, acting as a tailwind for future revenue growth and improved operating leverage.

- Persistent focus on cost optimization through initiatives like the endeavourGO program-already delivering substantial savings and on track to exceed $290 million by FY26-could continue to reduce the cost of doing business, bolster gross profit, and mitigate inflationary pressures, thereby enhancing net margins.

- The company's strong working capital management, disciplined capital allocation, and significant undrawn debt capacity provide financial flexibility to pursue strategic investments and navigate economic or competitive headwinds, which could result in stable or growing free cash flow and earnings over time.

- Product innovation and category expansion through Pinnacle Drinks, together with resilience in premium and value segments, position Endeavour to benefit from evolving consumer preferences and premiumization trends, supporting sustained sales growth and margin improvements that could underpin a long-term increase in share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Endeavour Group is A$3.8, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Endeavour Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$6.1, and the most bearish reporting a price target of just A$3.8.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$13.0 billion, earnings will come to A$491.4 million, and it would be trading on a PE ratio of 17.0x, assuming you use a discount rate of 7.4%.

- Given the current share price of A$4.03, the bearish analyst price target of A$3.8 is 6.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.