Key Takeaways

- Transformative venue upgrades, cost-saving programs, and digitization are driving profitability and potential margin expansion beyond market expectations.

- Strong loyalty programs, digital innovations, and market consolidation position the company for significant long-term earnings growth and market share gains.

- Regulatory, social, and market shifts combined with competitive and financial pressures threaten Endeavour Group's margins, revenue stability, and long-term growth prospects.

Catalysts

About Endeavour Group- Engages in the retail drinks and hospitality businesses in Australia.

- Analyst consensus expects a strong uplift from store and hotel renewals, but this likely understates the potential for transformative step-changes in venue profitability, with recent large-scale pub redevelopments already delivering sustained return on capital well above 15 percent within just one year, pointing to material and rapid EBITDA upside as rollout pace accelerates.

- Analyst consensus assumes endeavourGO's $290 million savings target is achievable, but management commentary and current run-rates imply the program will surpass this, with additional cost-out and digitization opportunities already identified that could push net margin expansion significantly above consensus expectations.

- Endeavour Group's unrivaled customer membership base-with My Dan's penetration at one in four Australian adults and loyalty members spending 80 percent more per basket than non-members-enables sophisticated data-driven cross-selling and premiumization, uniquely positioning the company to capture outsize revenue and gross margin gains as consumer demand for premium, crafted, and exclusive products continues to rise.

- The company stands to drive disproportionately higher long-term earnings growth from accelerating omni-channel transformation, particularly as best-in-class digital execution (e.g., the BWS Appy Deals and rapid delivery partnerships) bridges the gap between traditional retail and booming online/social alcohol consumption models.

- Industry consolidation and capital constraints among smaller players are likely to catalyze further market share gains and accretive bolt-on acquisitions for Endeavour, with its property-heavy balance sheet and $1 billion in undrawn facilities supporting strategic flexibility, reinforcing earnings growth and free cash flow resilience well beyond current market forecasts.

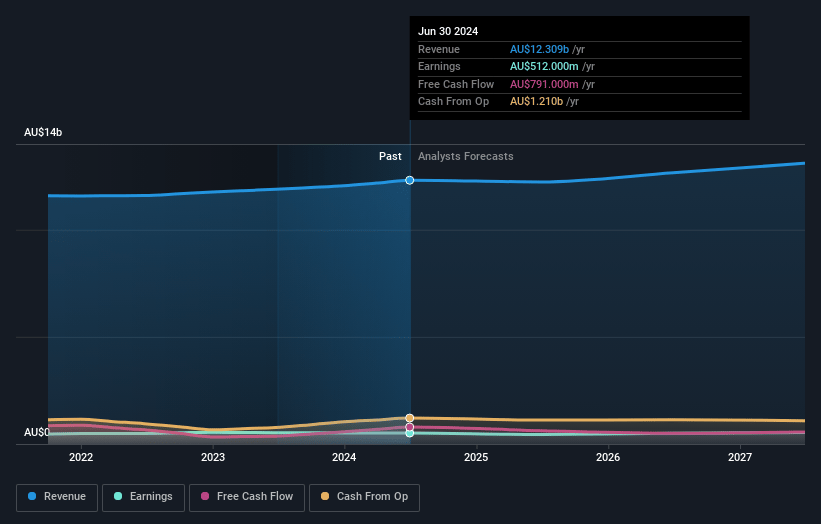

Endeavour Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Endeavour Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Endeavour Group's revenue will grow by 3.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.7% today to 4.3% in 3 years time.

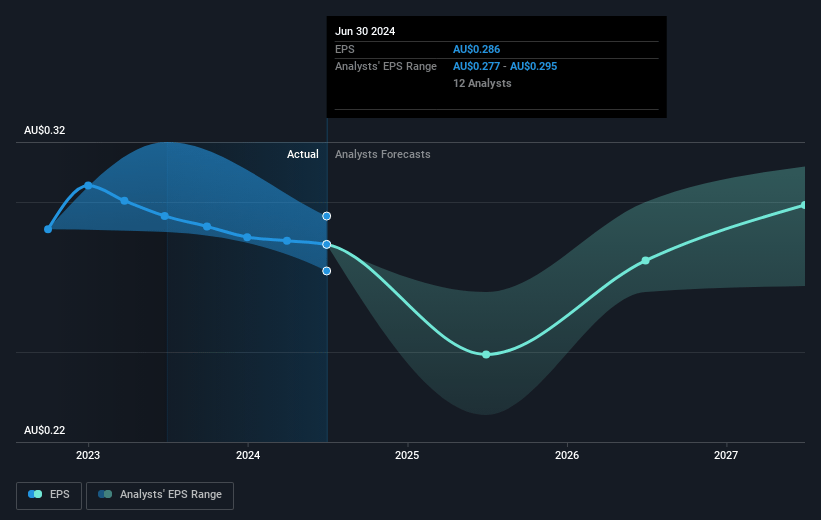

- The bullish analysts expect earnings to reach A$587.9 million (and earnings per share of A$0.33) by about July 2028, up from A$459.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.4x on those 2028 earnings, up from 16.1x today. This future PE is lower than the current PE for the AU Consumer Retailing industry at 23.0x.

- Analysts expect the number of shares outstanding to decline by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.42%, as per the Simply Wall St company report.

Endeavour Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened regulatory and social pressure on alcohol and gambling, combined with growing ESG scrutiny, could increase compliance costs and deter institutional investors, negatively impacting net margins and the company's long-term share price performance.

- The rising shift toward health and wellness among consumers, along with reduced alcohol consumption by younger demographics, presents a structural headwind for long-term volume growth in the retail segment and could drive ongoing revenue declines.

- Endeavour Group's substantial exposure to the Australian market makes its earnings and revenue more susceptible to local economic downturns or adverse policy changes, increasing revenue volatility and reducing overall earnings predictability.

- Intensifying competition from supermarkets, specialty liquor retailers, and digital entrants is driving greater promotional intensity, pressuring retail sales and margins, as evidenced by discounting and subdued underlying retail sales even outside of supply chain disruptions.

- Large real estate obligations and lease liabilities from its brick-and-mortar networks and hotel assets may drag on free cash flow and increase financial risk, particularly as the shift to e-commerce and digital experiences continues to diminish in-store foot traffic and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Endeavour Group is A$5.72, which represents two standard deviations above the consensus price target of A$4.56. This valuation is based on what can be assumed as the expectations of Endeavour Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$6.1, and the most bearish reporting a price target of just A$3.8.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$13.7 billion, earnings will come to A$587.9 million, and it would be trading on a PE ratio of 21.4x, assuming you use a discount rate of 7.4%.

- Given the current share price of A$4.12, the bullish analyst price target of A$5.72 is 28.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.