Last Update 26 Aug 25

Fair value Decreased 23%Despite an upgrade in consensus revenue growth forecasts, a notable decline in expected net profit margins has led analysts to lower Reece’s fair value estimate from A$15.30 to A$12.98.

What's in the News

- Reece declared a final dividend of 11.86 cents per share fully franked, bringing total dividends for Fiscal Year 2025 to 18.36 cents per share, down from 25.75 cents per share in the previous fiscal year.

Valuation Changes

Summary of Valuation Changes for Reece

- The Consensus Analyst Price Target has significantly fallen from A$15.30 to A$12.98.

- The Consensus Revenue Growth forecasts for Reece has significantly risen from 2.8% per annum to 3.3% per annum.

- The Net Profit Margin for Reece has significantly fallen from 4.51% to 4.04%.

Key Takeaways

- Strategic investments in network, digital, and product innovation position Reece to capture emerging demand and benefit from premium, eco-friendly market trends.

- Expansion in the U.S. and focus on operational efficiency offer future growth opportunities as market conditions recover, supporting higher margins and recurring revenue.

- Competitive pressures, core market softness, structural cost increases, and US integration challenges are constraining earnings potential, compressing margins, and increasing execution and asset risks.

Catalysts

About Reece- Engages in the distribution of plumbing, waterworks, heating, ventilation, air-conditioning, and refrigeration products to commercial and residential customers in Australia, New Zealand, and the United States.

- Continued investments in network expansion and digital capabilities position Reece to capture long-term demand driven by ongoing urbanisation, population growth, and the need to upgrade aging infrastructure, which should support above-market revenue growth and widen the addressable market as macro conditions improve.

- The significant expansion in the U.S.-despite current losses and integration challenges-creates operational leverage opportunities; when residential construction cycles recover, Reece stands to benefit from scale benefits and improved margins, enhancing medium-to-long-term earnings potential.

- Sustained commitment to product innovation and premiumisation (e.g., launches like WiFi-compatible heat pumps and enhanced digital tools) aligns with a rising market preference for sustainable, efficient solutions-this should enable higher margin product mix and improved net margins as demand trends shift toward eco-friendly offerings.

- The company's ongoing investment in value-added services (such as design, technical advice, and improved digital customer engagement) supports increased wallet share per customer and greater customer retention, which could drive recurring revenue and bolster top-line stability against cyclical headwinds.

- Operational streamlining, technology investments, and supply chain optimisation (automation, proprietary ERP systems) lay the groundwork for long-term cost efficiencies, supporting net margin expansion and stronger cash generation once current market softness abates.

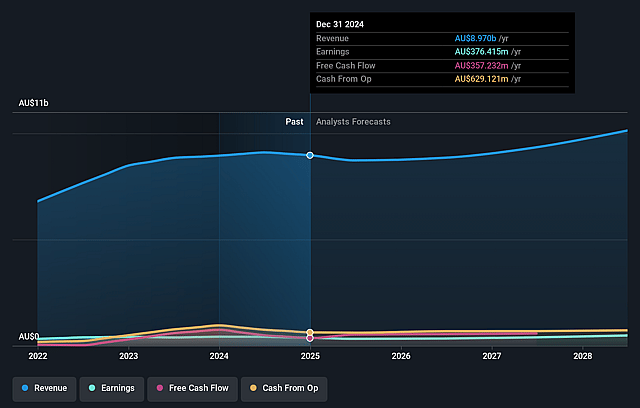

Reece Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Reece's revenue will grow by 3.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.5% today to 4.0% in 3 years time.

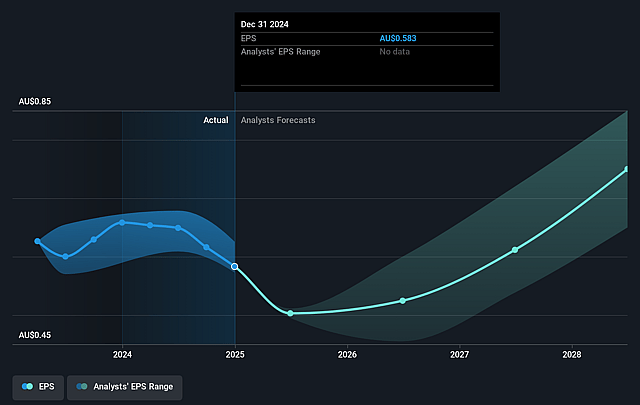

- Analysts expect earnings to reach A$389.1 million (and earnings per share of A$0.61) by about September 2028, up from A$316.9 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as A$445 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.7x on those 2028 earnings, up from 21.1x today. This future PE is greater than the current PE for the AU Trade Distributors industry at 16.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.07%, as per the Simply Wall St company report.

Reece Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent softness in core end markets, both in Australia/New Zealand and the US, combined with a prolonged slowdown in residential construction, could lead to structurally lower sales volumes, ongoing revenue headwinds, and drag on earnings.

- Increasing competitive intensity-including market entry from aggressive, well-capitalized rivals (Tradelink, JB Hi-Fi in bathrooms, and a newly formed competitor in US Waterworks)-is eroding market share and driving price-based competition, pressuring margins and limiting potential for earnings recovery.

- Structural wage and cost pressures, along with necessary investments in digital, innovation, and leadership capabilities, are elevating operating expenses and contributing to long-term EBIT margin compression, especially in ANZ where historical margin levels are unlikely to return without meaningful market recovery.

- Integration and capability-building challenges in the US segment, including cultural and structural issues post-acquisition, as well as executive turnover in key business units (e.g., Waterworks), are increasing execution risk and may result in ongoing US market share loss, suppressed profitability, and negative return on capital trends.

- Inventory build-up, pressured by pre-tariff purchasing and slow-moving stock from network expansion, is heightening working capital requirements and risks asset write-downs, which could negatively impact cash flows and net earnings resilience moving forward.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$11.815 for Reece based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$14.5, and the most bearish reporting a price target of just A$10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$9.8 billion, earnings will come to A$389.1 million, and it would be trading on a PE ratio of 24.7x, assuming you use a discount rate of 8.1%.

- Given the current share price of A$10.36, the analyst price target of A$11.82 is 12.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.