Last Update 12 Dec 25

Fair value Decreased 28%REH: Share Buyback Will Support Margins And Future Earnings Power

Analysts have lowered their price target on Reece from approximately $19.52 to $14.04. This reflects a more cautious view on margins and valuation multiples, even as revenue growth expectations improve.

What's in the News

- The Board of Directors has authorized a new share buyback plan for Reece Limited, which signals confidence in the company’s balance sheet and future cash generation (Key Developments).

- Reece Limited (ASX:REH) has launched a share repurchase program of up to 36.4 million shares, with a total value of AUD 400 million (Key Developments).

- The buyback price range has been set between AUD 11.00 and AUD 13.00 per share, with all repurchased shares to be cancelled (Key Developments).

- The buyback will be funded from the company’s general pool of funds, with a pro rata scale back mechanism applied for applications above 350 shares, and a record date for eligibility of September 26, 2025 (Key Developments).

- The buyback program will remain open until October 17, 2025, which provides a defined window for shareholders to participate (Key Developments).

Valuation Changes

- The fair value estimate has fallen significantly from A$19.52 to A$14.04, reflecting a more conservative view of Reece’s intrinsic value.

- The discount rate has risen slightly from 7.89 percent to 8.02 percent, indicating a modest increase in perceived risk or required return.

- Revenue growth has risen meaningfully from 5.26 percent to 7.29 percent, signalling higher expectations for top line expansion.

- The net profit margin has fallen notably from 5.30 percent to 4.08 percent, pointing to more cautious assumptions on profitability.

- The future P/E multiple has reduced from about 28.6x to 25.2x, implying a lower valuation multiple applied to Reece’s forecast earnings.

Key Takeaways

- Accelerated digital innovation, U.S. expansion, and industry consolidation position Reece for stronger margins, efficiency gains, and outsized growth compared to consensus expectations.

- Focus on premium, sustainable products and experienced leadership is expected to drive higher profitability, operational excellence, and resilience against macroeconomic headwinds.

- Mounting competition, operational cost pressures, and sluggish construction activity threaten Reece's margins, revenue growth, and long-term market position.

Catalysts

About Reece- Engages in the distribution of plumbing, bathroom, heating, ventilation, air-conditioning, waterworks, and refrigeration products to commercial and residential customers in Australia, the United States, and New Zealand.

- Analyst consensus sees Reece's large-scale digital innovation efforts, such as the Shadowboxer acquisition, as offering incremental upside, but this likely underrates the transformative potential of data-driven platforms and AI-powered customer solutions to rapidly capture market share and meaningfully expand margins as digitization accelerates across trade distribution.

- While analysts broadly acknowledge ongoing U.S. network expansion (32 new branches in half-year) as a foundation for long-term revenue growth, this underestimates the compounding effect of accelerated store rollout in an underpenetrated, highly fragmented U.S. market, particularly as construction activity normalizes and secular tailwinds from rising infrastructure investment and population growth translate to outsized revenue and earnings growth.

- Reece is well positioned to capitalize on an emerging wave of premiumization, with increasing adoption of water-efficient, sustainable plumbing products driven by stricter regulatory requirements and consumer demand, enabling higher-margin product mix and expanded profitability over time.

- Significant industry consolidation in plumbing and trade distribution remains in an early phase in both the U.S. and Australia, suggesting Reece can deliver substantial incremental scale efficiencies and procurement advantages beyond current consensus, leading to structurally stronger net margins and resilient earnings.

- The refreshed and highly experienced leadership team provides a catalyst for accelerated operational excellence, organizational agility, and best-in-class talent development, which can drive sustained above-market growth, increased branch productivity, and stronger long-term returns on capital as macro headwinds abate.

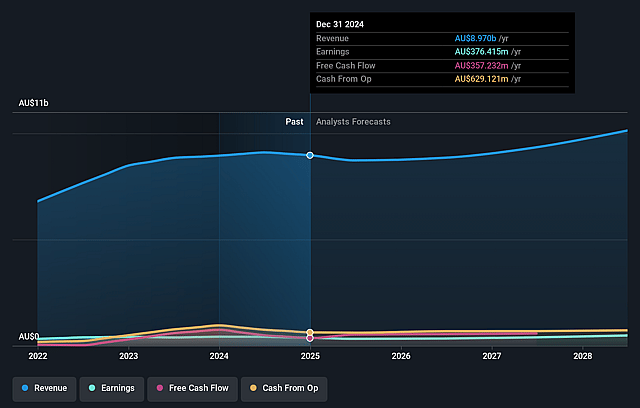

Reece Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Reece compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Reece's revenue will grow by 5.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.2% today to 5.3% in 3 years time.

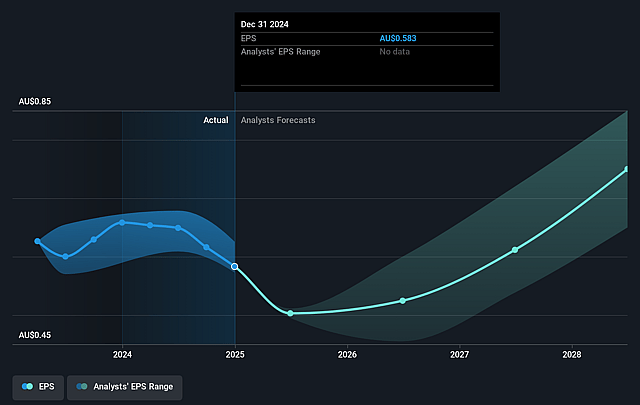

- The bullish analysts expect earnings to reach A$553.9 million (and earnings per share of A$0.86) by about August 2028, up from A$376.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 28.6x on those 2028 earnings, up from 23.7x today. This future PE is greater than the current PE for the AU Trade Distributors industry at 19.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.89%, as per the Simply Wall St company report.

Reece Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Reece is experiencing declining like-for-like sales, margin compression, and lost market share in the U.S., caused by aggressive new rivals and industry deflation, which threatens future revenue growth and overall profitability.

- The company continues to invest heavily in organic expansion, digital transformation, and acquisitions, resulting in rising operational expenses and higher CapEx, which is already weighing on net margins and return on capital.

- Reece faces significant execution risk in its ongoing digital innovation and ERP initiatives; failure to deliver these projects effectively could increase expenses and further erode net margins over the long term.

- There is mounting competitive intensity from both multinational incumbents and online disruptors in both Australia and the U.S., as well as the risk of e-commerce disintermediation, which threatens to reduce Reece's revenue and gross margins if traditional distribution models are bypassed.

- Slowing housing construction growth due to demographic shifts, along with heightened focus on sustainability and circular economy principles, could reduce long-term demand for new fixtures and fittings, negatively impacting Reece's revenue base.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Reece is A$19.52, which represents two standard deviations above the consensus price target of A$15.3. This valuation is based on what can be assumed as the expectations of Reece's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$19.9, and the most bearish reporting a price target of just A$12.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$10.5 billion, earnings will come to A$553.9 million, and it would be trading on a PE ratio of 28.6x, assuming you use a discount rate of 7.9%.

- Given the current share price of A$13.83, the bullish analyst price target of A$19.52 is 29.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Reece?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.