What Happened in the Market This Week?

Market Insight for 23rd May - 30th May 2022

The U.S. Market has slightly recovered from its selloff last week, with the S&P 500 and Nasdaq on track to snap their 7-week losing streaks. Analysts however, believe that the stock market's rally in the last few days have been mainly fuelled by short-term optimism , with the overall trend still pointing towards a slowing economy and rising inflation.

Here are some key developments from the past week:

- The USD Dollar index (DXY) briefly jumped to a 20-year high as the US showed signs of a better outlook relative to other regions.

- Advertising platforms declined further as Snap ( NYSE:SNAP ) signalled a possible contraction for the industry in the second quarter.

- Sri Lanka is in default , prompting investors to revisit their international holdings in risky countries.

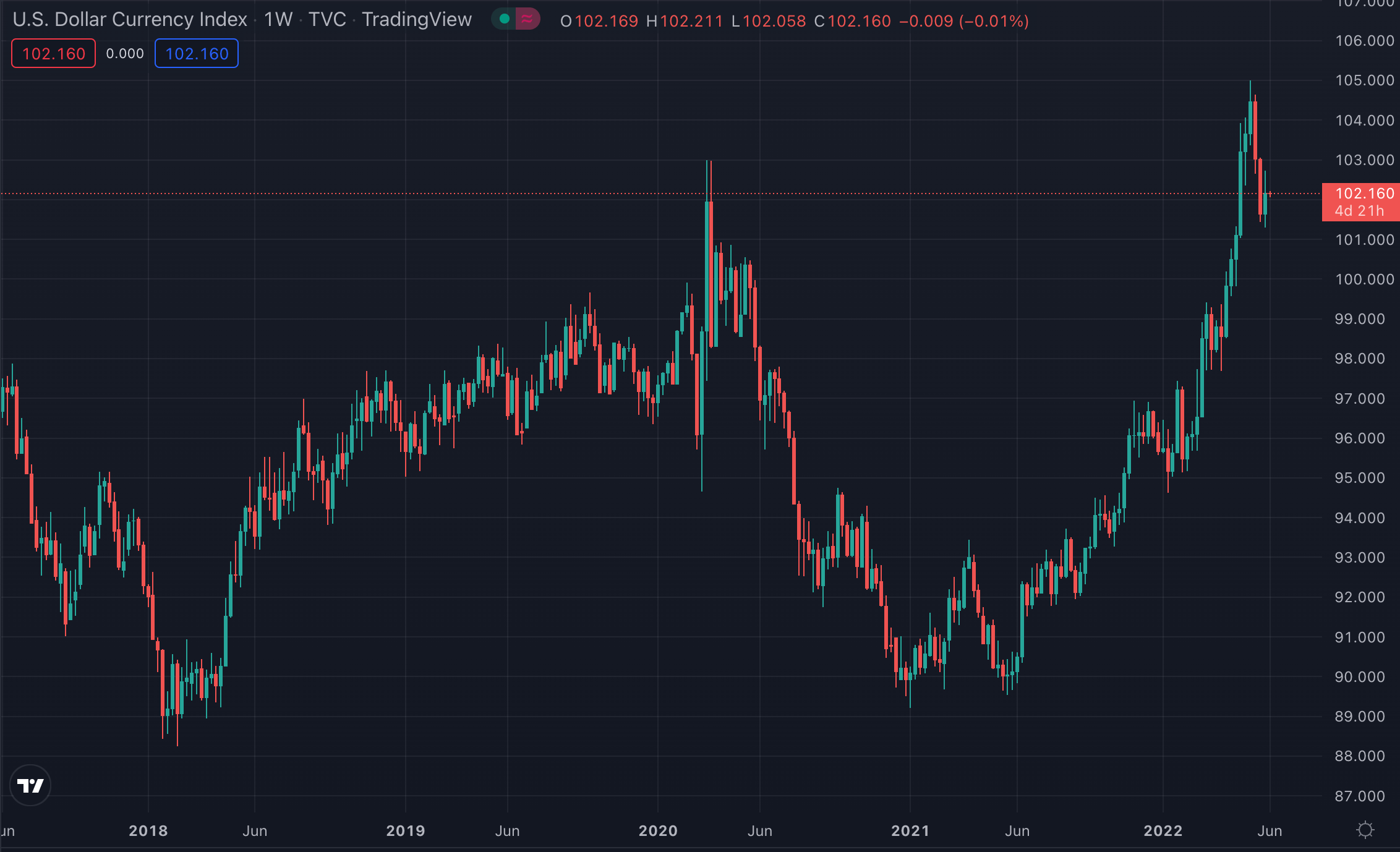

The DXY reached 20-year highs

The U.S. Dollar index (DXY) jumped to 104.9 on May 13th, marking a 20-year high. The DXY shows investors how strong the USD is against a basket of other currencies, with the EUR making up 57.6% of the counterweight.

This means that the DXY is a relative measure , and in order for it to rise, the US economy should be performing better, or at least less poorly, than the other economies it’s compared to.

Since the start of this year, investors have been focused on capital preservation over capital growth , and that means capital has been flowing from higher-risk assets like equities, into “safe-havens”, like cash (especially the USD).

One of the reasons why the USD is gaining is because relative to other economies, the U.S. is implementing measures to curb inflation faster, in contrast to others like the ECB who are delaying rate hikes . This week’s U.S. FOMC minutes revealed that the U.S. will likely stick to a 0.5% periodic (June and July) hike, in addition to the Fed’s implementation of its plan to reduce the Federal Balance Sheet.

While fighting inflation may inadvertently hurt the US economy, countries that leave inflation untamed stand to lose even more in terms of currency strength. Regions like the Eurozone for example, have currencies that are losing relative to the USD, partly because they are slower to respond to rising inflation . Additional factors that impact the Eurozone are the possibilities of a further escalation of the Russian-Ukraine war, the supply chain disruptions in energy and food markets, and a lower GDP rate vs the U.S .

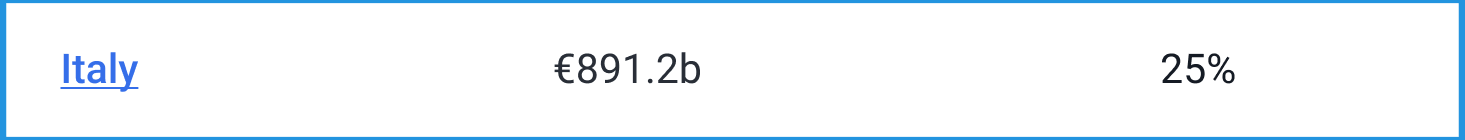

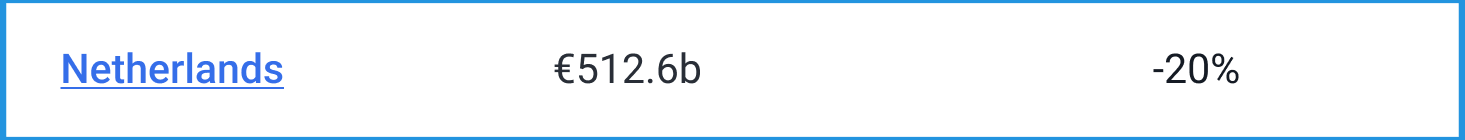

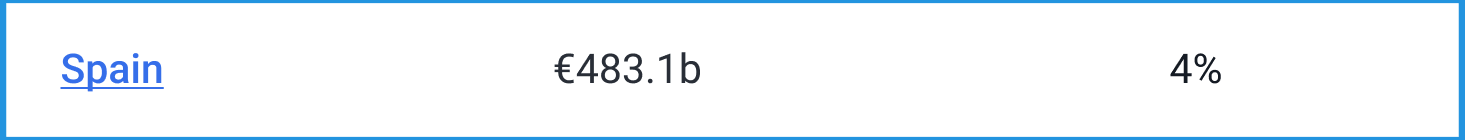

Currency strength underlies an economy, which is why the US still outpaces other large countries and regions. Public companies in the United States had US$19.4tn in sales (up 19% y/y) in the last 12 months , while the top 8 countries in Europe have a combined €9.5tn in public company sales. This makes the U.S. public sector double the size of the major combined hubs in Europe .

In the table below, you can see a breakdown of the largest European economies by revenues from public companies:

The rise in the U.S. dollar can also threaten some U.S. stocks, especially those with international revenue exposure. This is known as an FX (Foreign Exchange) drag, and can affect companies that have a lot of sales in foreign markets. If a company makes sales in Euros, then the USD gains in value against the Euro before the company has a chance to convert its revenue back to USD, their final sales figure will be negatively impacted by the lower conversion. We might see many U.S. based companies show this in their next earnings results.

The Insight: The rise of the USD can have a negative effect on the revenues and earnings of US companies which sell internationally. This will likely impact large cap stocks in the second quarter, and investors can either try looking at smaller domestic companies or diversifying the risk away with international companies that have sales in the US.

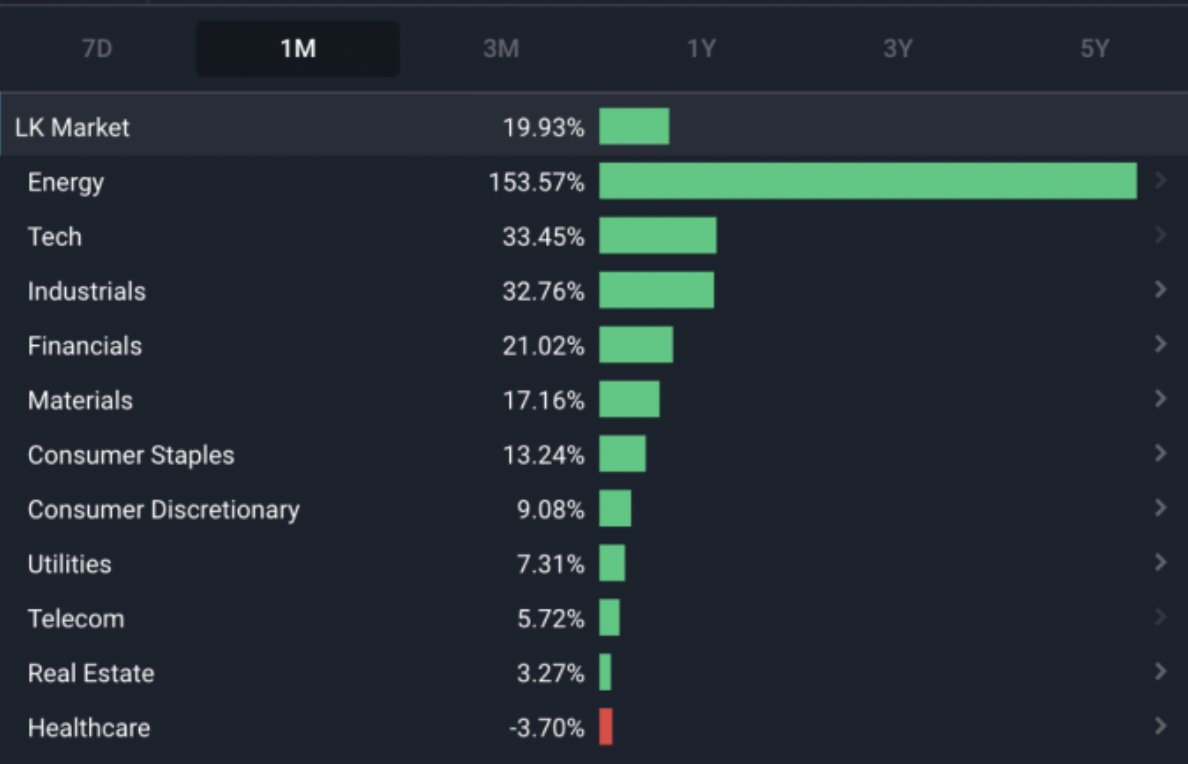

While cash may be “trash” as a long term investment, it’s crazy to think that over the last 12 months, the USD, even with 8% inflation prints, has outperformed the U.S. Financials, Tech, Industrials, Consumer Discretionary and Telco sectors. When you think about it that way, those who’ve held cash for the last year don’t look as silly now!

Snap’s outlook pulls down online advertisers

This week’s big mover was Snap Inc., ( NYSE:SNAP ), which dropped some 42% after the latest earnings call. The drop on Tuesday was so large that it affected general investor sentiment for other online advertising platforms like Meta Platforms ( NASDAQ:FB ), Alphabet ( NASDAQ:GOOGL ), and Pinterest ( NYSE:PINS ), which shed 7.6%, 4.95% and 23.6% respectively.

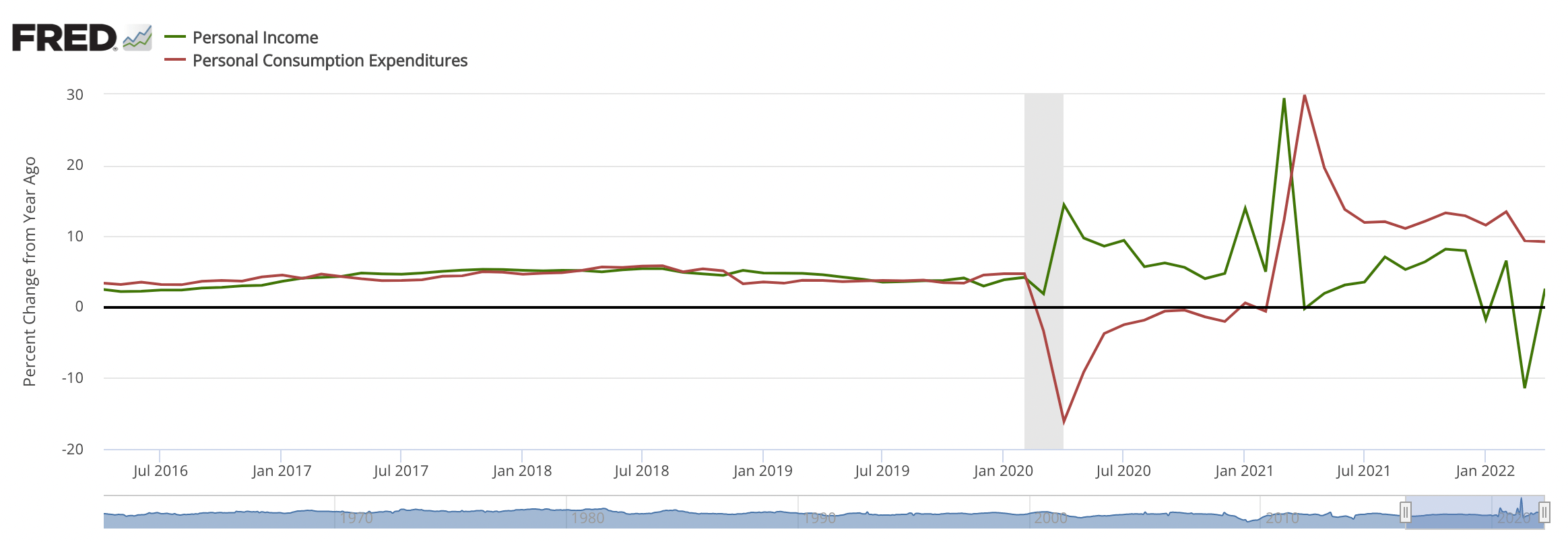

Investors fear that inflation is outpacing personal income , and that advertisers are going to tighten their spending, ultimately affecting the earnings of online advertising platforms in 2022.

Although Snap markets itself as a “camera company”, its revenues come primarily from digital advertising, which is why it pulled down other advertisers with it. Investors thought the company had a better chance to gain traction, but Snap’s outlook indicated a deceleration in the second quarter.

The Insight: The second quarter may be more difficult for unprofitable tech stocks as inflation outpaces consumers’ income.

To avoid this, investors can try to look for more well established and profitable companies that are less likely to be affected by a decline in consumers’ discretionary spending habits. Additionally, some tech stocks have been dragged down despite being quality businesses with great long term potential. Value investors may be able to find some opportunities among the tech rubble.

Sri Lanka defaults on its debt for the first time in history

Sri Lanka owes approximately US$50b to foreign creditors, of which US$7b is due this year. The country missed the US$78m interest payment last week, and declared a “pre-emptive” default, with the goal to force lenders to restructure its debt.

The general situation in the country is degrading. The government hiked fuel and petrol prices by more than 20%, and encouraged people to work from home.

Sri Lanka’s debt stock increased by 42.8% between 2015 and 2019, with 89% of the increase a function of the interest expenses accumulating from pre-2015 debt.

The government hired Lazard ( NYSE:LAZ ) as financial advisors and Clifford Chance as legal counsel, in the upcoming battle to restructure the country’s debts.

While the situation in Sri Lanka is mostly a regional affair, its debt default may be used by its top creditors - China and India - as an opportunity to exert more influence over the region. The IMF and World Bank could also intervene with financial options for the country if they find it necessary to keep the balance.

Sri Lanka has been calling for debt restructuring from China for some time, but has not managed to open negotiations as China was uninterested in restructuring. This puts the creditor in a better situation to exert influence in the country, since debt balances have mounted and the situation has escalated.

The Insight: Global inflation, rising energy prices, and an economic slowdown have acted as catalysts for financial distress in some countries. International investors may want to review any investments they have in countries with a BBB and below sovereign rating .

While these factors are currently impacting emerging markets, it does not mean that developed countries with equally leveraged balance sheets are immune to similar economic pain.

Market Outlook Next Week

The real estate sector may show insights regarding the financial health of the US consumer, with key series like new home sales and the 30-year fixed average mortgage rate acting as key indicators.

Additionally, the U.S. earnings seasons is still ongoing, with some notable companies releasing results next week:

- Salesforce ( NYSE:CRM )

- HP ( NYSE:HPQ )

- Gamestop Corp. ( NYSE:GME )

- Lululemon Athletica ( NASDAQ:LULU )

Investors may also want to keep track of the situation in Asia as lockdowns in China continue, which can have a continued impact on production output and ripple away to economies that import Chinese goods.

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.