- South Africa

- /

- Transportation

- /

- JSE:FTH

Would Shareholders Who Purchased Hosken Passenger Logistics and Rail's (JSE:HPR) Stock Year Be Happy With The Share price Today?

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Hosken Passenger Logistics and Rail Limited (JSE:HPR) shareholders over the last year, as the share price declined 26%. That falls noticeably short of the market decline of around 3.6%. Because Hosken Passenger Logistics and Rail hasn't been listed for many years, the market is still learning about how the business performs.

See our latest analysis for Hosken Passenger Logistics and Rail

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

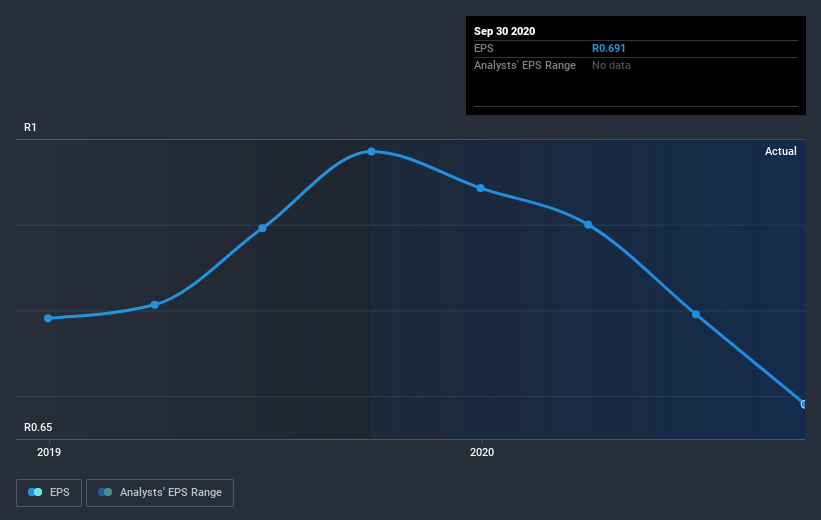

Unhappily, Hosken Passenger Logistics and Rail had to report a 30% decline in EPS over the last year. This proportional reduction in earnings per share isn't far from the 26% decrease in the share price. Therefore one could posit that the market has not become more concerned about the company, despite the lower EPS. Rather, the share price has approximately tracked EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Hosken Passenger Logistics and Rail's key metrics by checking this interactive graph of Hosken Passenger Logistics and Rail's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Hosken Passenger Logistics and Rail the TSR over the last year was -15%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Given that the market gained 3.6% in the last year, Hosken Passenger Logistics and Rail shareholders might be miffed that they lost 15% (even including dividends). While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 1.3% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Hosken Passenger Logistics and Rail that you should be aware of.

We will like Hosken Passenger Logistics and Rail better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ZA exchanges.

When trading Hosken Passenger Logistics and Rail or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:FTH

Frontier Transport Holdings

An investment holding company, operates in the transport sector in South Africa.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives