It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Group (JSE:PCT). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Group

How Fast Is Group Growing Its Earnings Per Share?

In the last three years Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Group's EPS shot from R0.18 to R0.31, over the last year. Year on year growth of 70% is certainly a sight to behold.

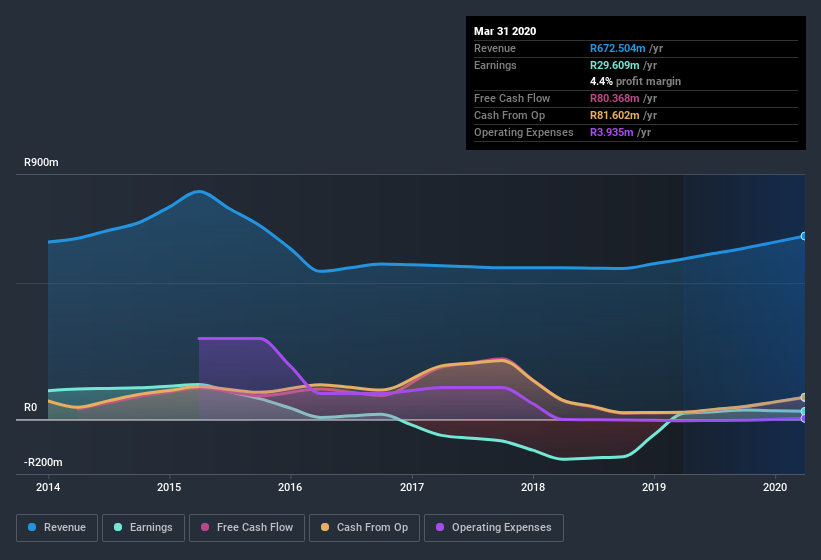

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Group's EBIT margins were flat over the last year, revenue grew by a solid 14% to R673m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Group is no giant, with a market capitalization of R347m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Group top brass are certainly in sync, not having sold any shares, over the last year. But my excitement comes from the R2.0m that Consultant A. Louw spent buying shares (at an average price of about R1.75).

And the insider buying isn't the only sign of alignment between shareholders and the board, since Group insiders own more than a third of the company. In fact, they own 43% of the shares, making insiders a very influential shareholder group. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Of course, Group is a very small company, with a market cap of only R347m. So despite a large proportional holding, insiders only have R148m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Does Group Deserve A Spot On Your Watchlist?

Group's earnings per share have taken off like a rocket aimed right at the moon. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Group deserves timely attention. You still need to take note of risks, for example - Group has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About JSE:PBG

PBT Group

Provides consulting services to finance, insurance, medical healthcare, retail, telecommunication, and other sectors in South Africa, Europe, Australia, and the United Kingdom.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives