- South Africa

- /

- Software

- /

- JSE:ISA

With EPS Growth And More, ISA Holdings (JSE:ISA) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like ISA Holdings (JSE:ISA). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for ISA Holdings

ISA Holdings' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. ISA Holdings managed to grow EPS by 12% per year, over three years. That's a good rate of growth, if it can be sustained.

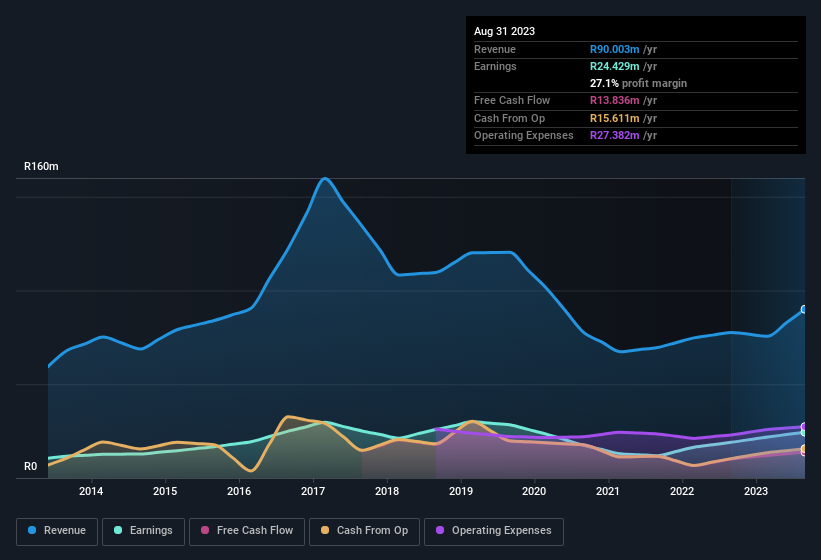

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While ISA Holdings did well to grow revenue over the last year, EBIT margins were dampened at the same time. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since ISA Holdings is no giant, with a market capitalisation of R259m, you should definitely check its cash and debt before getting too excited about its prospects.

Are ISA Holdings Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that ISA Holdings insiders own a meaningful share of the business. Owning 40% of the company, insiders have plenty riding on the performance of the the share price. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Of course, ISA Holdings is a very small company, with a market cap of only R259m. That means insiders only have R103m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to ISA Holdings, with market caps under R3.7b is around R6.2m.

ISA Holdings offered total compensation worth R3.6m to its CEO in the year to February 2023. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is ISA Holdings Worth Keeping An Eye On?

One important encouraging feature of ISA Holdings is that it is growing profits. The fact that EPS is growing is a genuine positive for ISA Holdings, but the pleasant picture gets better than that. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. It's still necessary to consider the ever-present spectre of investment risk. We've identified 6 warning signs with ISA Holdings (at least 3 which make us uncomfortable) , and understanding them should be part of your investment process.

Although ISA Holdings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of South African companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:ISA

ISA Holdings

An investment holding company, provides network, internet, and information security solutions to the sub-Saharan Africa market.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives