- South Africa

- /

- Diversified Financial

- /

- JSE:AXX

With EPS Growth And More, Capital Appreciation (JSE:CTA) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Capital Appreciation (JSE:CTA), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Capital Appreciation

Capital Appreciation's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, Capital Appreciation's EPS has grown 34% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

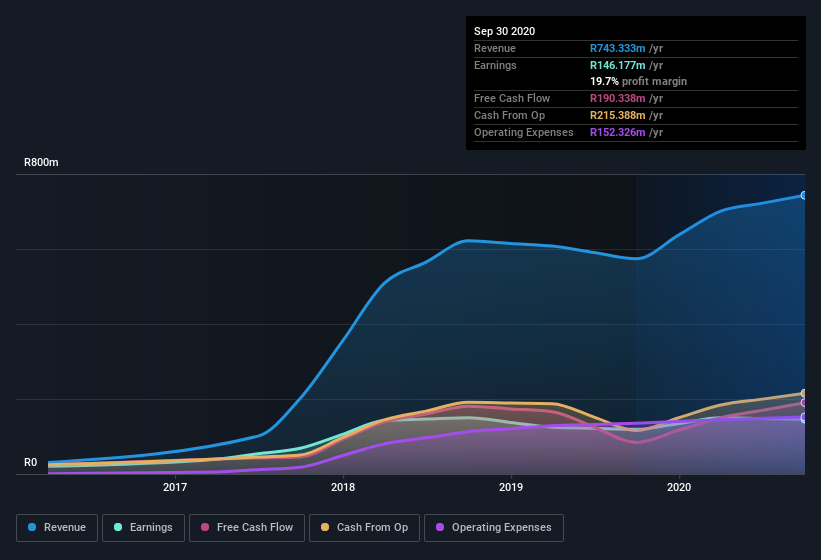

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Capital Appreciation maintained stable EBIT margins over the last year, all while growing revenue 29% to R743m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Capital Appreciation is no giant, with a market capitalization of R1.4b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Capital Appreciation Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Any way you look at it Capital Appreciation shareholders can gain quiet confidence from the fact that insiders shelled out R9.2m to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. It is also worth noting that it was CFO & Executive Director Alan Salomon who made the biggest single purchase, worth R2.7m, paying R0.94 per share.

Along with the insider buying, another encouraging sign for Capital Appreciation is that insiders, as a group, have a considerable shareholding. Indeed, they hold R221m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 15% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Michael Pimstein, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Capital Appreciation with market caps under R2.9b is about R4.1m.

The Capital Appreciation CEO received total compensation of just R1.8m in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Capital Appreciation Deserve A Spot On Your Watchlist?

You can't deny that Capital Appreciation has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Capital Appreciation that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Capital Appreciation, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:AXX

Araxi

Operates as a financial technology company in South Africa, the Asia Pacific, the United States, the United Kingdom, Europe, the rest of Africa, and the Indian Ocean Islands.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success