- South Africa

- /

- Specialty Stores

- /

- JSE:PPH

Recent 5.8% pullback isn't enough to hurt long-term Pepkor Holdings (JSE:PPH) shareholders, they're still up 61% over 1 year

The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Pepkor Holdings Limited (JSE:PPH) share price is up 61% in the last 1 year, clearly besting the market return of around 12% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! Having said that, the longer term returns aren't so impressive, with stock gaining just 4.1% in three years.

Since the long term performance has been good but there's been a recent pullback of 5.8%, let's check if the fundamentals match the share price.

See our latest analysis for Pepkor Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Pepkor Holdings went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

We are skeptical of the suggestion that the 2.0% dividend yield would entice buyers to the stock. We think that the revenue growth of 21% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

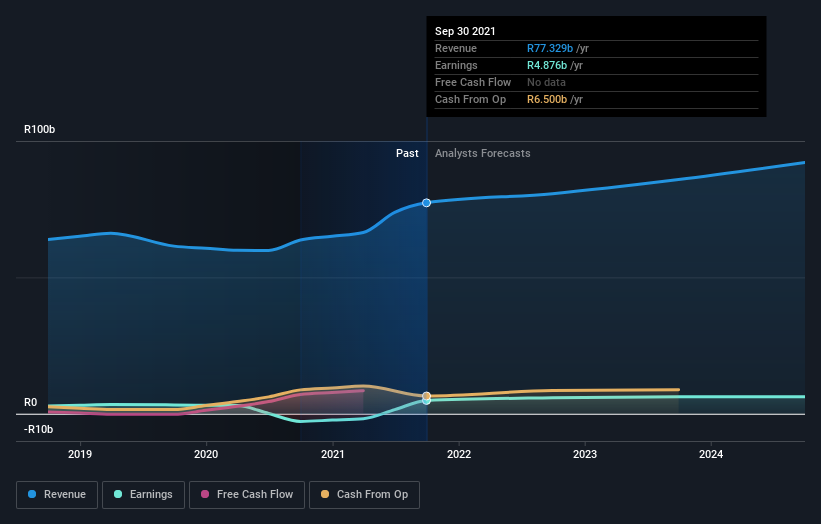

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Pepkor Holdings

A Different Perspective

It's nice to see that Pepkor Holdings shareholders have gained 61% (in total) over the last year. That's including the dividend. That's better than the annualized TSR of 2.2% over the last three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. Before deciding if you like the current share price, check how Pepkor Holdings scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ZA exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:PPH

Pepkor Holdings

Operates as a retailer focusing on discount, value, and specialized goods in Angola, Botswana, Brazil, Eswatini, Lesotho, Mozambique, Malawi, Namibia, South Africa, and Zambia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives