This article will reflect on the compensation paid to Leon Sasse who has served as CEO of Growthpoint Properties Limited (JSE:GRT) since 2018. This analysis will also assess whether Growthpoint Properties pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Note: The company does not report funds from operations, and as a result, we have used earnings per share in our analysis.

View our latest analysis for Growthpoint Properties

How Does Total Compensation For Leon Sasse Compare With Other Companies In The Industry?

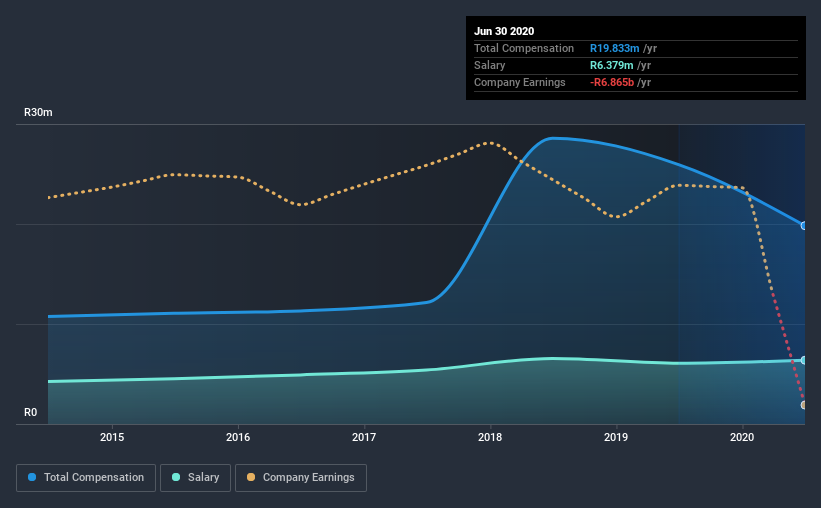

At the time of writing, our data shows that Growthpoint Properties Limited has a market capitalization of R43b, and reported total annual CEO compensation of R20m for the year to June 2020. We note that's a decrease of 24% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at R6.4m.

On comparing similar companies from the same industry with market caps ranging from R29b to R94b, we found that the median CEO total compensation was R55m. Accordingly, Growthpoint Properties pays its CEO under the industry median. What's more, Leon Sasse holds R37m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | R6.4m | R6.1m | 32% |

| Other | R13m | R20m | 68% |

| Total Compensation | R20m | R26m | 100% |

Speaking on an industry level, nearly 57% of total compensation represents salary, while the remainder of 43% is other remuneration. Growthpoint Properties sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Growthpoint Properties Limited's Growth

Growthpoint Properties Limited has reduced its earnings per share by 53% a year over the last three years. It achieved revenue growth of 7.0% over the last year.

Overall this is not a very positive result for shareholders. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Growthpoint Properties Limited Been A Good Investment?

With a three year total loss of 39% for the shareholders, Growthpoint Properties Limited would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As we noted earlier, Growthpoint Properties pays its CEO lower than the norm for similar-sized companies belonging to the same industry. EPS growth has failed to impress us, and the same can be said about shareholder returns. We can't say the CEO compensation is high, but shareholders will be cold to a bump at this stage, considering negative investor returns.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 3 warning signs for Growthpoint Properties (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Growthpoint Properties, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:GRT

Growthpoint Properties

Growthpoint is an international property company that provides space to thrive incorporating innovative and sustainable property solutions.

Proven track record with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)