- South Africa

- /

- REITS

- /

- JSE:GRT

Optimism for Growthpoint Properties (JSE:GRT) has grown this past week, despite five-year decline in earnings

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Growthpoint Properties Limited (JSE:GRT) shareholders for doubting their decision to hold, with the stock down 39% over a half decade.

The recent uptick of 3.0% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for Growthpoint Properties

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Growthpoint Properties moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

The most recent dividend was actually lower than it was in the past, so that may have sent the share price lower.

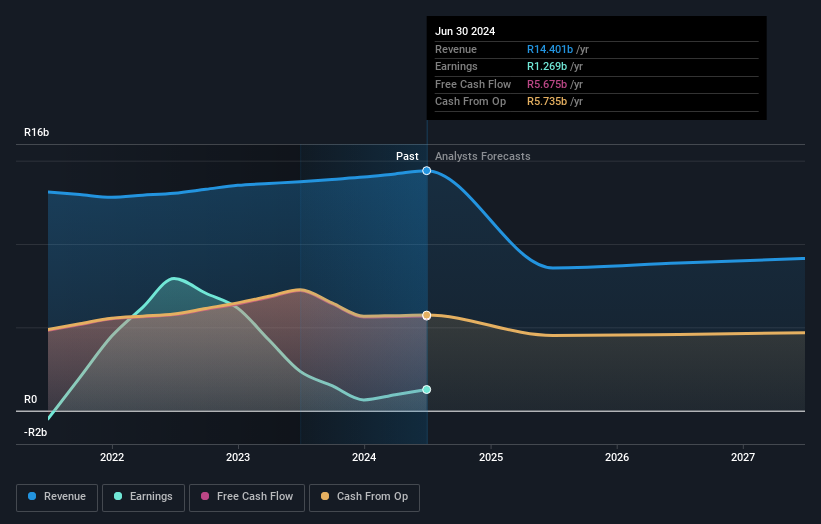

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Growthpoint Properties stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Growthpoint Properties' TSR for the last 5 years was 1.6%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Growthpoint Properties shareholders are up 15% for the year (even including dividends). Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 0.3% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Growthpoint Properties is showing 5 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South African exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:GRT

Growthpoint Properties

Growthpoint is a Real Estate Investment Trust (REIT) and is the largest South African listed property company which owns a property portfolio of 369 directly owned properties in South Africa valued at R64.1bn, 58 properties valued at R61.8bn through its 63.7% investment in Growthpoint Properties Australia Limited (GOZ), five properties valued at R8.5bn through a 62.4% investment in Capital & Regional Plc (C&R), a 50% interest in the properties of the V&A Waterfront, valued at R10.1bn, a 29.5% interest in the properties of Globalworth Real Estate Investment Limited (GWI), valued at R17.4bn, a 39.1% interest in the properties of Growthpoint Healthcare Property Holdings (RF) Limited (GHPH) valued at R3.7bn, a 14.3% interest in the properties of Growthpoint Student Accommodation Holdings (RF) Limited (GSAH) valued at R2.7bn and a 18.4% interest in the properties of Lango Real Estate Limited (Lango) valued at R2.1bn.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives