- South Africa

- /

- Consumer Durables

- /

- JSE:BWN

A Quick Analysis On Balwin Properties' (JSE:BWN) CEO Compensation

This article will reflect on the compensation paid to Steve Brookes who has served as CEO of Balwin Properties Limited (JSE:BWN) since 1996. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Balwin Properties

How Does Total Compensation For Steve Brookes Compare With Other Companies In The Industry?

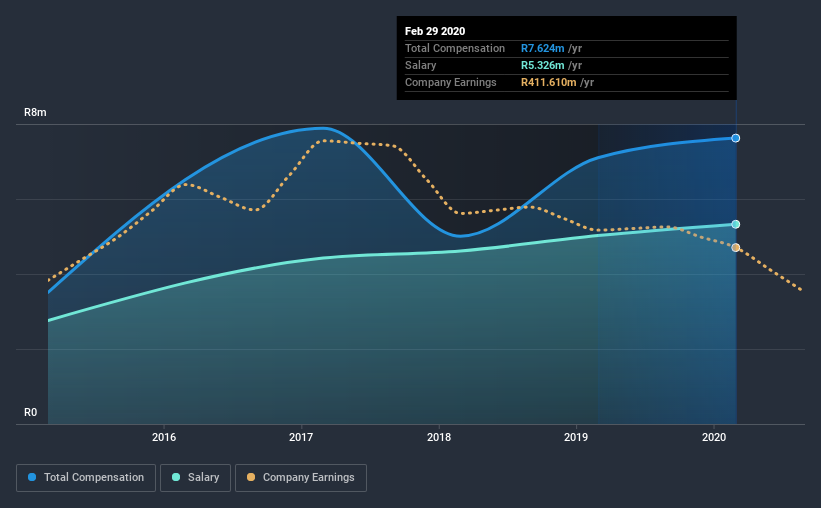

Our data indicates that Balwin Properties Limited has a market capitalization of R2.1b, and total annual CEO compensation was reported as R7.6m for the year to February 2020. That's just a smallish increase of 7.4% on last year. We note that the salary portion, which stands at R5.33m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under R2.9b, the reported median total CEO compensation was R3.4m. Hence, we can conclude that Steve Brookes is remunerated higher than the industry median. What's more, Steve Brookes holds R748m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | R5.3m | R5.0m | 70% |

| Other | R2.3m | R2.1m | 30% |

| Total Compensation | R7.6m | R7.1m | 100% |

On an industry level, around 70% of total compensation represents salary and 30% is other remuneration. There isn't a significant difference between Balwin Properties and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Balwin Properties Limited's Growth

Over the last three years, Balwin Properties Limited has shrunk its earnings per share by 22% per year. It saw its revenue drop 15% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Balwin Properties Limited Been A Good Investment?

With a three year total loss of 13% for the shareholders, Balwin Properties Limited would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we touched on above, Balwin Properties Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. This doesn't look good against shareholder returns, which have been negative for the past three years. To make matters worse, EPS growth has also been negative during this period. Understandably, the company's shareholders might have some questions about the CEO's remuneration, given the disappointing performance.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 4 warning signs for Balwin Properties you should be aware of, and 2 of them are potentially serious.

Switching gears from Balwin Properties, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Balwin Properties, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Balwin Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:BWN

Balwin Properties

Engages in the development and sale of residential properties in South Africa.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives