- South Africa

- /

- Pharma

- /

- JSE:APN

Three Top Stocks Possibly Valued Up To 42.8% Below Intrinsic Estimates

Reviewed by Simply Wall St

As global markets exhibit varied responses to political and economic stimuli, with the S&P 500 and Nasdaq reaching new highs amidst a backdrop of subdued inflation and interest rate adjustments, investors remain vigilant in their search for value. In such an environment, identifying stocks that appear undervalued relative to their intrinsic estimates could be particularly compelling.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Selective Insurance Group (NasdaqGS:SIGI) | US$91.91 | US$183.51 | 49.9% |

| Kuaishou Technology (SEHK:1024) | HK$49.50 | HK$98.76 | 49.9% |

| Hodogaya Chemical (TSE:4112) | ¥5790.00 | ¥11521.12 | 49.7% |

| Smart Parking (ASX:SPZ) | A$0.48 | A$0.95 | 49.7% |

| Alleima (OM:ALLEI) | SEK69.55 | SEK138.36 | 49.7% |

| Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49536.79 | 49.7% |

| Kraft Bank (OB:KRAB) | NOK8.95 | NOK17.81 | 49.7% |

| Napatech (OB:NAPA) | NOK36.80 | NOK73.41 | 49.9% |

| John Wood Group (LSE:WG.) | £2.00 | £3.98 | 49.7% |

| eEnergy Group (AIM:EAAS) | £0.055 | £0.11 | 49.7% |

Let's explore several standout options from the results in the screener

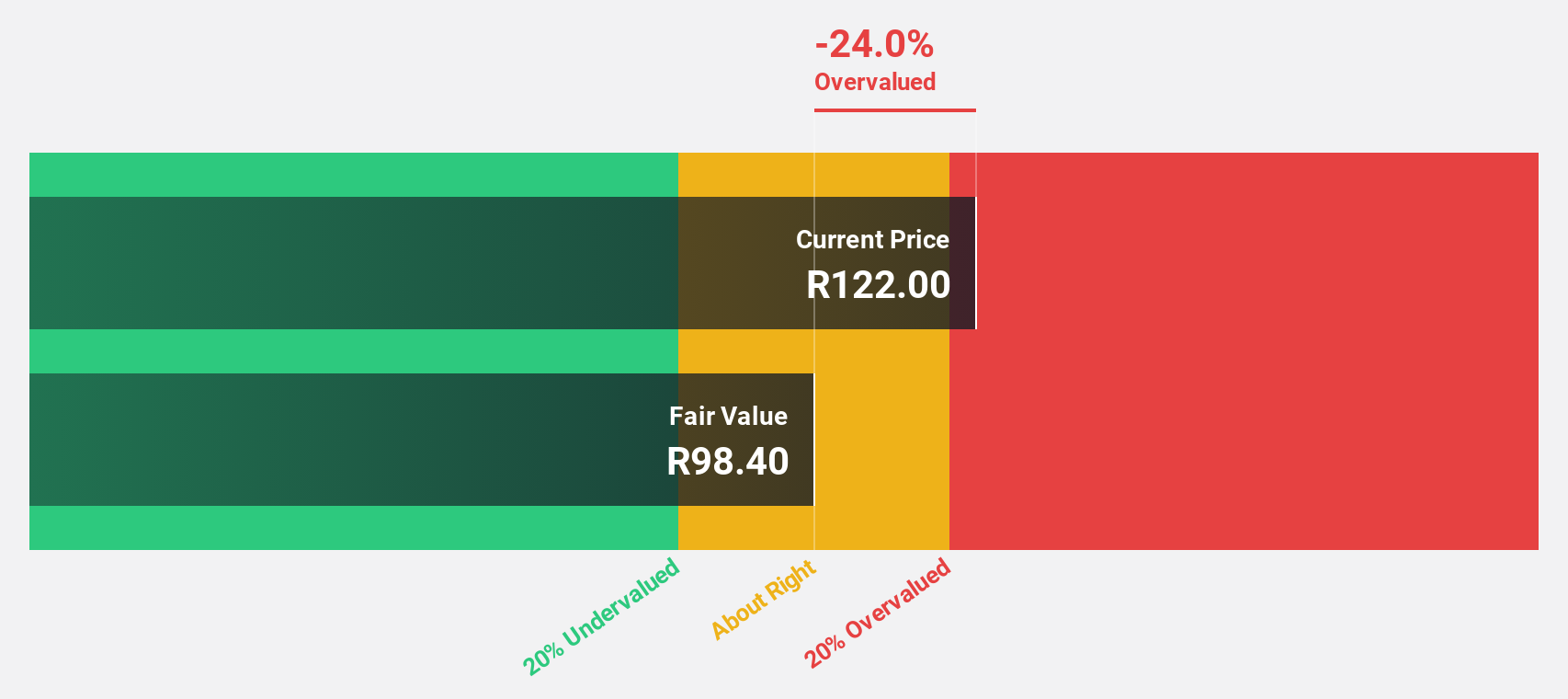

Aspen Pharmacare Holdings (JSE:APN)

Overview: Aspen Pharmacare Holdings Limited operates globally, manufacturing and supplying specialty and branded pharmaceutical products, with a market capitalization of approximately ZAR 108.45 billion.

Operations: The company's revenue segments include ZAR 12.81 billion from manufacturing activities.

Estimated Discount To Fair Value: 38.4%

Aspen Pharmacare Holdings, priced at ZAR243.74, appears undervalued with a fair value estimate of ZAR395.71, reflecting a 38.4% discount. Despite a low forecasted Return on Equity of 9.4%, the company is poised for robust growth with earnings expected to increase by 27.73% annually over the next three years and revenue growing at 10.2% per year—outpacing the South African market's 2.8%. This financial profile suggests potential underpricing based on cash flow projections.

- The analysis detailed in our Aspen Pharmacare Holdings growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Aspen Pharmacare Holdings stock in this financial health report.

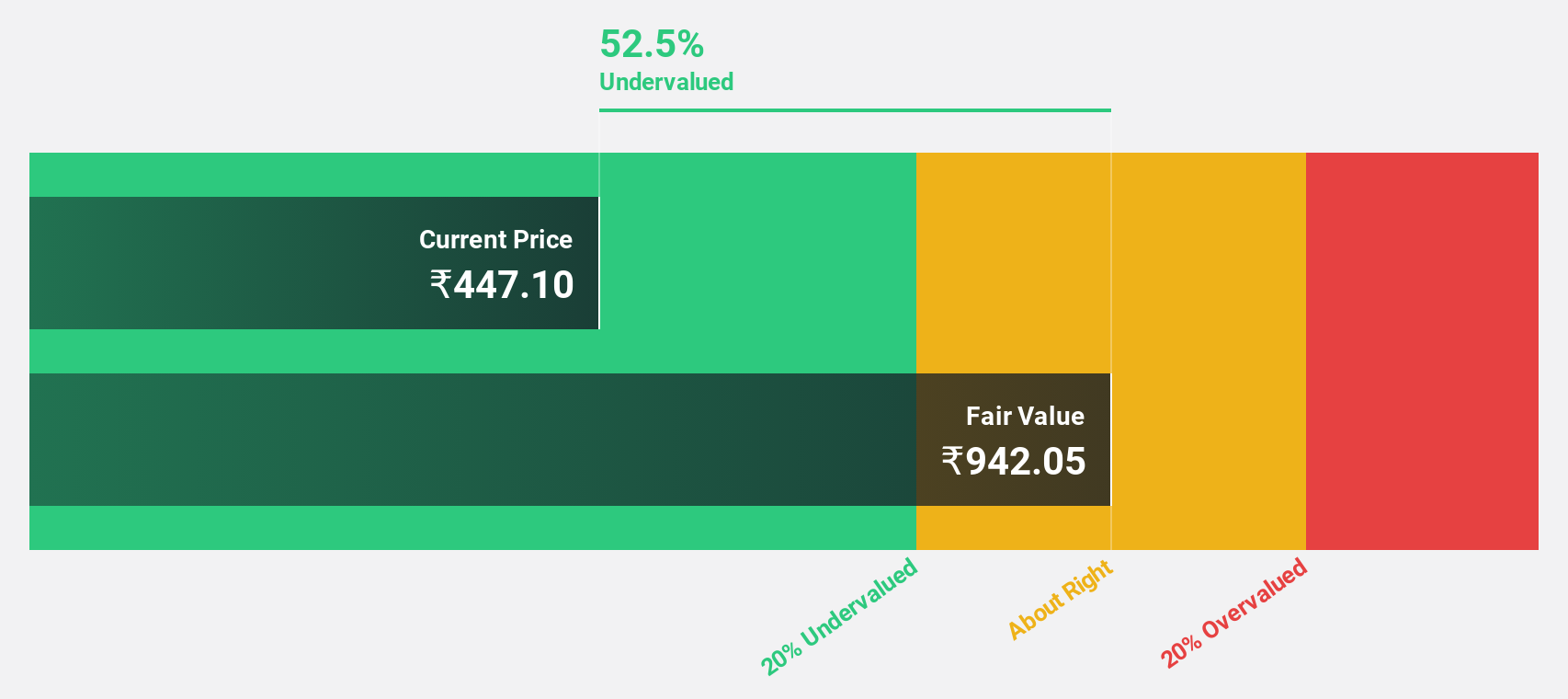

Vedanta (NSEI:VEDL)

Overview: Vedanta Limited is a diversified natural resources company operating in sectors including minerals, and oil and gas, with activities in India, Europe, China, the United States, Mexico, and globally; it has a market capitalization of approximately ₹1.66 trillion.

Operations: The company's revenue is primarily derived from its Aluminium, Zinc - India, Copper, Oil and Gas, Iron Ore, and Power segments, with revenues of ₹4.84 billion, ₹2.79 billion, ₹1.97 billion, ₹1.78 billion, ₹0.91 billion, and ₹0.62 billion respectively.

Estimated Discount To Fair Value: 26.1%

Vedanta, priced at ₹469.95, trades below its fair value of ₹636.1, indicating a significant undervaluation based on cash flow analysis. Despite this potential for appreciation, challenges such as a high debt level and lower-than-last-year profit margins at 3% compared to 7.2% raise concerns about its financial health. The company's earnings are expected to grow by 42.8% annually over the next three years, outpacing the Indian market's growth forecast of 15.9%, suggesting strong future profitability if it can manage its debts effectively.

- In light of our recent growth report, it seems possible that Vedanta's financial performance will exceed current levels.

- Navigate through the intricacies of Vedanta with our comprehensive financial health report here.

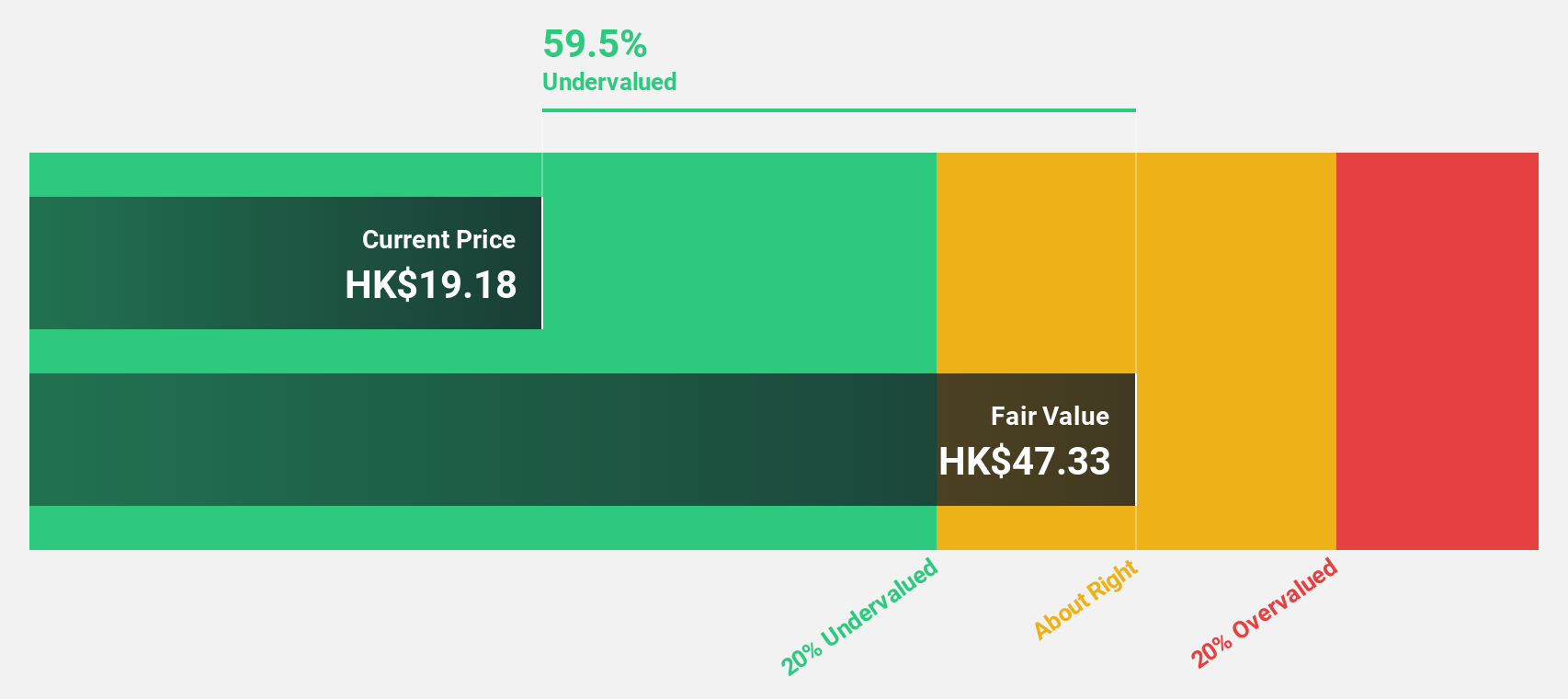

Zijin Mining Group (SEHK:2899)

Overview: Zijin Mining Group Company Limited operates in the exploration, mining, processing, refining, and sale of gold, non-ferrous metals, and other mineral resources both in Mainland China and internationally, with a market capitalization of approximately HK$477.72 billion.

Operations: The company generates revenue from the exploration, mining, processing, and refining of gold and non-ferrous metals across various global markets.

Estimated Discount To Fair Value: 42.8%

Zijin Mining Group, with a current price of HK$16.66, is trading at 42.8% below its estimated fair value of HK$29.14, showcasing potential undervaluation based on cash flow analysis. The company's earnings have grown by 13.4% over the past year and are expected to rise by 20.52% annually over the next three years, outperforming the Hong Kong market forecast of 11.7%. However, it carries a high level of debt which could impact financial stability despite robust revenue growth projections and significant anticipated improvements in return on equity.

- Our growth report here indicates Zijin Mining Group may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Zijin Mining Group.

Where To Now?

- Get an in-depth perspective on all 953 Undervalued Stocks Based On Cash Flows by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About JSE:APN

Aspen Pharmacare Holdings

Manufactures and supplies specialty and branded pharmaceutical products worldwide.

Excellent balance sheet and fair value.

Market Insights

Community Narratives