The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Sasol Limited (JSE:SOL) share price is 82% higher than it was a year ago, much better than the market return of around 14% (not including dividends) in the same period. So that should have shareholders smiling. On the other hand, longer term shareholders have had a tougher run, with the stock falling 57% in three years.

The past week has proven to be lucrative for Sasol investors, so let's see if fundamentals drove the company's one-year performance.

View our latest analysis for Sasol

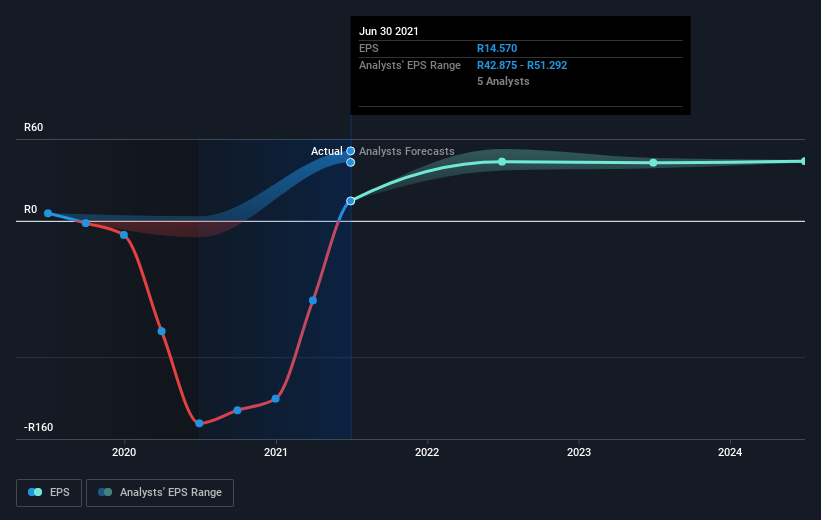

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Sasol grew its earnings per share, moving from a loss to a profit.

The result looks like a strong improvement to us, so we're not surprised the market likes the growth. Generally speaking the profitability inflection point is a great time to research a company closely, lest you miss an opportunity to profit.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Sasol's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Sasol shareholders have received a total shareholder return of 82% over the last year. That certainly beats the loss of about 5% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Sasol better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Sasol .

Sasol is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ZA exchanges.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:SOL

Sasol

Operates as a chemical and energy company in South Africa and internationally.

Fair value with moderate growth potential.