The harsh reality for PPC Ltd (JSE:PPC) shareholders is that its auditors, Deloitte & Touche LLP, expressed doubts about its ability to continue as a going concern, in its reported results to March 2021. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

If the company does have to issue more shares, potential investors will be sure to consider how desperate it is for capital. So it is suddenly extremely important to consider whether the company is taking too much risk on its balance sheet. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

View our latest analysis for PPC

What Is PPC's Debt?

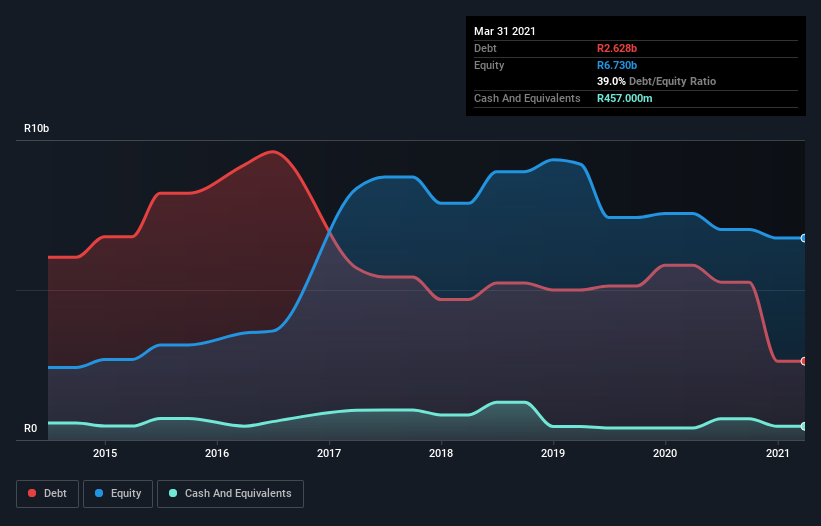

As you can see below, PPC had R2.63b of debt at March 2021, down from R5.82b a year prior. However, because it has a cash reserve of R457.0m, its net debt is less, at about R2.17b.

How Healthy Is PPC's Balance Sheet?

The latest balance sheet data shows that PPC had liabilities of R6.22b due within a year, and liabilities of R2.86b falling due after that. Offsetting these obligations, it had cash of R457.0m as well as receivables valued at R941.0m due within 12 months. So its liabilities total R7.68b more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's R5.70b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While PPC's low debt to EBITDA ratio of 1.3 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 4.3 times last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Importantly, PPC grew its EBIT by 94% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since PPC will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, PPC produced sturdy free cash flow equating to 51% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

PPC's level of total liabilities and interest cover definitely weigh on it, in our esteem. But its EBIT growth rate tells a very different story, and suggests some resilience. Looking at all the angles mentioned above, it does seem to us that PPC is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. Some investors may be interested in buying high risk stocks at the right price, but we prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. We prefer to invest in companies that ensure the balance sheet remains healthier than that. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for PPC (2 are potentially serious) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:PPC

PPC

Engages in the production and sale of cement, aggregates, ready mix concrete, and fly ash in South Africa, Botswana, and Zimbabwe.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives