- South Africa

- /

- Metals and Mining

- /

- JSE:NPH

Why Investors Shouldn't Be Surprised By Northam Platinum Holdings Limited's (JSE:NPH) P/E

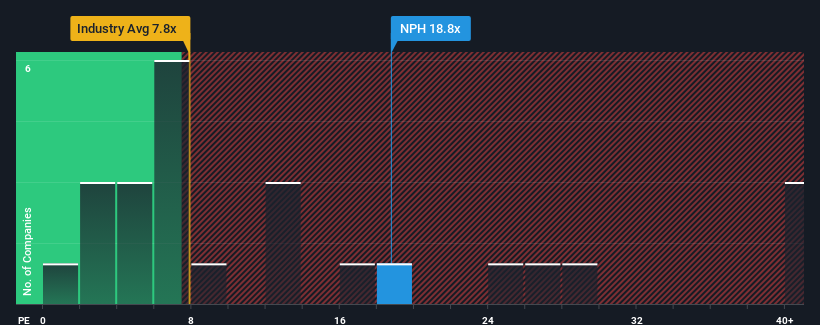

Northam Platinum Holdings Limited's (JSE:NPH) price-to-earnings (or "P/E") ratio of 18.8x might make it look like a strong sell right now compared to the market in South Africa, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Northam Platinum Holdings hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Northam Platinum Holdings

Is There Enough Growth For Northam Platinum Holdings?

Northam Platinum Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 75%. Regardless, EPS has managed to lift by a handy 5.6% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 39% each year as estimated by the eight analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 12% each year, which is noticeably less attractive.

With this information, we can see why Northam Platinum Holdings is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Northam Platinum Holdings' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Northam Platinum Holdings maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 6 warning signs for Northam Platinum Holdings that we have uncovered.

You might be able to find a better investment than Northam Platinum Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Northam Platinum Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:NPH

Northam Platinum Holdings

Through its subsidiary, Northam Platinum Limited, engages in the production and sale of platinum group metals in South Africa, the Americas, Europe, the United Kingdom, Far East, rest of Africa, the Middle East, Australasia, and the People's Republic of China.

Flawless balance sheet with reasonable growth potential.