- South Africa

- /

- Metals and Mining

- /

- JSE:AMS

Optimistic Investors Push Anglo American Platinum Limited (JSE:AMS) Shares Up 31% But Growth Is Lacking

The Anglo American Platinum Limited (JSE:AMS) share price has done very well over the last month, posting an excellent gain of 31%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 36% in the last twelve months.

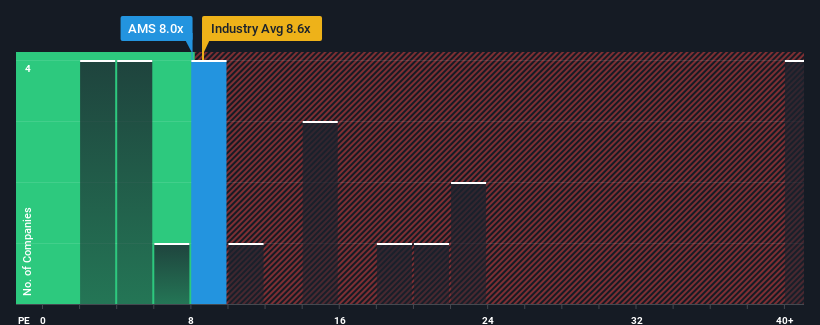

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Anglo American Platinum's P/E ratio of 8x, since the median price-to-earnings (or "P/E") ratio in South Africa is also close to 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Anglo American Platinum's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Anglo American Platinum

Is There Some Growth For Anglo American Platinum?

In order to justify its P/E ratio, Anglo American Platinum would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 49%. Still, the latest three year period has seen an excellent 69% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 1.9% per annum during the coming three years according to the ten analysts following the company. Meanwhile, the broader market is forecast to expand by 12% per year, which paints a poor picture.

In light of this, it's somewhat alarming that Anglo American Platinum's P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

What We Can Learn From Anglo American Platinum's P/E?

Anglo American Platinum's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Anglo American Platinum currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 3 warning signs for Anglo American Platinum (1 makes us a bit uncomfortable!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:AMS

Anglo American Platinum

Engages in the production and supply of platinum group metals, base metals, and precious metals in South Africa, Asia, Europe, North America, and internationally.

Excellent balance sheet low.