- South Africa

- /

- Healthcare Services

- /

- JSE:NTC

Weak Financial Prospects Seem To Be Dragging Down Netcare Limited (JSE:NTC) Stock

With its stock down 8.6% over the past month, it is easy to disregard Netcare (JSE:NTC). We decided to study the company's financials to determine if the downtrend will continue as the long-term performance of a company usually dictates market outcomes. Particularly, we will be paying attention to Netcare's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Netcare

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Netcare is:

12% = R1.4b ÷ R11b (Based on the trailing twelve months to March 2024).

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every ZAR1 worth of equity, the company was able to earn ZAR0.12 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Netcare's Earnings Growth And 12% ROE

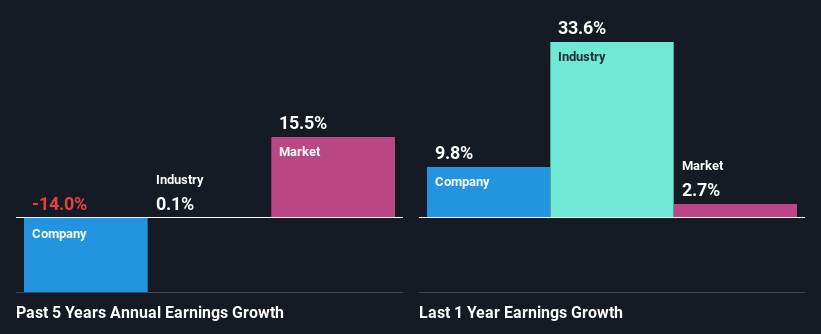

At first glance, Netcare's ROE doesn't look very promising. However, its ROE is similar to the industry average of 15%, so we won't completely dismiss the company. But then again, Netcare's five year net income shrunk at a rate of 14%. Bear in mind, the company does have a slightly low ROE. Hence, this goes some way in explaining the shrinking earnings.

So, as a next step, we compared Netcare's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 0.1% over the last few years.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Has the market priced in the future outlook for NTC? You can find out in our latest intrinsic value infographic research report.

Is Netcare Using Its Retained Earnings Effectively?

Netcare's declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 69% (or a retention ratio of 31%). With only a little being reinvested into the business, earnings growth would obviously be low or non-existent. You can see the 2 risks we have identified for Netcare by visiting our risks dashboard for free on our platform here.

Additionally, Netcare has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 63%. Still, forecasts suggest that Netcare's future ROE will rise to 16% even though the the company's payout ratio is not expected to change by much.

Summary

Overall, we would be extremely cautious before making any decision on Netcare. The company has seen a lack of earnings growth as a result of retaining very little profits and whatever little it does retain, is being reinvested at a very low rate of return. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if Netcare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About JSE:NTC

Netcare

An investment holding company, operates private hospitals in South Africa.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives