Bruce Alan Henderson is the CEO of RFG Holdings Limited (JSE:RFG), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for RFG Holdings

How Does Total Compensation For Bruce Alan Henderson Compare With Other Companies In The Industry?

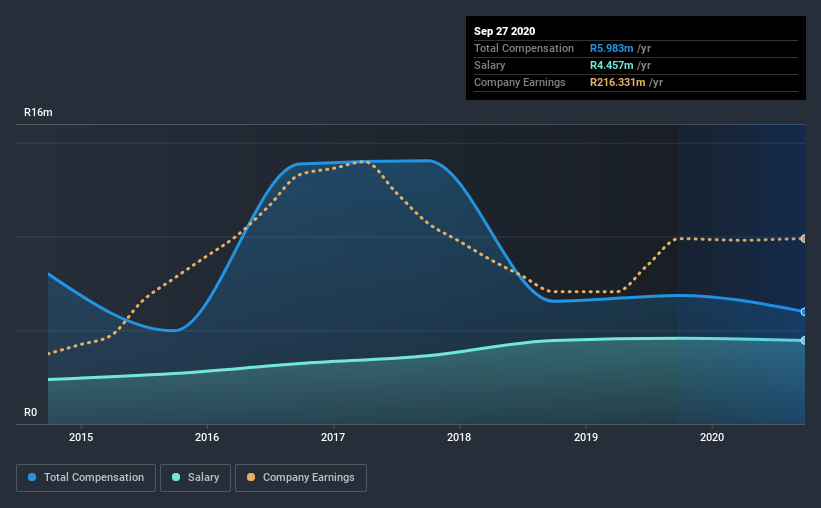

Our data indicates that RFG Holdings Limited has a market capitalization of R3.1b, and total annual CEO compensation was reported as R6.0m for the year to September 2020. Notably, that's a decrease of 13% over the year before. Notably, the salary which is R4.46m, represents most of the total compensation being paid.

For comparison, other companies in the same industry with market capitalizations ranging between R1.5b and R5.8b had a median total CEO compensation of R9.4m. That is to say, Bruce Alan Henderson is paid under the industry median. Furthermore, Bruce Alan Henderson directly owns R195m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | R4.5m | R4.6m | 74% |

| Other | R1.5m | R2.3m | 26% |

| Total Compensation | R6.0m | R6.9m | 100% |

Speaking on an industry level, nearly 52% of total compensation represents salary, while the remainder of 48% is other remuneration. RFG Holdings is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at RFG Holdings Limited's Growth Numbers

Over the last three years, RFG Holdings Limited has shrunk its earnings per share by 4.8% per year. In the last year, its revenue is up 8.4%.

Overall this is not a very positive result for shareholders. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has RFG Holdings Limited Been A Good Investment?

Given the total shareholder loss of 44% over three years, many shareholders in RFG Holdings Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we noted earlier, RFG Holdings pays its CEO lower than the norm for similar-sized companies belonging to the same industry. Over the last three years, shareholder returns have been downright disappointing, and EPSgrowth has been equally disappointing. It's tough to say that Bruce Alan is earning a very high compensation, but shareholders will likely want to see healthier investor returns before agreeing that a raise is in order.

So you may want to check if insiders are buying RFG Holdings shares with their own money (free access).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade RFG Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:RFG

RFG Holdings

Manufactures and markets convenience meal solutions in South Africa, the Kingdom of Eswatini, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives