- South Africa

- /

- Food

- /

- JSE:RCL

Shareholders Will Most Likely Find RCL Foods Limited's (JSE:RCL) CEO Compensation Acceptable

Key Insights

- RCL Foods will host its Annual General Meeting on 14th of November

- Salary of R7.83m is part of CEO Paul Cruickshank's total remuneration

- The overall pay is comparable to the industry average

- Over the past three years, RCL Foods' EPS grew by 6.0% and over the past three years, the total shareholder return was 13%

CEO Paul Cruickshank has done a decent job of delivering relatively good performance at RCL Foods Limited (JSE:RCL) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 14th of November. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

See our latest analysis for RCL Foods

Comparing RCL Foods Limited's CEO Compensation With The Industry

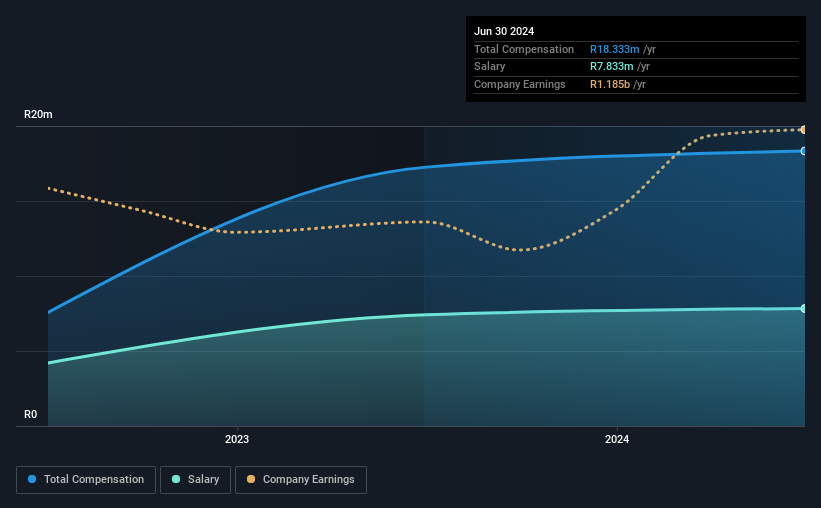

Our data indicates that RCL Foods Limited has a market capitalization of R8.2b, and total annual CEO compensation was reported as R18m for the year to June 2024. That's a fairly small increase of 6.2% over the previous year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at R7.8m.

On examining similar-sized companies in the South African Food industry with market capitalizations between R3.5b and R14b, we discovered that the median CEO total compensation of that group was R15m. So it looks like RCL Foods compensates Paul Cruickshank in line with the median for the industry. What's more, Paul Cruickshank holds R7.1m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | R7.8m | R7.4m | 43% |

| Other | R11m | R9.8m | 57% |

| Total Compensation | R18m | R17m | 100% |

On an industry level, around 46% of total compensation represents salary and 54% is other remuneration. Although there is a difference in how total compensation is set, RCL Foods more or less reflects the market in terms of setting the salary. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at RCL Foods Limited's Growth Numbers

RCL Foods Limited's earnings per share (EPS) grew 6.0% per year over the last three years. It achieved revenue growth of 6.4% over the last year.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but it is good to see modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has RCL Foods Limited Been A Good Investment?

RCL Foods Limited has served shareholders reasonably well, with a total return of 13% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for RCL Foods that investors should be aware of in a dynamic business environment.

Important note: RCL Foods is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:RCL

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.