- South Africa

- /

- Food

- /

- JSE:QFH

Quantum Foods Holdings Ltd (JSE:QFH) Shares Slammed 25% But Getting In Cheap Might Be Difficult Regardless

The Quantum Foods Holdings Ltd (JSE:QFH) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 143% in the last twelve months.

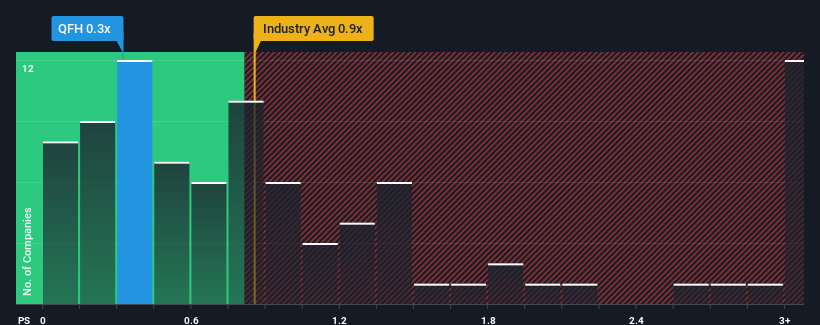

Even after such a large drop in price, it's still not a stretch to say that Quantum Foods Holdings' price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Food industry in South Africa, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Quantum Foods Holdings

What Does Quantum Foods Holdings' P/S Mean For Shareholders?

For instance, Quantum Foods Holdings' receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Quantum Foods Holdings will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Quantum Foods Holdings?

Quantum Foods Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.0%. Regardless, revenue has managed to lift by a handy 23% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 5.9% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we can see why Quantum Foods Holdings is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Quantum Foods Holdings looks to be in line with the rest of the Food industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears to us that Quantum Foods Holdings maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Quantum Foods Holdings (2 shouldn't be ignored!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Quantum Foods Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:QFH

Quantum Foods Holdings

Engages in the feed and poultry business in South African and other African markets.

Excellent balance sheet slight.

Market Insights

Community Narratives