- South Africa

- /

- Diversified Financial

- /

- JSE:SBP

Insider Spends R1.7m Buying More Shares In Sabvest Capital

Whilst it may not be a huge deal, we thought it was good to see that the Sabvest Capital Limited (JSE:SBP) CFO & Executive Director, Kyle De Matteis, recently bought R1.7m worth of stock, for R68.00 per share. Even though that isn't a massive buy, it did increase their holding by 8,333%, which is arguably a good sign.

View our latest analysis for Sabvest Capital

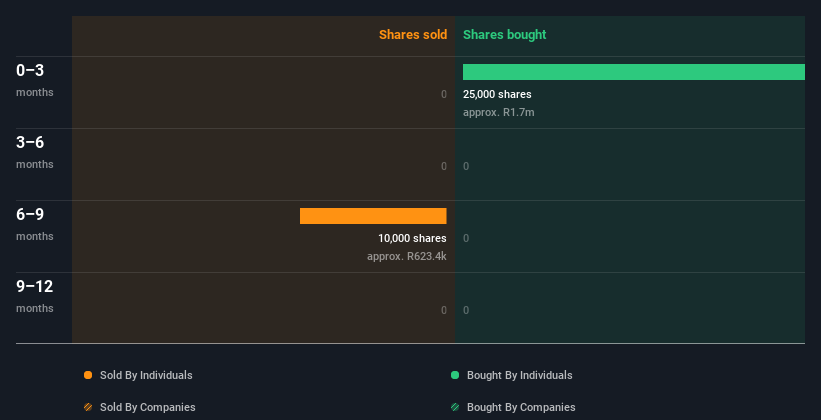

The Last 12 Months Of Insider Transactions At Sabvest Capital

In fact, the recent purchase by Kyle De Matteis was the biggest purchase of Sabvest Capital shares made by an insider individual in the last twelve months, according to our records. That means that even when the share price was higher than R67.30 (the recent price), an insider wanted to purchase shares. It's very possible they regret the purchase, but it's more likely they are bullish about the company. We always take careful note of the price insiders pay when purchasing shares. It is encouraging to see an insider paid above the current price for shares, as it suggests they saw value, even at higher levels. Kyle De Matteis was the only individual insider to buy during the last year.

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Sabvest Capital insiders own about R1.1b worth of shares (which is 43% of the company). Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

What Might The Insider Transactions At Sabvest Capital Tell Us?

The recent insider purchase is heartening. And an analysis of the transactions over the last year also gives us confidence. But on the other hand, the company made a loss during the last year, which makes us a little cautious. Once you factor in the high insider ownership, it certainly seems like insiders are positive about Sabvest Capital. Nice! While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Case in point: We've spotted 1 warning sign for Sabvest Capital you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:SBP

Sabvest Capital

A private equity and venture capital firm specializing in early venture, mid venture, late venture, emerging growth, growth capital, special situation and management buyouts.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives