- South Africa

- /

- Food and Staples Retail

- /

- JSE:CLS

Does Clicks Group (JSE:CLS) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Clicks Group (JSE:CLS). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Clicks Group with the means to add long-term value to shareholders.

How Fast Is Clicks Group Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. We can see that in the last three years Clicks Group grew its EPS by 13% per year. That's a good rate of growth, if it can be sustained.

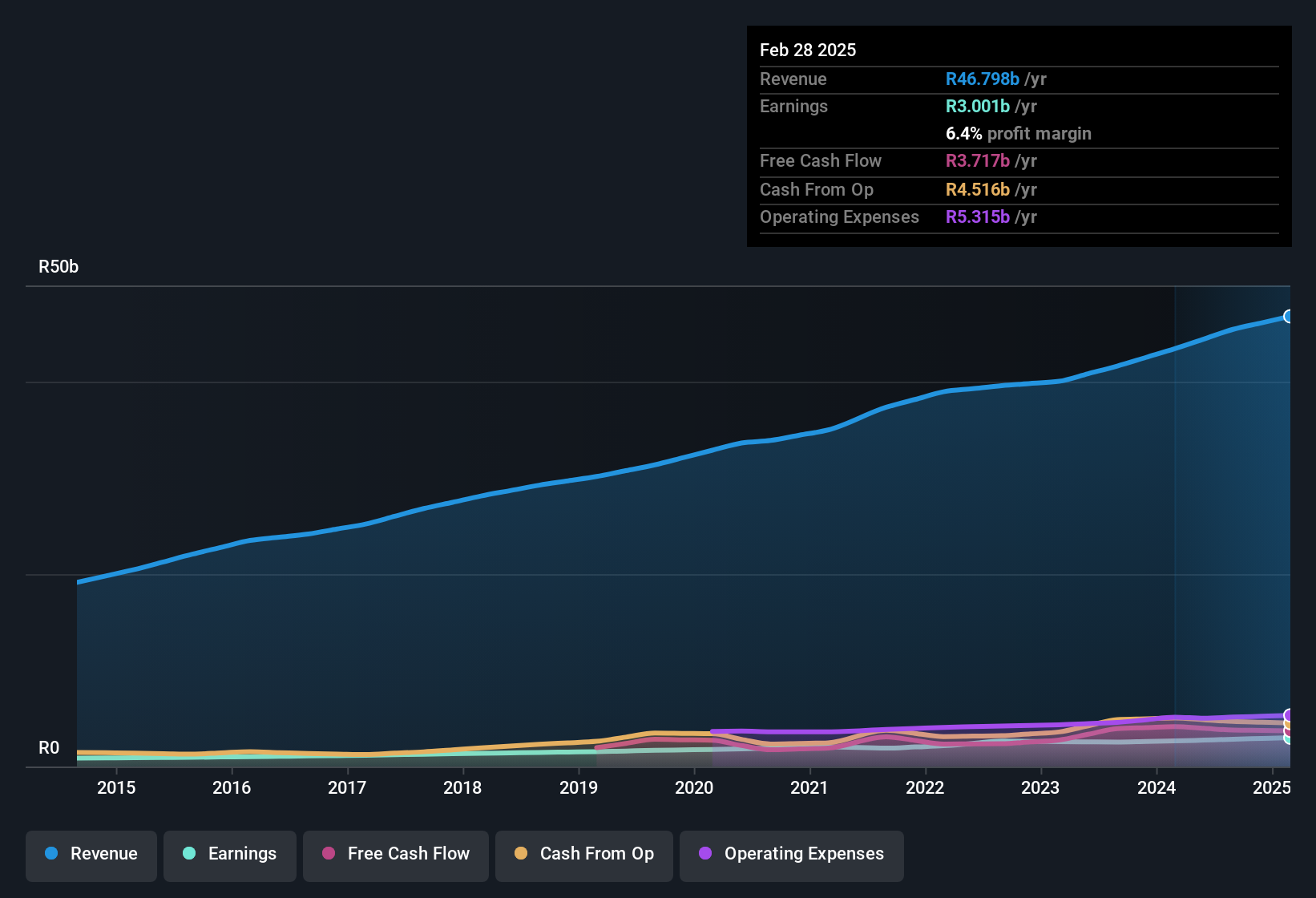

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Clicks Group maintained stable EBIT margins over the last year, all while growing revenue 7.8% to R47b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

See our latest analysis for Clicks Group

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Clicks Group.

Are Clicks Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Shareholders in Clicks Group will be more than happy to see insiders committing themselves to the company, spending R6.4m on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. Zooming in, we can see that the biggest insider purchase was by CEO & Executive Director Bertina Engelbrecht for R3.5m worth of shares, at about R340 per share.

Does Clicks Group Deserve A Spot On Your Watchlist?

One important encouraging feature of Clicks Group is that it is growing profits. While some companies are struggling to grow EPS, Clicks Group seems free from that morose affliction. The cherry on top is the insider share purchases, which provide an extra impetus to keep and eye on this stock, at the very least. Now, you could try to make up your mind on Clicks Group by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Clicks Group, you'll probably love this curated collection of companies in ZA that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:CLS

Clicks Group

Operates as a health, wellness, and beauty retailer in South Africa and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives