- South Africa

- /

- Professional Services

- /

- JSE:PMV

Most Shareholders Will Probably Find That The CEO Compensation For Primeserv Group Limited (JSE:PMV) Is Reasonable

CEO Merrick Abel has done a decent job of delivering relatively good performance at Primeserv Group Limited (JSE:PMV) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 26 November 2021. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

View our latest analysis for Primeserv Group

How Does Total Compensation For Merrick Abel Compare With Other Companies In The Industry?

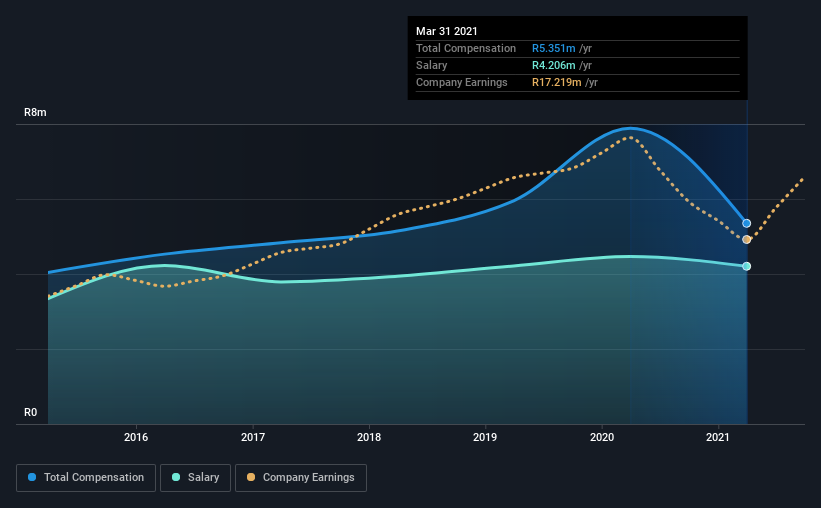

At the time of writing, our data shows that Primeserv Group Limited has a market capitalization of R94m, and reported total annual CEO compensation of R5.4m for the year to March 2021. We note that's a decrease of 32% compared to last year. We note that the salary portion, which stands at R4.21m constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below R3.1b, we found that the median total CEO compensation was R4.2m. So it looks like Primeserv Group compensates Merrick Abel in line with the median for the industry. Moreover, Merrick Abel also holds R24m worth of Primeserv Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | R4.2m | R4.5m | 79% |

| Other | R1.1m | R3.4m | 21% |

| Total Compensation | R5.4m | R7.9m | 100% |

Speaking on an industry level, nearly 52% of total compensation represents salary, while the remainder of 48% is other remuneration. According to our research, Primeserv Group has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Primeserv Group Limited's Growth Numbers

Over the past three years, Primeserv Group Limited has seen its earnings per share (EPS) grow by 5.2% per year. It achieved revenue growth of 6.8% over the last year.

We're not particularly impressed by the revenue growth, but we're happy with the modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Primeserv Group Limited Been A Good Investment?

We think that the total shareholder return of 115%, over three years, would leave most Primeserv Group Limited shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Primeserv Group you should be aware of, and 1 of them is potentially serious.

Important note: Primeserv Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About JSE:PMV

Primeserv Group

An investment holding company, provides integrated business support services in South Africa.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026