- South Africa

- /

- Machinery

- /

- JSE:BEL

Bell Equipment Limited's (JSE:BEL) Share Price Boosted 67% But Its Business Prospects Need A Lift Too

Bell Equipment Limited (JSE:BEL) shareholders have had their patience rewarded with a 67% share price jump in the last month. The annual gain comes to 205% following the latest surge, making investors sit up and take notice.

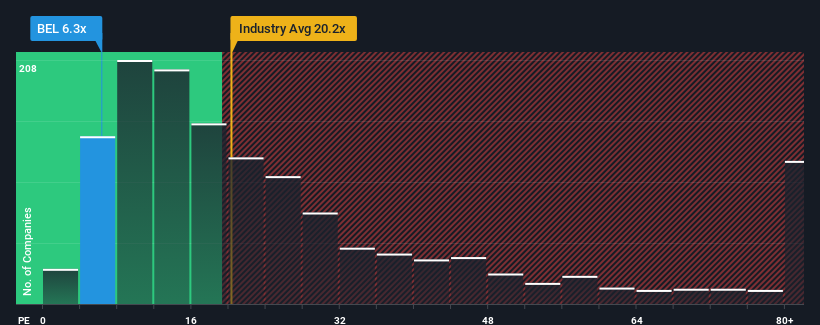

In spite of the firm bounce in price, given about half the companies in South Africa have price-to-earnings ratios (or "P/E's") above 10x, you may still consider Bell Equipment as an attractive investment with its 6.3x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Bell Equipment as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Bell Equipment

What Are Growth Metrics Telling Us About The Low P/E?

Bell Equipment's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 67%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 14% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Bell Equipment is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

Bell Equipment's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Bell Equipment revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Bell Equipment that you should be aware of.

If these risks are making you reconsider your opinion on Bell Equipment, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bell Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:BEL

Bell Equipment

Designs, manufactures, exports, distributes, and supports a range of heavy equipment for the mining and quarrying, construction, forestry, agriculture, and industry sectors in South Africa, Rest of Africa, and Europe.

Flawless balance sheet and fair value.

Market Insights

Community Narratives