- South Africa

- /

- Construction

- /

- JSE:AEG

Aveng (JSE:AEG) shareholder returns have been favorable, earning 69% in 1 year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Aveng Limited (JSE:AEG) share price is up 69% in the last 1 year, clearly besting the market return of around 18% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! Zooming out, the stock is actually down 58% in the last three years.

Since the stock has added R138m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Aveng

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Aveng went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

However the year on year revenue growth of 27% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

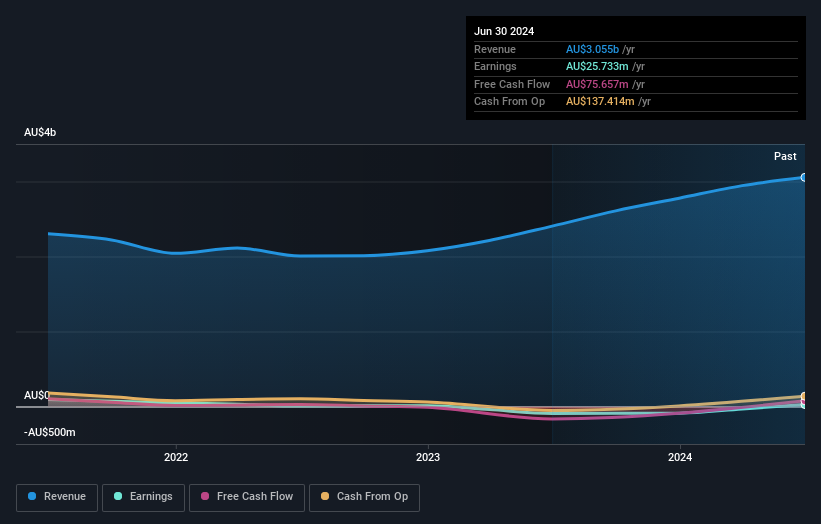

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Aveng stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Aveng shareholders have received a total shareholder return of 69% over the last year. Notably the five-year annualised TSR loss of 0.1% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Aveng better, we need to consider many other factors. Take risks, for example - Aveng has 4 warning signs we think you should be aware of.

Of course Aveng may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South African exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:AEG

Aveng

Engages in the construction and engineering, and mining activities in South Africa, Australia, New Zealand and Pacific Islands, Southeast Asia, and internationally.

Flawless balance sheet and good value.