Stock Analysis

- Hong Kong

- /

- Metals and Mining

- /

- SEHK:98

Top Dividend Stocks To Watch In June 2024

Reviewed by Simply Wall St

As global markets navigate through a landscape marked by political turmoil in Europe and mixed economic signals from major economies, investors continue to seek stable returns amidst the uncertainty. Dividend stocks, known for their potential to provide income and stability, may capture heightened interest as market participants look for reliable investment avenues during these fluctuating conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.37% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.58% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.59% | ★★★★★★ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.98% | ★★★★★★ |

| Globeride (TSE:7990) | 3.70% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 5.87% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.96% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.16% | ★★★★★★ |

| Innotech (TSE:9880) | 3.99% | ★★★★★★ |

Click here to see the full list of 1961 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

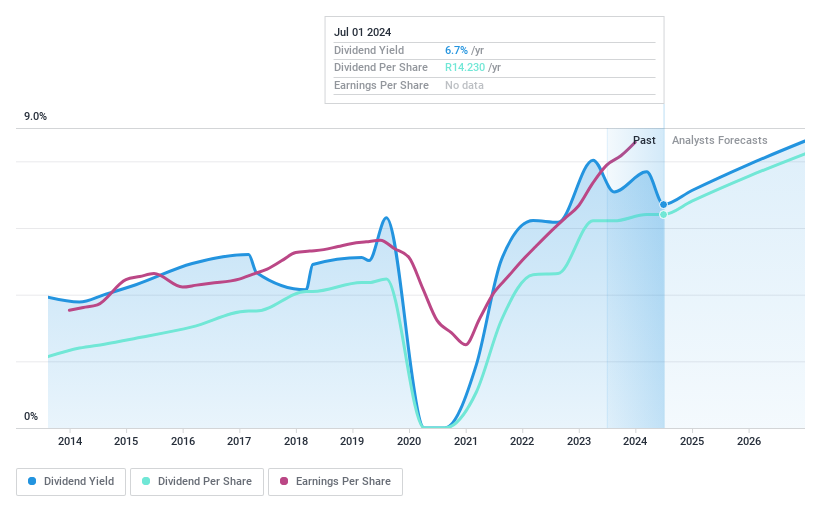

Standard Bank Group (JSE:SBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Standard Bank Group Limited, operating both in South Africa and internationally, offers a range of banking and financial services with a market capitalization of approximately ZAR 352.04 billion.

Operations: Standard Bank Group Limited generates revenue through various segments, with ZAR 45.99 billion from Personal & Private Banking, ZAR 34.63 billion from Business & Commercial Banking, and ZAR 61.90 billion from Corporate & Investment Banking, alongside ZAR 5.01 billion from Insurance & Asset Management.

Dividend Yield: 6.7%

Standard Bank Group's dividend yield of 6.7% is lower than the top quartile of South African dividend payers at 8.61%. While the bank has increased its dividends over the past decade, payments have been volatile, reflecting an unstable track record. The payout ratio stands at a reasonable 53.4%, indicating that earnings currently cover dividends, with projections maintaining similar coverage in three years (57%). However, challenges include a high bad loans ratio (5.8%) and a low allowance for bad loans (66%), which could impact future financial stability and dividend sustainability.

- Dive into the specifics of Standard Bank Group here with our thorough dividend report.

- The valuation report we've compiled suggests that Standard Bank Group's current price could be inflated.

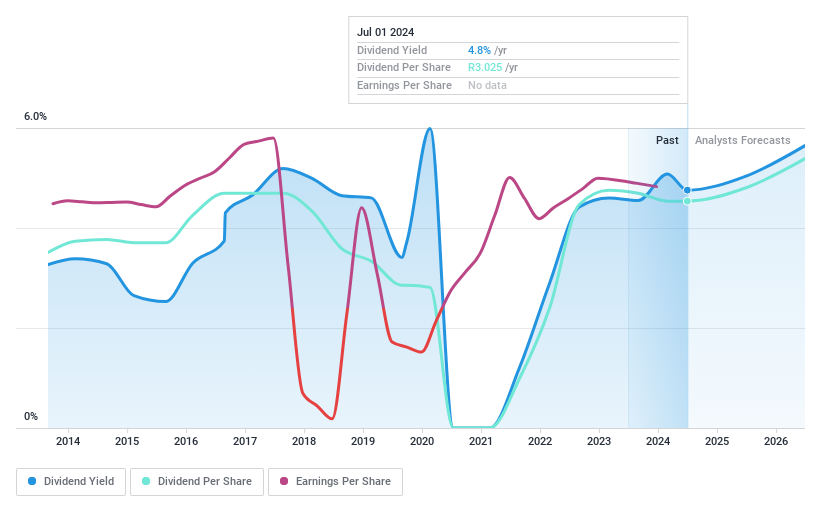

Woolworths Holdings (JSE:WHL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Woolworths Holdings Limited operates a chain of retail stores across sub-Saharan Africa, Australia, and New Zealand, with a market capitalization of approximately ZAR 56.58 billion.

Operations: Woolworths Holdings Limited generates revenue primarily through three segments: Woolworths Food (ZAR 44.16 billion), Woolworths Fashion, Beauty and Home (ZAR 14.75 billion), and Country Road Group (ZAR 14.49 billion).

Dividend Yield: 4.8%

Woolworths Holdings offers a dividend yield of 4.84%, lower than many top South African dividend stocks. Despite a P/E ratio below the industry average, suggesting potential value, its dividends have shown instability over the past decade with significant fluctuations in annual payments. Dividends are currently supported by earnings and cash flow, with payout ratios of 74.8% and 81.5% respectively, but recent substantial insider selling could signal caution about future performance or stability.

- Delve into the full analysis dividend report here for a deeper understanding of Woolworths Holdings.

- Our valuation report here indicates Woolworths Holdings may be overvalued.

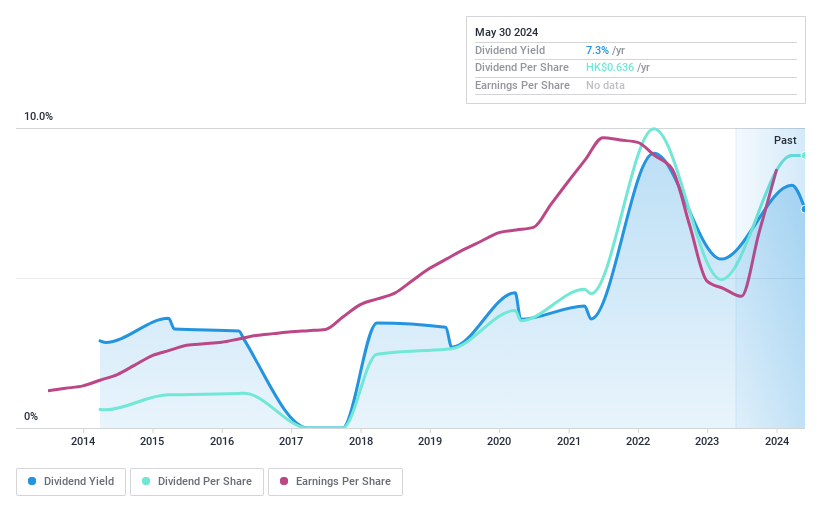

Xingfa Aluminium Holdings (SEHK:98)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xingfa Aluminium Holdings Limited operates as an investment holding company that manufactures and sells construction and industrial aluminium profiles in the People’s Republic of China, with a market capitalization of approximately HK$3.44 billion.

Operations: Xingfa Aluminium Holdings Limited generates CN¥14.12 billion from its construction aluminium profiles segment and CN¥2.64 billion from industrial aluminium profiles.

Dividend Yield: 7.5%

Xingfa Aluminium Holdings has demonstrated a volatile dividend history over the past decade, with payments not showing consistent growth. Despite this, dividends are reasonably covered by both earnings and cash flows, with payout ratios of 30.4% and 51.1% respectively. Recently, the company reported a significant earnings increase to CNY 804.17 million for 2023 from CNY 457.77 million in the previous year and proposed a final dividend of HKD 0.64 per share for approval in May 2024.

- Click here to discover the nuances of Xingfa Aluminium Holdings with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Xingfa Aluminium Holdings' share price might be too pessimistic.

Make It Happen

- Delve into our full catalog of 1961 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Xingfa Aluminium Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:98

Xingfa Aluminium Holdings

An investment holding company, engages in the manufacture and sale of construction and industrial aluminium profiles in the People’s Republic of China.

Flawless balance sheet with solid track record and pays a dividend.