- Bangladesh

- /

- Food

- /

- DSE:OLYMPIC

Undiscovered Gems with Strong Potential for August 2024

Reviewed by Simply Wall St

As global markets celebrate the prospect of upcoming interest rate cuts, small-cap stocks have shown notable outperformance, suggesting a favorable environment for discovering undervalued opportunities. With this backdrop, identifying stocks with strong fundamentals and growth potential becomes crucial for investors looking to capitalize on these market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mark Dynamics Indonesia | 3.49% | 10.31% | 13.38% | ★★★★★★ |

| Padma Oil | 0.87% | -0.90% | 3.72% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 2.74% | 67.99% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Olympic Industries (DSE:OLYMPIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Olympic Industries Limited manufactures, markets, distributes, and sells dry cell batteries, biscuits, candy, and confectionery items in Bangladesh and internationally with a market cap of BDT38.89 billion.

Operations: Olympic Industries generates revenue primarily from its food processing segment, which accounted for BDT25.41 billion. The company has a market cap of BDT38.89 billion.

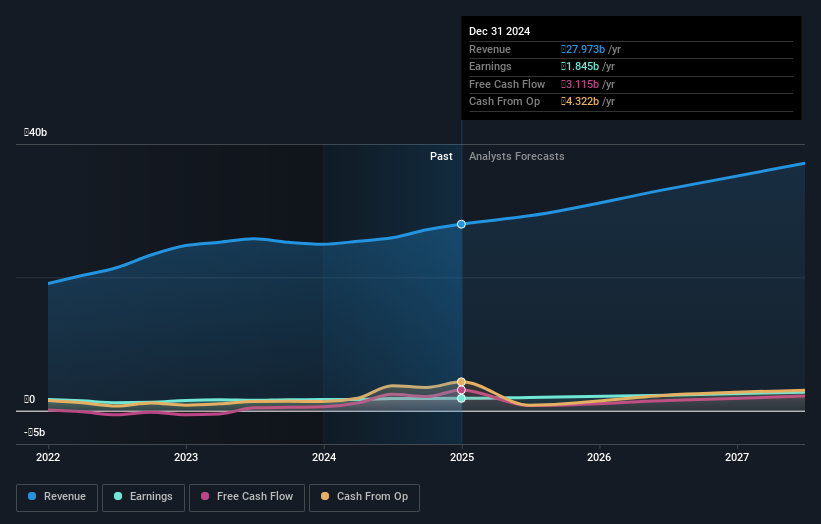

Olympic Industries, a small cap stock, has shown notable financial improvements. The price-to-earnings ratio stands at 23.2x, significantly lower than the industry average of 49.6x. Over the past five years, its debt to equity ratio decreased from 34.4% to 13.1%, reflecting better financial health. Despite earnings growth of just 2% last year, future projections indicate a promising annual growth rate of 12%. The company has more cash than total debt and enjoys high-quality earnings.

- Get an in-depth perspective on Olympic Industries' performance by reading our health report here.

Examine Olympic Industries' past performance report to understand how it has performed in the past.

Vinacafé Bien Hoa (HOSE:VCF)

Simply Wall St Value Rating: ★★★★★★

Overview: Vinacafé Bien Hoa Joint Stock Company engages in the manufacture and sale of food products in Vietnam and internationally, with a market cap of ₫7.09 trillion.

Operations: Vinacafé Bien Hoa generates revenue primarily from Coffee and Non-Alcoholic Drinks, amounting to ₫2.04 trillion. The company also has additional revenue streams contributing ₫375.76 billion.

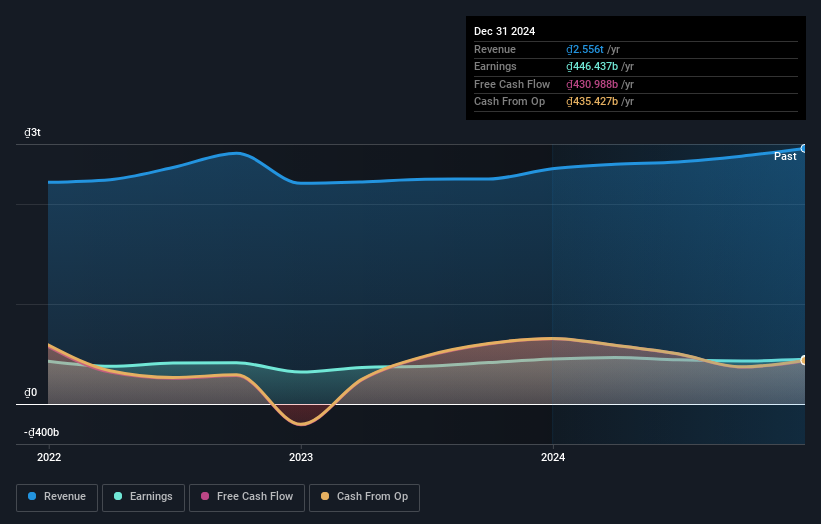

Vinacafé Bien Hoa, a notable player in the food industry, has seen its earnings grow by 17.1% over the past year, outpacing the industry's 14.3%. Trading at 16% below its estimated fair value, it offers potential for value investors. The company's debt to equity ratio improved from 13% to 10.2% over five years, and it remains free cash flow positive. Recently reported Q2 revenue was VND578 million with net income of VND98 million.

- Click here to discover the nuances of Vinacafé Bien Hoa with our detailed analytical health report.

Understand Vinacafé Bien Hoa's track record by examining our Past report.

Verusa Holding (IBSE:VERUS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Verusa Holding A.S. is a private equity and venture capital firm specializing in various investment stages including recapitalizations, growth capital, restructuring, and pre-IPO companies with a market cap of TRY23.94 billion.

Operations: Verusa Holding generates revenue primarily from the production of cellulose (TRY466.52 million), energy production (TRY49.49 million), and wholesale sales of electrical energy (TRY20.19 million).

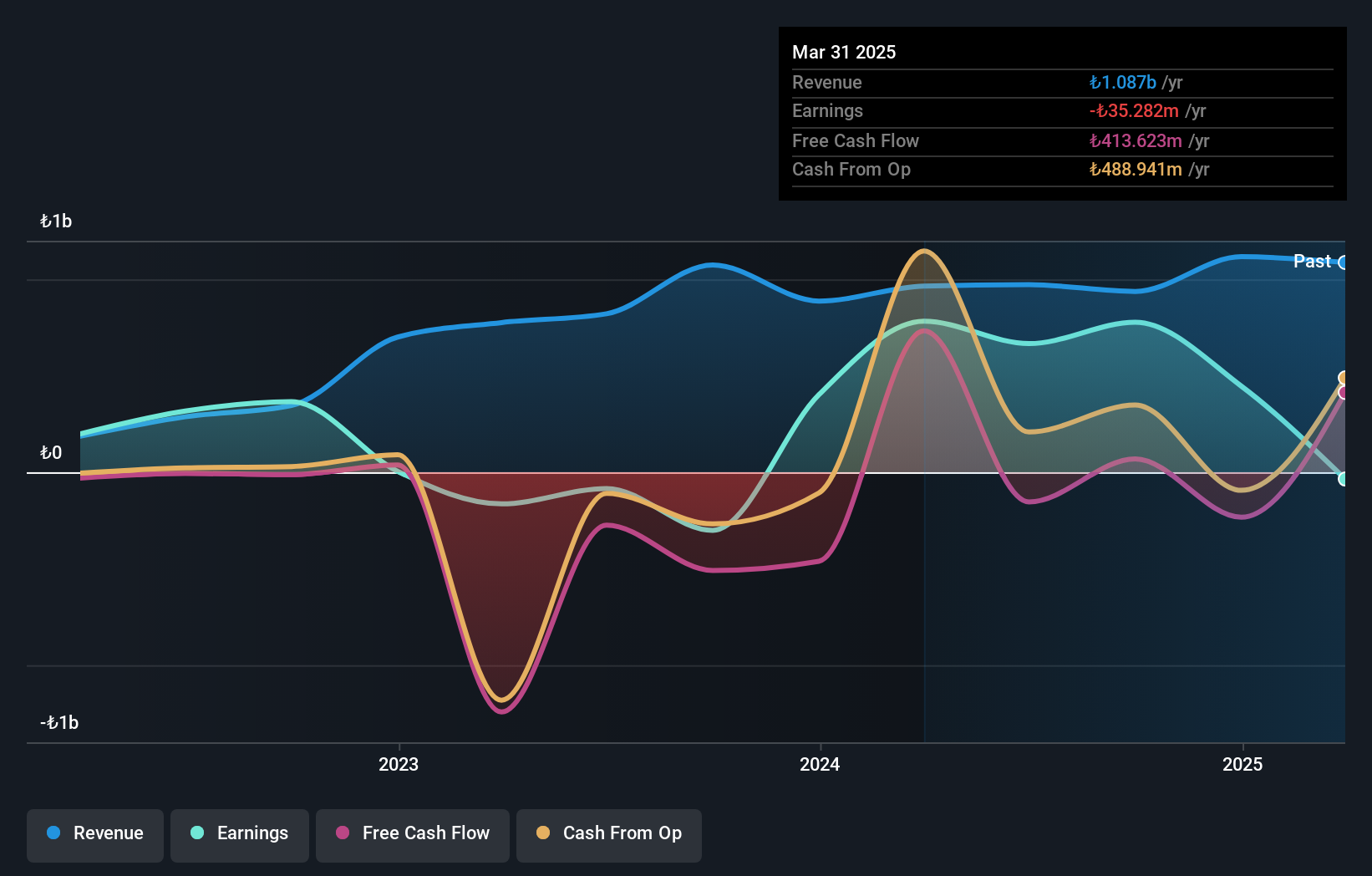

Verusa Holding has shown notable improvement, becoming profitable this year with a net income of TRY 189.89M for the first quarter of 2024, compared to a net loss of TRY 111.82M last year. The company's debt-to-equity ratio slightly increased from 7% to 7.4% over five years, and it reported a significant one-off gain of TRY701.8M impacting recent financial results. Verusa's basic earnings per share rose to TRY2.71 from a loss per share of TRY1.6 previously.

- Delve into the full analysis health report here for a deeper understanding of Verusa Holding.

Review our historical performance report to gain insights into Verusa Holding's's past performance.

Turning Ideas Into Actions

- Gain an insight into the universe of 4895 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DSE:OLYMPIC

Olympic Industries

Manufactures, markets, distributes, and sells dry cell batteries, biscuits, candies, and confectionary items in Bangladesh and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives