- United States

- /

- Other Utilities

- /

- NYSE:WEC

The Bull Case For WEC Energy Group (WEC) Could Change Following New Investments in Battery Storage and Renewables

Reviewed by Simply Wall St

- WEC Energy Group recently reported second-quarter results for 2025, with sales reaching US$2.01 billion and earnings per share exceeding analyst estimates, while the company reaffirmed its full-year earnings guidance of US$5.17 to US$5.27 per share.

- An important development is the company's commitment to major infrastructure projects, including expansion into battery storage and renewable generation, to meet growing demand from large data center developments.

- We’ll explore how WEC Energy Group's reaffirmed earnings guidance and ongoing investment in energy infrastructure shape its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

WEC Energy Group Investment Narrative Recap

To be a shareholder in WEC Energy Group, you need to believe in the company's ability to execute its extensive US$28 billion capital plan and maintain earnings reliability as it addresses surging energy demand, particularly from data center growth. The company's reaffirmation of its full-year earnings guidance and strong second-quarter results support near-term stability, though the biggest risk remains the successful and timely completion of major infrastructure projects. This latest earnings report does not materially alter that fundamental risk or the primary catalyst of regional growth driving higher demand.

Among this quarter's company announcements, WEC Energy Group’s commitment to Wisconsin’s first large-scale battery storage project stands out as especially relevant. This project directly connects to the company’s growth ambitions and its efforts to support the increasing energy requirements of new data centers, reflecting a critical step toward both sustaining regional demand and supporting future revenue streams.

However, investors should also be aware that even with these positives, delays or cost overruns in large-scale projects remain a key risk that could disrupt future returns...

Read the full narrative on WEC Energy Group (it's free!)

WEC Energy Group's narrative projects $10.6 billion revenue and $2.0 billion earnings by 2028. This requires 5.3% yearly revenue growth and a $0.4 billion earnings increase from $1.6 billion.

Uncover how WEC Energy Group's forecasts yield a $109.96 fair value, in line with its current price.

Exploring Other Perspectives

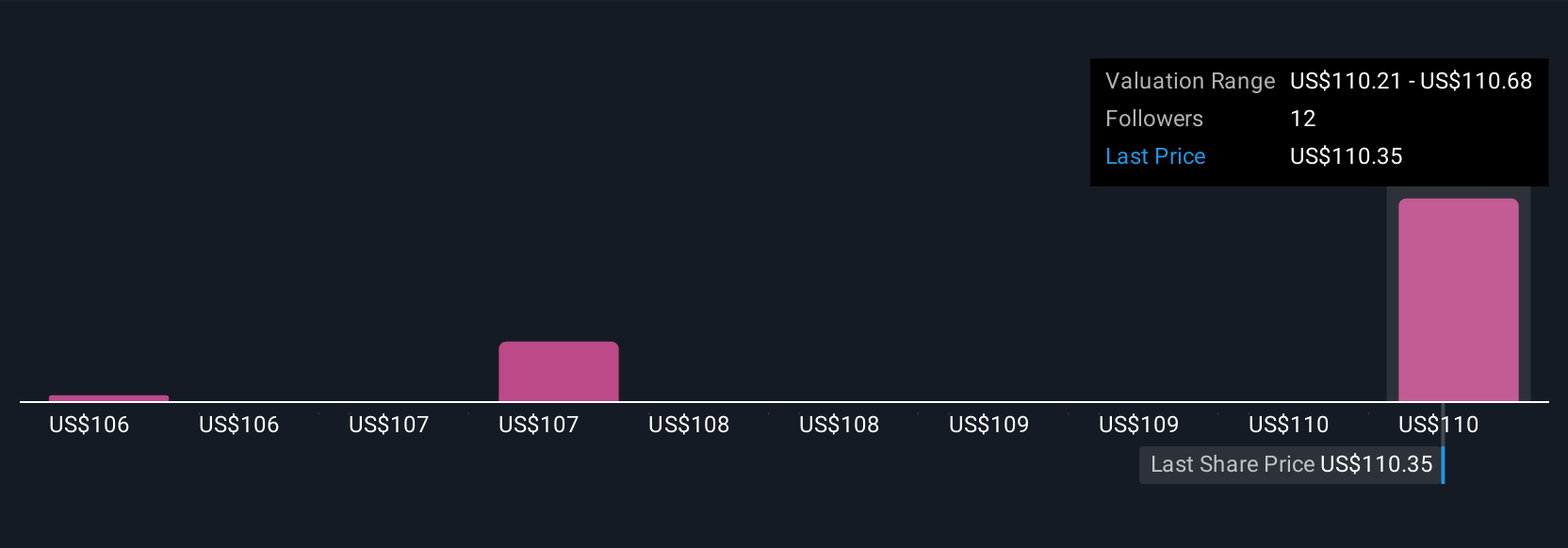

Simply Wall St Community members estimate WEC Energy Group’s fair value between US$106 and US$115, based on three individual forecasts. While many are looking for growth through large-scale projects, execution risk continues to frame how you balance optimism with caution.

Explore 3 other fair value estimates on WEC Energy Group - why the stock might be worth just $106.00!

Build Your Own WEC Energy Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WEC Energy Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WEC Energy Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WEC Energy Group's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEC Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEC

WEC Energy Group

Through its subsidiaries, provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives